Instructions for 8829 Instructions for Form 8829 Irs

What is Form 8829?

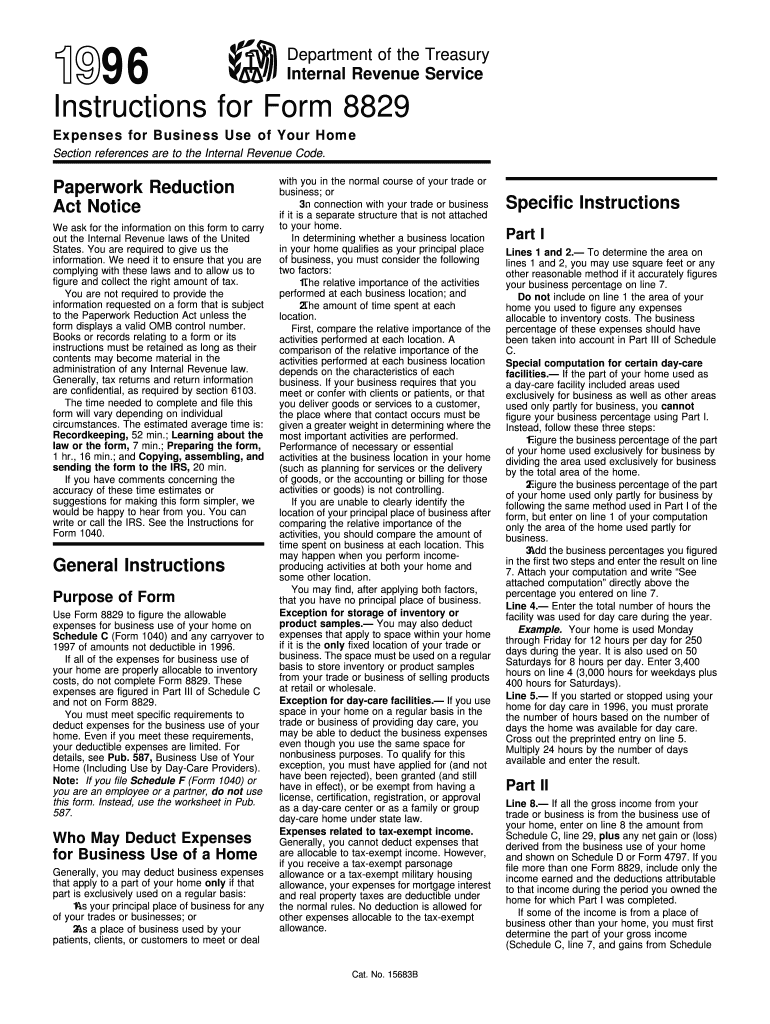

Form 8829, titled "Expenses for Business Use of Your Home," is an IRS form that allows taxpayers to calculate and claim deductions related to the business use of their home. This form is primarily used by self-employed individuals or those who run a business from their residence. It helps in determining the allowable expenses for home office deductions, which can significantly reduce taxable income. The form requires detailed information about the home, the percentage used for business, and the associated expenses like mortgage interest, utilities, and repairs.

Steps to Complete Form 8829

Completing Form 8829 involves several steps to ensure accurate reporting of home office expenses. Follow these steps:

- Determine the area of your home used exclusively for business. Measure the square footage of your home office and the total square footage of your home.

- Gather relevant financial documents, including mortgage statements, utility bills, and repair invoices.

- Calculate the percentage of your home used for business by dividing the office space by the total home space.

- Fill out the form by entering your calculated expenses in the appropriate sections, including direct and indirect expenses.

- Review the completed form for accuracy before submission.

Key Elements of Form 8829

Form 8829 consists of several key sections that are essential for accurately reporting home office expenses. These include:

- Part I: This section requires information about the business use of your home, including the size of the office and the total home area.

- Part II: Here, you report direct expenses related to the office, such as repairs made specifically to the office space.

- Part III: This part covers indirect expenses, including a portion of mortgage interest, property taxes, and utilities.

- Part IV: This section allows you to calculate the total deduction based on the expenses reported in previous parts.

IRS Guidelines for Form 8829

The IRS provides specific guidelines for completing Form 8829. Taxpayers must ensure that the business use of the home is exclusive and regular. The IRS defines exclusive use as a space used only for business activities, while regular use implies that the space is used for business on a consistent basis. Additionally, taxpayers should maintain accurate records of all expenses claimed and be prepared to substantiate their claims in case of an audit.

Filing Deadlines for Form 8829

Form 8829 must be filed along with your annual tax return, typically due on April fifteenth for most taxpayers. If you require additional time to file your return, you may request an extension, which extends the deadline for submitting the form as well. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Eligibility Criteria for Using Form 8829

To qualify for using Form 8829, taxpayers must meet certain eligibility criteria. This includes being self-employed or running a business from home. The home office must be used exclusively and regularly for business purposes. Additionally, the taxpayer must be able to substantiate all claimed expenses with appropriate documentation, such as receipts and invoices.

Quick guide on how to complete instructions for 8829 instructions for form 8829 irs

Complete [SKS] easily on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] with minimal effort

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or black out sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For 8829 Instructions For Form 8829 Irs

Create this form in 5 minutes!

How to create an eSignature for the instructions for 8829 instructions for form 8829 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For 8829 Instructions For Form 8829 Irs?

The Instructions For 8829 Instructions For Form 8829 Irs provide guidance on how to claim expenses for the business use of your home. This form is essential for self-employed individuals who want to deduct home office expenses on their tax returns. Understanding these instructions can help ensure you maximize your deductions accurately.

-

How can airSlate SignNow assist with completing Form 8829?

airSlate SignNow simplifies the process of completing Form 8829 by allowing users to fill out and eSign documents electronically. With our platform, you can easily manage your tax documents and ensure that all necessary information is included. This streamlines the process and helps you stay organized during tax season.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage your tax documents, including the Instructions For 8829 Instructions For Form 8829 Irs. Our platform is designed to enhance productivity and ensure compliance with IRS requirements.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their documents efficiently. Our pricing plans are designed to fit various budgets, making it accessible for businesses of all sizes. By using our platform, you can save time and reduce costs associated with traditional document management.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows you to seamlessly incorporate the Instructions For 8829 Instructions For Form 8829 Irs into your existing workflow, enhancing efficiency and ensuring all your documents are in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides numerous benefits, including increased efficiency, enhanced security, and easy access to your files. Our platform ensures that you can quickly complete and eSign the Instructions For 8829 Instructions For Form 8829 Irs, reducing the stress associated with tax season. Plus, you can access your documents anytime, anywhere.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your information, including the Instructions For 8829 Instructions For Form 8829 Irs. You can trust that your sensitive data is safe while using our platform.

Get more for Instructions For 8829 Instructions For Form 8829 Irs

- David s buffamoyer insurance agent in anderson sc form

- Applecare medical records request formdoc

- Browns mills cherry hill jersey city linwood vineland form

- Patient s name today s date form

- Fillable online newsite fssinc family support services form

- Consent treat minor form

- Members represent trauma nurses from around the world form

- Patient instructions for patient authorization for release form

Find out other Instructions For 8829 Instructions For Form 8829 Irs

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy