Form 2210 F Internal Revenue Service Irs

What is Form 2210-F?

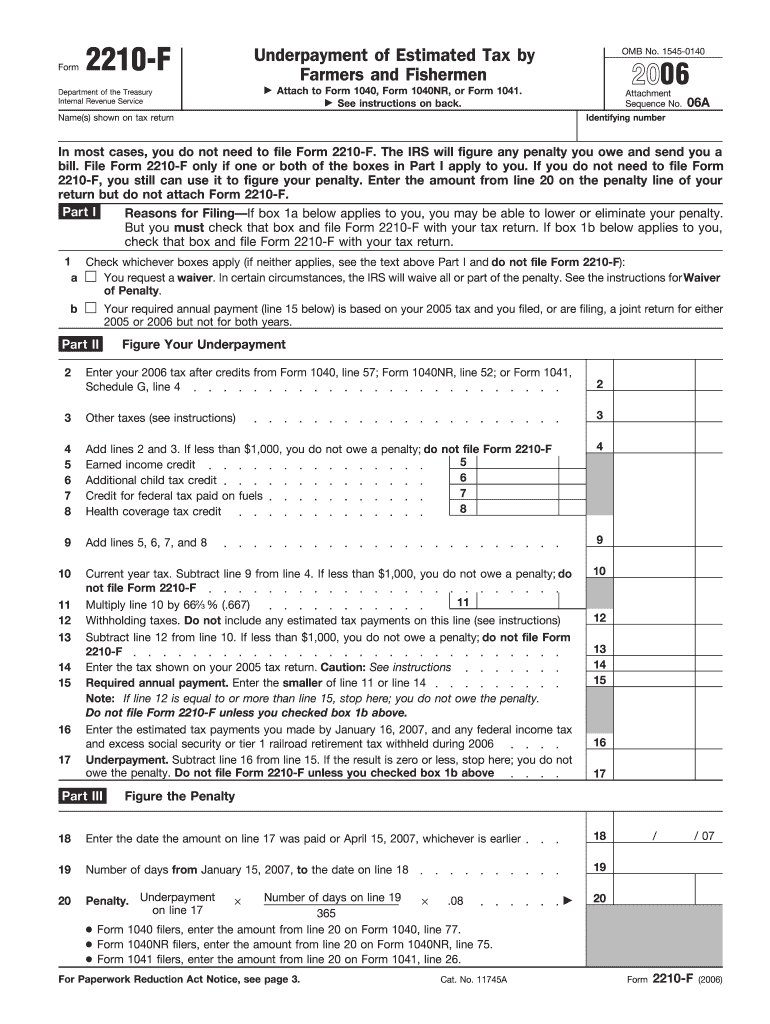

Form 2210-F is a tax form issued by the Internal Revenue Service (IRS) for farmers and fishermen. This form is specifically designed to help these taxpayers calculate their estimated tax payments and determine if they owe a penalty for underpayment of estimated tax. Farmers and fishermen often have unique income patterns, making this form essential for accurately reporting their tax obligations.

How to Use Form 2210-F

To use Form 2210-F, taxpayers need to complete the form by providing information about their expected income and tax liability for the year. The form includes sections for reporting income, calculating estimated taxes, and determining any penalties for underpayment. It is important to follow the instructions carefully to ensure accurate completion. This form can be used to claim an exception to the penalty if certain conditions are met, such as having paid enough tax in the previous year.

Steps to Complete Form 2210-F

Completing Form 2210-F involves several steps:

- Gather all necessary financial information, including income from farming or fishing activities.

- Calculate the total expected income for the year.

- Determine the estimated tax liability based on the expected income.

- Fill out the form sections, including income, tax calculations, and penalty assessments.

- Review the completed form for accuracy before submission.

Filing Deadlines for Form 2210-F

The filing deadline for Form 2210-F typically aligns with the tax return deadlines for farmers and fishermen. Generally, these taxpayers must file their returns by March 1 if they do not file for an extension. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid taxes.

Required Documents for Form 2210-F

When completing Form 2210-F, taxpayers should have the following documents ready:

- Income statements from farming or fishing activities.

- Previous year’s tax return for reference.

- Any relevant documentation regarding estimated tax payments made throughout the year.

Who Issues Form 2210-F?

The IRS is responsible for issuing Form 2210-F. This form is part of the IRS's efforts to assist farmers and fishermen in meeting their tax obligations while considering the unique nature of their income. Taxpayers can obtain this form directly from the IRS website or through tax preparation software that includes IRS forms.

Quick guide on how to complete form 2210 f internal revenue service irs

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents efficiently without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2210 F Internal Revenue Service Irs

Create this form in 5 minutes!

How to create an eSignature for the form 2210 f internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2210 F from the Internal Revenue Service (IRS)?

Form 2210 F is a tax form used by the IRS to determine if you owe a penalty for underpayment of estimated tax. It helps taxpayers calculate their required annual payment and assess any penalties for not meeting the payment requirements. Understanding this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow help with Form 2210 F submissions?

airSlate SignNow provides a seamless platform for electronically signing and submitting Form 2210 F to the IRS. Our solution simplifies the process, ensuring that your documents are securely signed and sent without delays. This efficiency can help you avoid penalties associated with late submissions.

-

What are the pricing options for using airSlate SignNow for Form 2210 F?

airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. Our cost-effective solutions ensure that you can manage your Form 2210 F submissions without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer for managing IRS forms like Form 2210 F?

With airSlate SignNow, you can easily create, edit, and eSign Form 2210 F. Our platform includes features like document templates, real-time tracking, and secure storage, making it easier to manage your IRS forms. These tools enhance your workflow and ensure compliance with IRS requirements.

-

Are there any benefits to using airSlate SignNow for Form 2210 F?

Using airSlate SignNow for Form 2210 F offers numerous benefits, including increased efficiency and reduced paperwork. Our electronic signing process speeds up submissions and minimizes the risk of errors. Additionally, you can access your documents anytime, ensuring you stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for Form 2210 F processing?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Form 2210 F. Whether you use accounting software or document management systems, our integrations streamline your workflow. This connectivity ensures that your data remains consistent and accessible.

-

Is airSlate SignNow secure for submitting IRS forms like Form 2210 F?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Form 2210 F submissions. Our platform ensures that your sensitive information is safe during the signing and submission process. You can trust us to handle your IRS forms securely.

Get more for Form 2210 F Internal Revenue Service Irs

Find out other Form 2210 F Internal Revenue Service Irs

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document