Instructions for 990T Instructions for Form 990T Nccsdataweb Urban

What is the Instructions For 990T Instructions For Form 990T Nccsdataweb Urban

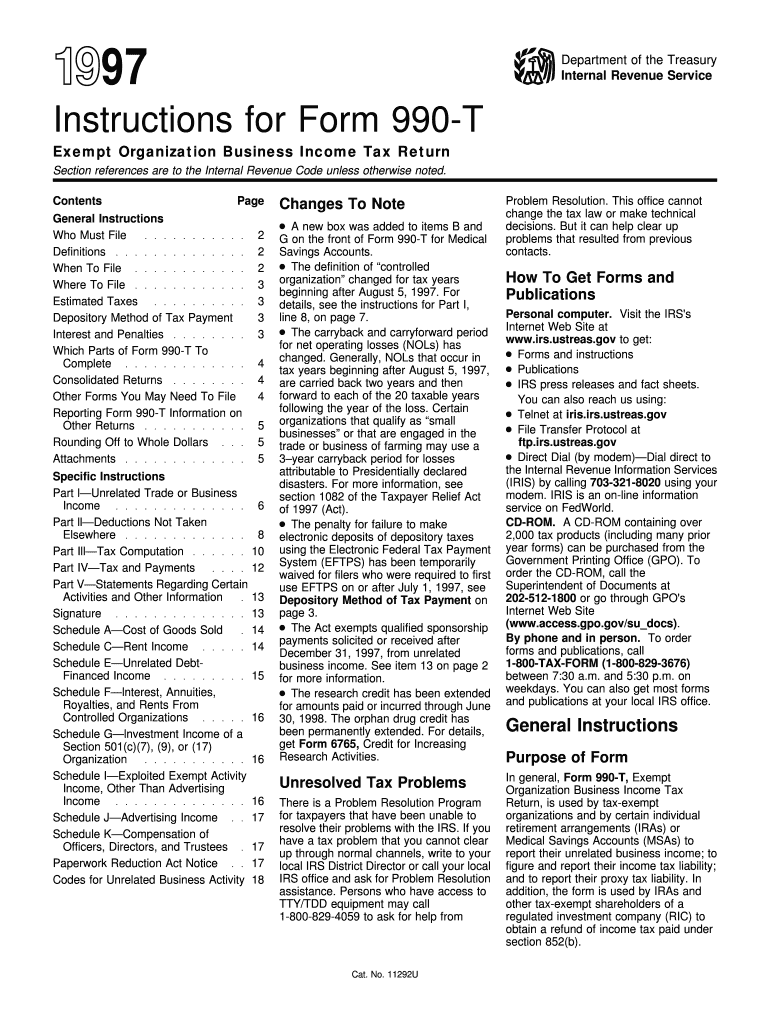

The Instructions For 990T provide essential guidance for organizations that need to file Form 990-T, which is specifically designed for tax-exempt organizations that generate unrelated business income. This form is crucial for ensuring compliance with IRS regulations and helps organizations report their income accurately. The instructions outline the necessary steps to complete the form, including definitions of terms, explanations of various sections, and the requirements for reporting income and expenses related to unrelated business activities.

Steps to complete the Instructions For 990T Instructions For Form 990T Nccsdataweb Urban

Completing the Instructions For 990T involves several systematic steps:

- Review the eligibility criteria to confirm that your organization needs to file Form 990-T.

- Gather all necessary financial documents, including income statements and expense records related to unrelated business activities.

- Follow the detailed instructions for each section of Form 990-T, ensuring that all required information is included.

- Calculate the unrelated business taxable income (UBTI) by subtracting allowable deductions from gross income.

- Complete the form accurately, double-checking for any errors or omissions.

- Submit the completed form by the specified deadline, either electronically or via mail.

Key elements of the Instructions For 990T Instructions For Form 990T Nccsdataweb Urban

Understanding the key elements of the Instructions For 990T is vital for accurate filing. These elements include:

- Definitions: Clear definitions of unrelated business income and related terms.

- Filing requirements: Specific criteria that determine if an organization must file Form 990-T.

- Income reporting: Guidelines on how to report various types of income from unrelated business activities.

- Deductions: Information on allowable deductions that can reduce taxable income.

- Penalties: Potential penalties for failure to file or inaccuracies in reporting.

IRS Guidelines

The IRS provides comprehensive guidelines that govern the completion and submission of Form 990-T. These guidelines include:

- Instructions on determining unrelated business income.

- Clarification on the types of activities that qualify as unrelated business activities.

- Details on the tax rates applicable to unrelated business income.

- Information on the implications of filing Form 990-T on an organization's tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for Form 990-T are critical for compliance. Organizations must adhere to the following important dates:

- The form is generally due on the fifteenth day of the fifth month after the end of the organization's tax year.

- Extensions can be requested, but they must be filed before the original due date.

- Late filings may incur penalties, so timely submission is essential.

Required Documents

Before completing Form 990-T, organizations should prepare the following required documents:

- Financial statements detailing income and expenses from unrelated business activities.

- Documentation supporting any deductions claimed.

- Prior year tax returns, if applicable, for reference.

- Any additional IRS forms that may be necessary based on the organization's specific circumstances.

Quick guide on how to complete instructions for 990t instructions for form 990t nccsdataweb urban

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides for that specific purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering the form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For 990T Instructions For Form 990T Nccsdataweb Urban

Create this form in 5 minutes!

How to create an eSignature for the instructions for 990t instructions for form 990t nccsdataweb urban

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing Instructions For 990T Instructions For Form 990T Nccsdataweb Urban?

airSlate SignNow offers a range of features designed to simplify the management of Instructions For 990T Instructions For Form 990T Nccsdataweb Urban. Users can easily create, send, and eSign documents, ensuring compliance and efficiency. The platform also includes templates specifically tailored for 990T forms, making it easier to navigate complex tax requirements.

-

How does airSlate SignNow ensure the security of my documents related to Instructions For 990T Instructions For Form 990T Nccsdataweb Urban?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols to protect your documents, including those related to Instructions For 990T Instructions For Form 990T Nccsdataweb Urban. Additionally, user authentication and audit trails ensure that your sensitive information remains secure throughout the signing process.

-

What is the pricing structure for airSlate SignNow when dealing with Instructions For 990T Instructions For Form 990T Nccsdataweb Urban?

airSlate SignNow offers flexible pricing plans that cater to various business needs, especially for those handling Instructions For 990T Instructions For Form 990T Nccsdataweb Urban. Plans are designed to be cost-effective, allowing businesses to choose a package that fits their budget while still accessing essential features for document management and eSigning.

-

Can I integrate airSlate SignNow with other software for managing Instructions For 990T Instructions For Form 990T Nccsdataweb Urban?

Yes, airSlate SignNow supports integrations with various software applications, enhancing your workflow for Instructions For 990T Instructions For Form 990T Nccsdataweb Urban. Whether you use CRM systems, cloud storage, or accounting software, you can seamlessly connect these tools to streamline your document management process.

-

What benefits does airSlate SignNow provide for businesses handling Instructions For 990T Instructions For Form 990T Nccsdataweb Urban?

Using airSlate SignNow for Instructions For 990T Instructions For Form 990T Nccsdataweb Urban offers numerous benefits, including increased efficiency and reduced turnaround times for document processing. The platform's user-friendly interface allows for quick eSigning, which can signNowly enhance productivity and ensure timely compliance with tax regulations.

-

Is there customer support available for users of airSlate SignNow dealing with Instructions For 990T Instructions For Form 990T Nccsdataweb Urban?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any inquiries related to Instructions For 990T Instructions For Form 990T Nccsdataweb Urban. Whether you need help with technical issues or guidance on using specific features, the support team is readily available to ensure a smooth experience.

-

How can I get started with airSlate SignNow for Instructions For 990T Instructions For Form 990T Nccsdataweb Urban?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore the features tailored for Instructions For 990T Instructions For Form 990T Nccsdataweb Urban. Once registered, you can begin creating and sending documents immediately, allowing you to experience the platform's capabilities firsthand.

Get more for Instructions For 990T Instructions For Form 990T Nccsdataweb Urban

- Procuring third party document discovery under the abtl form

- Ccp section 1706 should be repealed when opinions are form

- Vehicleplate update termination form f9

- Vehicleplate update termination form f9 72251314

- Lic8 do i form

- Form fsi302 ampquotapplication for retail food store license

- New york state department of state division of form

- Retail renewal or permit renewal new york form

Find out other Instructions For 990T Instructions For Form 990T Nccsdataweb Urban

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement