Form CT 592 CT Gov

Understanding Form CT 592

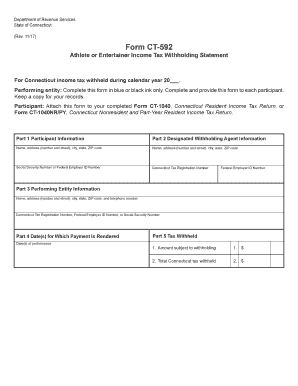

Form CT 592 is a critical document used for reporting Connecticut income tax withheld from non-residents. This form is essential for businesses and individuals who have paid non-residents for services rendered within the state. By accurately completing this form, payers ensure compliance with state tax laws and help non-residents fulfill their tax obligations.

Steps to Complete Form CT 592

Completing Form CT 592 involves several key steps:

- Gather necessary information: Collect details about the non-resident payee, including their name, address, and Social Security number or taxpayer identification number.

- Calculate the amount withheld: Determine the total amount of income paid to the non-resident and apply the appropriate withholding rate to calculate the tax withheld.

- Fill out the form: Enter the required information into the form, ensuring accuracy to avoid delays or penalties.

- Submit the form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent by the appropriate deadline.

Obtaining Form CT 592

Form CT 592 can be easily obtained through the Connecticut Department of Revenue Services website. It is available as a downloadable PDF, allowing users to print and complete the form manually. Additionally, many tax software programs include this form, enabling users to fill it out digitally.

Legal Use of Form CT 592

Form CT 592 serves a legal purpose by ensuring that taxes are withheld from payments made to non-residents. This compliance protects both the payer and the payee from potential legal issues related to tax evasion. It is important for businesses to understand their obligations under Connecticut tax law to avoid penalties.

Filing Deadlines for Form CT 592

Timely filing of Form CT 592 is crucial to avoid penalties. The form must typically be submitted by the 15th day of the month following the payment to the non-resident. For example, if a payment is made in January, the form should be filed by February 15. It is advisable to check for any specific updates or changes to deadlines each tax year.

Key Elements of Form CT 592

Form CT 592 includes several important sections that must be completed:

- Payee Information: This section requires the name, address, and identification number of the non-resident.

- Payment Details: Here, the payer must indicate the total amount paid and the tax withheld.

- Signature: The form must be signed by the payer or an authorized representative to validate the submission.

Examples of Using Form CT 592

Form CT 592 is commonly used in various scenarios, such as:

- A business hiring a contractor from another state for a project.

- An event organizer paying speakers or entertainers who reside outside Connecticut.

- Companies compensating non-resident employees for temporary assignments in Connecticut.

Quick guide on how to complete form ct 592 ct gov

Manage Form CT 592 CT gov effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any hold-ups. Handle Form CT 592 CT gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form CT 592 CT gov easily

- Locate Form CT 592 CT gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form CT 592 CT gov while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 592 ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 592 and how does it relate to airSlate SignNow?

CT 592 is a form used for reporting certain tax information in Connecticut. airSlate SignNow simplifies the process of completing and eSigning CT 592 forms, ensuring that your documents are compliant and securely stored.

-

How much does airSlate SignNow cost for handling CT 592 forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing our service, you can efficiently manage CT 592 forms without incurring excessive costs, making it a cost-effective solution for your document needs.

-

What features does airSlate SignNow provide for CT 592 document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for CT 592 documents. These features streamline the workflow, making it easier for businesses to manage their tax-related paperwork.

-

Can I integrate airSlate SignNow with other software for CT 592 processing?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage CT 592 forms. This allows you to connect with your existing tools and improve overall efficiency in document handling.

-

What are the benefits of using airSlate SignNow for CT 592 forms?

Using airSlate SignNow for CT 592 forms provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are processed quickly and accurately, saving you time and resources.

-

Is airSlate SignNow user-friendly for completing CT 592 forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete CT 592 forms. Our intuitive interface allows users to navigate the platform effortlessly, even if they have limited technical skills.

-

How does airSlate SignNow ensure the security of my CT 592 documents?

airSlate SignNow prioritizes the security of your CT 592 documents by employing advanced encryption and secure storage solutions. This ensures that your sensitive information remains protected throughout the signing and storage process.

Get more for Form CT 592 CT gov

- New employer packet hawaii department of labor form

- 20 do hereby revoke such gift pursuant to hawaii revised form

- Employment law attorney honolulujob terminationhawaii form

- Control number hi p027 pkg form

- Control number hi p023 pkg form

- Free hawaii residential lease to purchase agreement form

- Hawaii prenuptial agreement form downloadus legal forms

- Control number hi p037 pkg form

Find out other Form CT 592 CT gov

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF