Form 587 Nonresident Withholding Allocation Worksheet Sdge

What is the Form 587 Nonresident Withholding Allocation Worksheet Sdge

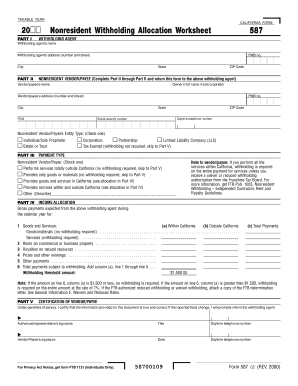

The Form 587 Nonresident Withholding Allocation Worksheet is a tax document used in the United States for nonresident individuals and entities to allocate income that is subject to withholding. This form is particularly relevant for those receiving payments from California sources, such as utility companies like SDG&E (San Diego Gas & Electric). It helps determine the correct amount of withholding tax that should be applied to specific income types, ensuring compliance with state tax regulations.

How to use the Form 587 Nonresident Withholding Allocation Worksheet Sdge

Using the Form 587 involves several steps to ensure accurate completion. First, gather all relevant income information related to the payments received from SDG&E or other California sources. Next, fill out the form by providing details such as your name, address, and the type of income. It is essential to accurately report the amounts and any applicable deductions. Once completed, the form should be submitted to the withholding agent, typically the payer, to ensure the correct withholding amount is applied.

Steps to complete the Form 587 Nonresident Withholding Allocation Worksheet Sdge

Completing the Form 587 requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name and address.

- Identify the type of income you are reporting, such as wages or rental income.

- Allocate the income to the appropriate categories as specified in the form.

- Calculate the withholding amount based on the income allocated.

- Review all entries for accuracy before submission.

Key elements of the Form 587 Nonresident Withholding Allocation Worksheet Sdge

The Form 587 includes several key elements that are crucial for proper completion. These elements consist of personal identification sections, income allocation categories, and calculation fields for withholding amounts. Each section is designed to capture specific information needed to comply with California tax laws. Understanding these elements helps ensure that the form is filled out correctly and submitted on time.

Legal use of the Form 587 Nonresident Withholding Allocation Worksheet Sdge

The legal use of the Form 587 is essential for nonresidents earning income from California sources. By accurately completing and submitting this form, individuals and entities can ensure they are compliant with state tax withholding requirements. Failure to use this form correctly may result in incorrect withholding amounts, leading to potential penalties or issues with tax compliance.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 587. Generally, the form should be submitted to the withholding agent at the time of payment or before the end of the tax year. Keeping track of these deadlines helps avoid unnecessary penalties and ensures that withholding is applied correctly throughout the year.

Quick guide on how to complete form 587 nonresident withholding allocation worksheet sdge

Manage [SKS] easily on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, time-consuming form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 587 Nonresident Withholding Allocation Worksheet Sdge

Create this form in 5 minutes!

How to create an eSignature for the form 587 nonresident withholding allocation worksheet sdge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 587 Nonresident Withholding Allocation Worksheet Sdge?

The Form 587 Nonresident Withholding Allocation Worksheet Sdge is a tax form used by nonresidents to allocate income and determine withholding amounts for California state taxes. This form is essential for ensuring compliance with state tax regulations and helps nonresidents accurately report their income.

-

How can airSlate SignNow help with the Form 587 Nonresident Withholding Allocation Worksheet Sdge?

airSlate SignNow provides an efficient platform for completing and eSigning the Form 587 Nonresident Withholding Allocation Worksheet Sdge. Our user-friendly interface simplifies the process, allowing users to fill out the form digitally and securely send it to the necessary parties.

-

Is there a cost associated with using airSlate SignNow for the Form 587 Nonresident Withholding Allocation Worksheet Sdge?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the Form 587 Nonresident Withholding Allocation Worksheet Sdge without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the Form 587 Nonresident Withholding Allocation Worksheet Sdge?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the Form 587 Nonresident Withholding Allocation Worksheet Sdge. These features streamline the process, making it easier to complete and submit your tax forms.

-

Can I integrate airSlate SignNow with other software for the Form 587 Nonresident Withholding Allocation Worksheet Sdge?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Form 587 Nonresident Withholding Allocation Worksheet Sdge alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the Form 587 Nonresident Withholding Allocation Worksheet Sdge?

Using airSlate SignNow for the Form 587 Nonresident Withholding Allocation Worksheet Sdge provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform ensures that your documents are handled efficiently, reducing the risk of errors and ensuring compliance with tax regulations.

-

Is airSlate SignNow secure for handling the Form 587 Nonresident Withholding Allocation Worksheet Sdge?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Form 587 Nonresident Withholding Allocation Worksheet Sdge. We utilize advanced encryption and security protocols to protect your sensitive information throughout the signing and submission process.

Get more for Form 587 Nonresident Withholding Allocation Worksheet Sdge

- Allocations of tax creditsallocations of tax creditsform it 203 nonresident and part year resident income tax form it 203

- Printable 2020 new york form it 641 manufacturers real property tax credit

- Fillable online form it 203 s att2017attachment to form it

- Department of taxation and finance claim for farmers school form

- Return of organization exempt from income tax its personal form

- Form it 135 download fillable pdf or fill online sales and

- Printable 2020 new york form it 2106 estimated income tax payment voucher for fiduciaries

- New york form it 222 general corporation tax credit for full

Find out other Form 587 Nonresident Withholding Allocation Worksheet Sdge

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF