Form 990, Fill in Version Return of Organization Exempt from Income Tax

What is the Form 990, Fill in Version Return Of Organization Exempt From Income Tax

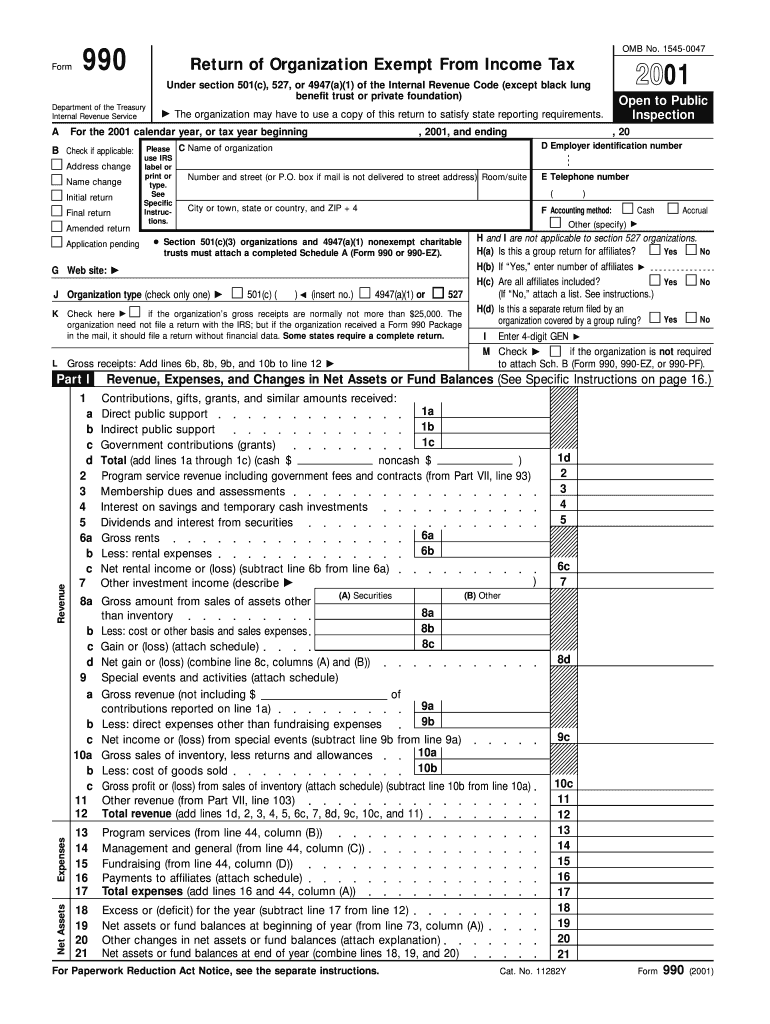

The Form 990, Fill in Version Return Of Organization Exempt From Income Tax, is a crucial document for tax-exempt organizations in the United States. It provides the IRS with detailed information about the organization's activities, governance, and financial status. This form is mandatory for most tax-exempt entities, including charities and non-profits, to maintain their tax-exempt status. By filing Form 990, organizations demonstrate transparency and accountability, which can enhance their credibility with donors and the public.

How to obtain the Form 990, Fill in Version Return Of Organization Exempt From Income Tax

Organizations can obtain the Form 990 from the IRS website or through authorized tax preparation software. It is available as a downloadable PDF, which can be filled in electronically or printed for manual completion. Additionally, many tax professionals and accountants can provide this form as part of their services. Ensuring that the correct version of the form is used is essential, as there are variations based on the organization's size and type.

Steps to complete the Form 990, Fill in Version Return Of Organization Exempt From Income Tax

Completing the Form 990 involves several key steps:

- Gather necessary financial records, including income statements, balance sheets, and expense reports.

- Review the instructions provided with the form to understand the specific requirements for your organization.

- Fill in the organization’s basic information, including name, address, and Employer Identification Number (EIN).

- Complete the financial sections, detailing revenue, expenses, and net assets.

- Provide information on governance, including the board of directors and any related parties.

- Review the completed form for accuracy and completeness before submission.

Key elements of the Form 990, Fill in Version Return Of Organization Exempt From Income Tax

The Form 990 consists of several key elements that organizations must accurately report. These include:

- Part I: Summary of the organization’s mission and significant activities.

- Part II: Signature block and governance details.

- Part III: Statement of program service accomplishments.

- Part IV: Financial statements, including revenue and expenses.

- Part V: Information on the organization’s board and key employees.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for Form 990 to avoid penalties. Generally, Form 990 is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December 31, the form is due by May 15 of the following year. Extensions can be requested, but it is essential to file the request before the original deadline to avoid late fees.

Penalties for Non-Compliance

Failure to file Form 990 on time can result in significant penalties. The IRS imposes fines based on the organization’s gross receipts, which can accumulate daily. Additionally, repeated failures to file can lead to the loss of tax-exempt status. Organizations should prioritize timely and accurate filing to maintain compliance and avoid these financial repercussions.

Quick guide on how to complete form 990 fill in version return of organization exempt from income tax 11984970

Complete [SKS] easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow has designed specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the stress of lost or misplaced documents, laborious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990, Fill in Version Return Of Organization Exempt From Income Tax

Create this form in 5 minutes!

How to create an eSignature for the form 990 fill in version return of organization exempt from income tax 11984970

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990, Fill in Version Return Of Organization Exempt From Income Tax?

The Form 990, Fill in Version Return Of Organization Exempt From Income Tax is a tax form used by tax-exempt organizations to provide the IRS with information about their activities, governance, and financials. This form is essential for maintaining tax-exempt status and ensuring compliance with federal regulations.

-

How can airSlate SignNow help with completing the Form 990, Fill in Version Return Of Organization Exempt From Income Tax?

airSlate SignNow offers an intuitive platform that simplifies the process of completing the Form 990, Fill in Version Return Of Organization Exempt From Income Tax. With our easy-to-use tools, you can fill out the form electronically, ensuring accuracy and saving time.

-

What features does airSlate SignNow provide for managing Form 990 submissions?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage to streamline the management of Form 990, Fill in Version Return Of Organization Exempt From Income Tax submissions. These features enhance efficiency and ensure that your documents are always accessible.

-

Is there a cost associated with using airSlate SignNow for Form 990 submissions?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different organizations. Our cost-effective solutions provide excellent value for managing the Form 990, Fill in Version Return Of Organization Exempt From Income Tax and other essential documents.

-

Can I integrate airSlate SignNow with other software for Form 990 management?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to seamlessly manage your Form 990, Fill in Version Return Of Organization Exempt From Income Tax alongside your existing tools. This integration enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for Form 990 submissions?

Using airSlate SignNow for your Form 990, Fill in Version Return Of Organization Exempt From Income Tax submissions offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are handled professionally and securely.

-

How does airSlate SignNow ensure the security of my Form 990 data?

airSlate SignNow prioritizes the security of your data by implementing advanced encryption and secure access controls. When you use our platform for the Form 990, Fill in Version Return Of Organization Exempt From Income Tax, you can trust that your sensitive information is protected.

Get more for Form 990, Fill in Version Return Of Organization Exempt From Income Tax

- Florida lease to purchase option agreement form

- Iowa lease termination letter form 30 day notice

- Fillable online motor dealers and chattel auctioneers form

- Application for refund of fuel excise duty form

- Dha 1 form

- Accordance with the limited liability company act of the state of delaware form

- Certificate of dissolution delawaregov form

- Washington state tort claim form packetwashington state tort claim form packetwashington state tort claim form packetclaim for

Find out other Form 990, Fill in Version Return Of Organization Exempt From Income Tax

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple