Prepare Tax Returns for Someone Who Died Canada Ca Form

Understanding the Canada Income Tax Benefit Return

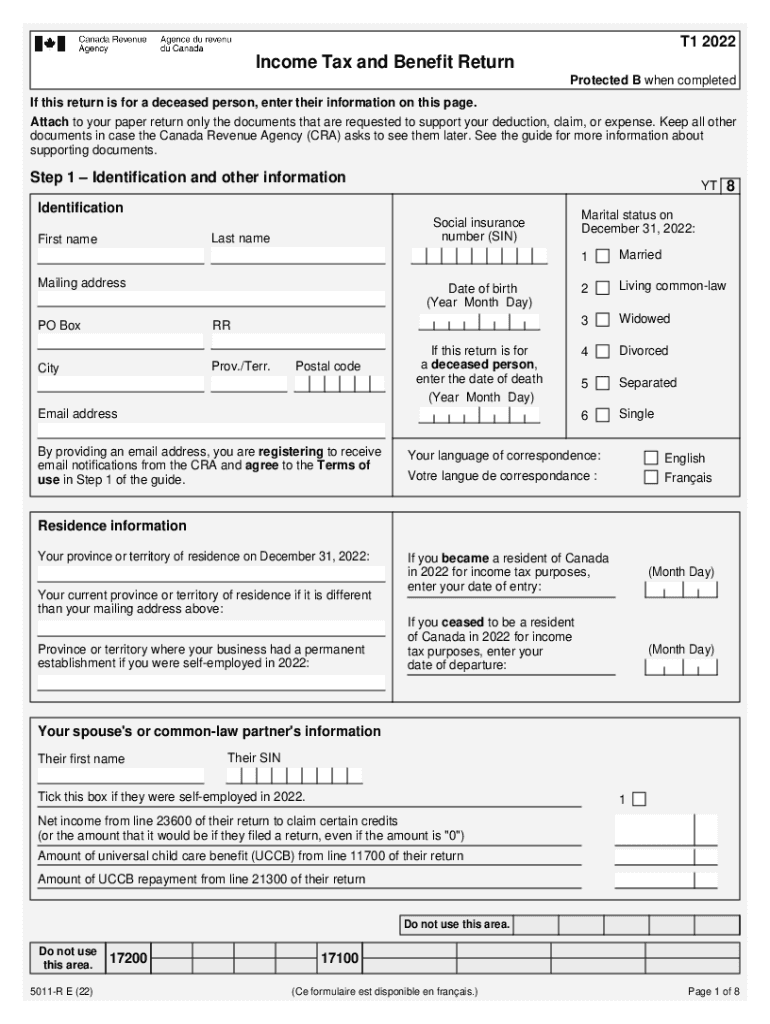

The Canada income tax benefit return is a crucial document for individuals seeking to claim various tax benefits. This form helps determine eligibility for benefits such as the Goods and Services Tax (GST) credit and the Canada Child Benefit (CCB). By accurately completing this return, taxpayers can ensure they receive the financial support they are entitled to. The return typically includes information about income, family status, and any applicable deductions or credits.

Steps to Complete the Income Tax Benefit Return

Filling out the income tax benefit return involves several key steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Determine your eligibility for specific benefits based on your income and family situation.

- Complete the income tax benefit return form, ensuring all information is accurate and up to date.

- Review the completed form for any errors or omissions.

- Submit the form either online, by mail, or in person, depending on your preference.

Required Documents for Filing

To successfully file the income tax benefit return, you will need to prepare several documents:

- Proof of income, such as T4 slips or other income statements.

- Identification documents, including Social Security numbers for all family members.

- Records of any deductions or credits being claimed, such as childcare expenses or medical expenses.

- Previous year’s tax return for reference.

Form Submission Methods

There are multiple ways to submit the income tax benefit return:

- Online: Many taxpayers choose to file electronically through tax software, which simplifies the process and often provides instant confirmation.

- By Mail: You can print the completed form and send it to the appropriate tax authority by postal service.

- In-Person: Some individuals may prefer to submit their returns directly at designated tax offices, where assistance is available.

Eligibility Criteria for Benefits

Eligibility for benefits associated with the income tax benefit return is determined by several factors:

- Your total household income must fall below a certain threshold.

- Family status, including marital status and number of dependents, affects eligibility for specific benefits.

- Residency requirements must be met, as benefits are generally available to residents of Canada.

Penalties for Non-Compliance

Failing to accurately complete and submit the income tax benefit return can lead to penalties:

- Late filing penalties may apply if the return is submitted after the deadline.

- Incorrect information can result in audits and potential fines.

- Loss of eligibility for benefits if the return is not filed properly or on time.

Quick guide on how to complete prepare tax returns for someone who died canada ca

Effortlessly Prepare Prepare Tax Returns For Someone Who Died Canada ca on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Prepare Tax Returns For Someone Who Died Canada ca on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Prepare Tax Returns For Someone Who Died Canada ca with Minimal Effort

- Obtain Prepare Tax Returns For Someone Who Died Canada ca and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign function, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Modify and eSign Prepare Tax Returns For Someone Who Died Canada ca, ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prepare tax returns for someone who died canada ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canada income tax benefit return?

The Canada income tax benefit return is a tax return that allows eligible individuals to claim various benefits and credits provided by the Canadian government. This return helps ensure that you receive the maximum benefits available to you, including the Canada Child Benefit and the GST/HST credit.

-

How can airSlate SignNow help with my Canada income tax benefit return?

airSlate SignNow simplifies the process of preparing and submitting your Canada income tax benefit return by allowing you to eSign and send documents securely. Our platform ensures that all your tax documents are organized and easily accessible, making it easier to manage your tax filings.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time collaboration, which are essential for managing your Canada income tax benefit return. These features streamline the process, reduce errors, and save you time during tax season.

-

Is airSlate SignNow cost-effective for managing my tax returns?

Yes, airSlate SignNow is a cost-effective solution for managing your Canada income tax benefit return. With flexible pricing plans, you can choose the option that best fits your needs, ensuring you get the most value for your investment in tax document management.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, making it easier to manage your Canada income tax benefit return. This integration allows for seamless data transfer and enhances your overall tax filing experience.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your Canada income tax benefit return offers numerous benefits, including enhanced security, ease of use, and improved efficiency. Our platform ensures that your documents are protected while providing a user-friendly interface for all your tax needs.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Canada income tax benefit return and other sensitive documents. You can trust that your information is safe and secure while using our platform.

Get more for Prepare Tax Returns For Someone Who Died Canada ca

- This packet contains the forms necessary to apply for long term disability benefits

- International claim form international claim form

- Blue advantage ppo prescription drug authorization request form blue advantage ppo prescription drug authorization request form

- Aafp adult immunization project planning form

- Local exposure control plan and guidance non laboratory form

- Employee or the employees spouse form

- Partners form

- Group short term disability claim guardian anytime form

Find out other Prepare Tax Returns For Someone Who Died Canada ca

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer