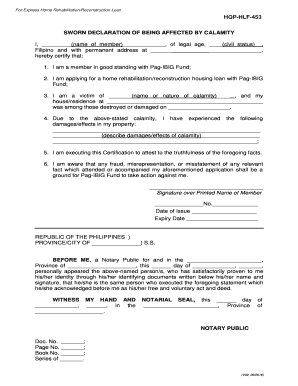

For Express Home RehabilitationReconstruction Loan Form

What is the For Express Home Rehabilitation/Reconstruction Loan

The For Express Home Rehabilitation/Reconstruction Loan is a financial product designed to assist homeowners in repairing or rebuilding their properties that have been damaged due to calamities. This loan aims to provide support to individuals who need to restore their homes to a safe and livable condition. The program is particularly beneficial for those who have experienced significant losses and require immediate funding to commence rehabilitation efforts.

Eligibility Criteria

To qualify for the For Express Home Rehabilitation/Reconstruction Loan, applicants must meet specific criteria. Typically, these include:

- Proof of ownership of the property requiring repairs.

- Documentation demonstrating the extent of damage due to a calamity.

- Income verification to assess repayment capacity.

- Compliance with local regulations regarding property rehabilitation.

Applicants should gather all necessary documents to streamline the approval process.

Application Process & Approval Time

The application process for the For Express Home Rehabilitation/Reconstruction Loan involves several steps. First, applicants need to complete the appropriate forms, providing detailed information about the property and the damage incurred. After submission, the application will undergo a review process, which typically takes a few weeks. Factors influencing approval time include the completeness of the application and the volume of requests being processed at that time.

Required Documents

Applicants must prepare a set of documents to support their loan application. Essential documents include:

- A completed application form.

- Proof of identity and ownership of the property.

- Estimates or quotes for the proposed rehabilitation work.

- Income statements or tax returns for financial assessment.

- Any additional documentation required by the lending institution.

Having these documents ready can facilitate a smoother application process.

Steps to complete the For Express Home Rehabilitation/Reconstruction Loan

Completing the For Express Home Rehabilitation/Reconstruction Loan involves several key steps:

- Gather all required documents as outlined in the application process.

- Fill out the application form accurately, ensuring all information is current.

- Submit the application along with all supporting documents to the designated office.

- Await feedback from the lender regarding application status and any additional requirements.

- Once approved, review the loan terms before signing.

Following these steps can help ensure a successful application for the loan.

Legal use of the For Express Home Rehabilitation/Reconstruction Loan

The For Express Home Rehabilitation/Reconstruction Loan must be used in accordance with legal guidelines established by the lending authority. Funds from this loan should solely be allocated for the rehabilitation or reconstruction of the property as specified in the application. Misuse of funds can lead to penalties, including loan default or legal action. It is essential to maintain accurate records of all expenditures related to the rehabilitation project.

Quick guide on how to complete for express home rehabilitationreconstruction loan

Prepare For Express Home RehabilitationReconstruction Loan effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage For Express Home RehabilitationReconstruction Loan on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign For Express Home RehabilitationReconstruction Loan seamlessly

- Find For Express Home RehabilitationReconstruction Loan and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in several clicks from any device you prefer. Edit and eSign For Express Home RehabilitationReconstruction Loan and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for express home rehabilitationreconstruction loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pag ibig calamity loan list of affected areas 2018?

The pag ibig calamity loan list of affected areas 2018 refers to the specific regions that were eligible for calamity loans due to natural disasters in that year. This list is crucial for individuals seeking financial assistance during challenging times. It helps borrowers identify if they qualify for the loan based on their location.

-

How can I check if my area is on the pag ibig calamity loan list of affected areas 2018?

To check if your area is included in the pag ibig calamity loan list of affected areas 2018, you can visit the official Pag-IBIG Fund website or contact their customer service. They provide updated information regarding affected areas and eligibility criteria for calamity loans. This ensures you have the most accurate and timely information.

-

What are the benefits of the pag ibig calamity loan for affected areas?

The pag ibig calamity loan offers several benefits for those in affected areas, including low-interest rates and flexible repayment terms. This financial support helps individuals recover from disasters by providing immediate funds for urgent needs. It is designed to ease the burden during tough times, making recovery more manageable.

-

What documents do I need to apply for the pag ibig calamity loan?

To apply for the pag ibig calamity loan, you typically need to provide valid identification, proof of income, and documentation showing your residence in an affected area listed in the pag ibig calamity loan list of affected areas 2018. Additional documents may be required depending on your specific situation. It's best to check with Pag-IBIG for the complete list of requirements.

-

Is there a fee to apply for the pag ibig calamity loan?

There are no application fees associated with the pag ibig calamity loan. However, borrowers should be aware of the interest rates and repayment terms that apply once the loan is approved. This makes the loan an accessible option for those in need of financial assistance during calamities.

-

How long does it take to process the pag ibig calamity loan application?

The processing time for the pag ibig calamity loan application can vary, but it typically takes a few days to a couple of weeks. Factors such as the completeness of your documentation and the volume of applications can affect this timeline. It's advisable to submit all required documents promptly to expedite the process.

-

Can I use the pag ibig calamity loan for any purpose?

Yes, the pag ibig calamity loan can be used for various purposes, including home repairs, medical expenses, and other urgent financial needs arising from the calamity. This flexibility allows borrowers to address their most pressing concerns effectively. However, it's essential to use the funds responsibly to ensure a smooth recovery.

Get more for For Express Home RehabilitationReconstruction Loan

- Affidavit of substantial hardship jpowrlcorg form

- Grande voiture du california inc consolidated cafortyandeight form

- Alabama secretary of state 2016 2019 form

- Civil docketing statement form

- Medical examiner release form miamidade

- Cit 0001 e application for a citizenship certificate form

- Medical education student physical examination form redcross

- Activity plan bwvub bextb energy express energyexpress ext wvu form

Find out other For Express Home RehabilitationReconstruction Loan

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation