Farm Tax Organizer Form

What is the Farm Tax Organizer

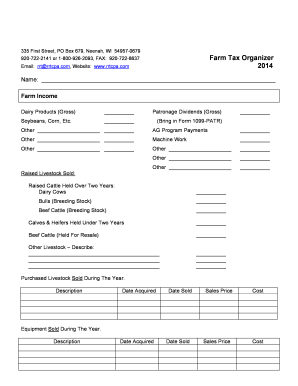

The Farm Tax Organizer is a specialized document designed to assist farmers and agricultural businesses in gathering and organizing essential financial information for tax preparation. This form consolidates various income and expense details, making it easier to report earnings, claim deductions, and ensure compliance with IRS regulations. By utilizing this organizer, farmers can streamline their tax filing process, ultimately saving time and reducing the risk of errors.

How to use the Farm Tax Organizer

Using the Farm Tax Organizer involves several straightforward steps. First, gather all relevant financial documents, including receipts, invoices, and bank statements. Next, fill out the organizer by categorizing income sources such as crop sales, livestock sales, and government payments. Document expenses in various categories, including feed, equipment, labor, and utilities. Once completed, review the organizer for accuracy before submitting it alongside your tax return. This organized approach helps ensure that you capture all eligible deductions and credits.

Key elements of the Farm Tax Organizer

The Farm Tax Organizer includes several key elements that are crucial for accurate tax reporting. These elements typically encompass:

- Income Reporting: Detailed sections for listing various income sources, including crop sales and livestock sales.

- Expense Tracking: Categories for tracking operational expenses, such as equipment purchases, feed costs, and labor expenses.

- Depreciation Information: Sections to report depreciation on farm assets, which can significantly impact tax liability.

- Tax Credits and Deductions: Areas to note any applicable tax credits or deductions specific to agricultural activities.

Steps to complete the Farm Tax Organizer

Completing the Farm Tax Organizer involves a systematic approach. Follow these steps:

- Gather all financial documents related to your farming operations.

- Fill in the income section, listing all sources of revenue from your farm.

- Document all expenses in the appropriate categories, ensuring you include all relevant costs.

- Calculate depreciation for any farm assets you own and include this information.

- Review the completed organizer for accuracy and completeness.

IRS Guidelines

It is essential to adhere to IRS guidelines when using the Farm Tax Organizer. The IRS provides specific instructions on how to report agricultural income and expenses, including what qualifies as deductible expenses. Farmers should ensure they are familiar with the latest IRS publications related to agriculture, as these documents outline the necessary compliance requirements and help avoid potential penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for farmers using the Farm Tax Organizer. Typically, individual tax returns are due on April fifteenth each year. However, farmers may qualify for extensions under certain circumstances. It is important to stay informed about any changes in deadlines, especially if you are filing as a business entity, as these may differ from individual deadlines.

Quick guide on how to complete farm tax organizer

Complete Farm Tax Organizer effortlessly on any device

Managing documents online has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Farm Tax Organizer on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Farm Tax Organizer with ease

- Find Farm Tax Organizer and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select how you wish to deliver your form, either by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your preference. Edit and electronically sign Farm Tax Organizer and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the farm tax organizer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Farm Tax Organizer?

A Farm Tax Organizer is a tool designed to help farmers and agricultural businesses efficiently gather and organize their tax-related documents. By using a Farm Tax Organizer, you can streamline the process of preparing for tax season, ensuring that all necessary information is readily available and accurately compiled.

-

How does airSlate SignNow's Farm Tax Organizer work?

airSlate SignNow's Farm Tax Organizer allows users to create, send, and eSign tax documents seamlessly. The platform provides templates and customizable forms that cater specifically to the needs of farmers, making it easier to manage tax documentation and compliance.

-

What are the benefits of using a Farm Tax Organizer?

Using a Farm Tax Organizer can signNowly reduce the time and effort spent on tax preparation. It helps ensure accuracy, minimizes the risk of errors, and allows for better organization of financial records, ultimately leading to a smoother tax filing experience.

-

Is there a cost associated with the Farm Tax Organizer?

Yes, airSlate SignNow offers competitive pricing for its Farm Tax Organizer features. The cost varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes, ensuring you get great value for your investment.

-

Can I integrate the Farm Tax Organizer with other software?

Absolutely! airSlate SignNow's Farm Tax Organizer can be integrated with various accounting and financial software, enhancing your workflow. This integration allows for seamless data transfer and ensures that all your financial information is synchronized across platforms.

-

What features are included in the Farm Tax Organizer?

The Farm Tax Organizer includes features such as customizable templates, eSigning capabilities, document storage, and collaboration tools. These features are designed to simplify the tax preparation process and enhance productivity for farmers and agricultural businesses.

-

How secure is the Farm Tax Organizer?

Security is a top priority for airSlate SignNow. The Farm Tax Organizer employs advanced encryption and security protocols to protect your sensitive tax documents and personal information, ensuring that your data remains safe and confidential.

Get more for Farm Tax Organizer

- Form 032 05 0979 00

- Deer harvest log sheet form

- Steve sisolak richard whitley ms ross e armstrong form

- Adm 275a form

- Form 160 employees biographical data sheet massgov

- Rhode island department of labor and training file a claim form

- Standard application form nycgov

- Horace mann insurance change of beneficary form

Find out other Farm Tax Organizer

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple