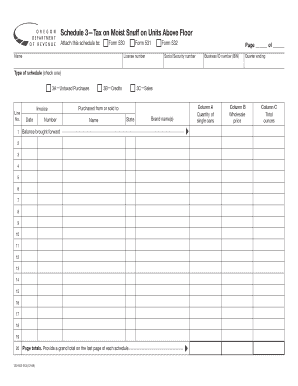

Schedule 3 Tax on Moist Snuff on Units above Floor Form

What is the Schedule 3 Tax On Moist Snuff On Units Above Floor

The Schedule 3 Tax On Moist Snuff On Units Above Floor is a specific tax form used to report and pay taxes on moist snuff tobacco products. This tax is applicable to manufacturers and importers of moist snuff that exceed a certain threshold, typically measured in units above a designated floor amount. Understanding this tax is crucial for compliance with federal regulations regarding tobacco products.

How to use the Schedule 3 Tax On Moist Snuff On Units Above Floor

Using the Schedule 3 Tax On Moist Snuff On Units Above Floor involves accurately reporting the quantity of moist snuff produced or imported. Businesses must complete the form by detailing the number of units exceeding the floor amount and calculating the tax owed based on current rates. It is essential to maintain accurate records to support the information provided on the form.

Steps to complete the Schedule 3 Tax On Moist Snuff On Units Above Floor

Completing the Schedule 3 Tax On Moist Snuff On Units Above Floor requires several steps:

- Gather necessary documentation, including production and sales records.

- Calculate the total number of units of moist snuff produced or imported.

- Determine the amount of moist snuff that exceeds the established floor threshold.

- Apply the appropriate tax rate to the excess units.

- Complete the form with accurate figures and information.

- Review the form for accuracy before submission.

Legal use of the Schedule 3 Tax On Moist Snuff On Units Above Floor

Legal use of the Schedule 3 Tax On Moist Snuff On Units Above Floor is essential for compliance with federal tax laws. Manufacturers and importers must ensure they are using the correct form and reporting all applicable moist snuff units accurately. Failure to comply with these regulations can result in penalties and legal repercussions.

Key elements of the Schedule 3 Tax On Moist Snuff On Units Above Floor

Key elements of the Schedule 3 Tax On Moist Snuff On Units Above Floor include:

- Identification of the taxpayer, including name, address, and taxpayer identification number.

- Details of the moist snuff products, including quantity and type.

- Calculation of the tax based on the number of units exceeding the floor amount.

- Signature of the responsible party, certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 3 Tax On Moist Snuff On Units Above Floor are typically aligned with quarterly tax periods. It is important for businesses to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submissions and compliance with federal regulations.

Quick guide on how to complete schedule 3 tax on moist snuff on units above floor

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

The easiest way to modify and eSign [SKS] without any hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 tax on moist snuff on units above floor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 3 Tax On Moist Snuff On Units Above Floor?

The Schedule 3 Tax On Moist Snuff On Units Above Floor refers to the specific tax regulations applied to moist snuff products that exceed certain unit thresholds. Understanding this tax is crucial for businesses involved in the sale of these products to ensure compliance and avoid penalties.

-

How does airSlate SignNow help with managing Schedule 3 Tax On Moist Snuff On Units Above Floor?

airSlate SignNow provides businesses with tools to streamline document management related to the Schedule 3 Tax On Moist Snuff On Units Above Floor. By using our eSigning and document automation features, companies can efficiently handle tax-related paperwork and maintain accurate records.

-

What are the pricing options for airSlate SignNow when dealing with Schedule 3 Tax On Moist Snuff On Units Above Floor?

Our pricing plans are designed to be cost-effective, catering to businesses of all sizes. Whether you need basic eSigning features or advanced document management capabilities related to the Schedule 3 Tax On Moist Snuff On Units Above Floor, we have a plan that fits your needs.

-

Can airSlate SignNow integrate with other software for Schedule 3 Tax On Moist Snuff On Units Above Floor?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software. This allows businesses to easily manage their documents and ensure compliance with the Schedule 3 Tax On Moist Snuff On Units Above Floor without disrupting their existing workflows.

-

What features does airSlate SignNow offer for handling Schedule 3 Tax On Moist Snuff On Units Above Floor?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing documents related to the Schedule 3 Tax On Moist Snuff On Units Above Floor. These tools help streamline processes and enhance efficiency.

-

How can airSlate SignNow improve compliance with Schedule 3 Tax On Moist Snuff On Units Above Floor?

By utilizing airSlate SignNow, businesses can ensure that all necessary documents are properly signed and stored, reducing the risk of non-compliance with the Schedule 3 Tax On Moist Snuff On Units Above Floor. Our audit trails and secure storage options provide peace of mind.

-

Is airSlate SignNow suitable for small businesses dealing with Schedule 3 Tax On Moist Snuff On Units Above Floor?

Absolutely! airSlate SignNow is designed to be user-friendly and affordable, making it an excellent choice for small businesses managing the Schedule 3 Tax On Moist Snuff On Units Above Floor. Our platform scales with your business needs, ensuring you have the right tools at every stage.

Get more for Schedule 3 Tax On Moist Snuff On Units Above Floor

Find out other Schedule 3 Tax On Moist Snuff On Units Above Floor

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer