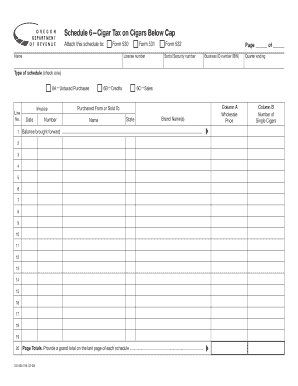

Clear Form Schedule 6 Cigar Tax on Cigars below Cap Attach This Schedule to Name Form 530 Form 531 Form 532 Social Security Numb

Understanding the Clear Form Schedule 6 for Cigar Tax

The Clear Form Schedule 6 is a specific tax form used for reporting cigar tax on cigars sold below the established cap. This schedule must be attached to the appropriate forms, such as Form 530, Form 531, or Form 532. It is essential for businesses involved in the sale of cigars to accurately complete this form to comply with federal regulations. The form requires the inclusion of critical information, including the Social Security Number, Business ID Number (BIN), and the license number of the business. This ensures that all transactions are properly documented and accounted for during tax assessments.

Steps to Complete the Clear Form Schedule 6

Completing the Clear Form Schedule 6 involves several key steps:

- Gather necessary information, including your Social Security Number, Business ID Number, and license number.

- Indicate the type of schedule by checking the appropriate box, such as 6A for untaxed cigars.

- Ensure that the form is filled out accurately, reflecting the total number of cigars sold below the cap.

- Attach the completed schedule to the relevant forms (Form 530, Form 531, or Form 532) before submission.

- Review all entries for accuracy to avoid potential penalties.

Legal Use of the Clear Form Schedule 6

The Clear Form Schedule 6 is legally required for businesses that sell cigars below the cap set by federal regulations. Failure to submit this form correctly can lead to penalties, including fines or additional scrutiny from tax authorities. It is crucial for businesses to understand their obligations under the law and ensure compliance with all reporting requirements. This form serves as a formal declaration of the tax owed on untaxed cigars, making it an essential component of tax documentation for cigar retailers.

Required Documents for Submission

When preparing to submit the Clear Form Schedule 6, certain documents are necessary to ensure a complete and accurate filing:

- Completed Clear Form Schedule 6.

- Form 530, Form 531, or Form 532, as applicable.

- Documentation of sales and inventory records for the reporting period.

- Any additional forms or schedules required by the IRS for your specific business type.

Filing Deadlines for the Clear Form Schedule 6

It is important to be aware of the filing deadlines associated with the Clear Form Schedule 6. Typically, this form must be submitted quarterly, coinciding with the end of the tax quarter. Businesses should mark their calendars for these deadlines to ensure timely submission and avoid penalties. Keeping track of these dates helps maintain compliance with federal tax regulations and supports smooth business operations.

Examples of Using the Clear Form Schedule 6

Businesses may encounter various scenarios when using the Clear Form Schedule 6. For instance, a cigar retailer may need to report sales from a promotional event where cigars were sold at a discount, resulting in sales below the cap. Another example could be a small business that primarily sells cigars online and must accurately report its sales for tax purposes. Understanding these examples can help businesses better prepare for their tax obligations and navigate the complexities of cigar taxation.

Quick guide on how to complete clear form schedule 6 cigar tax on cigars below cap attach this schedule to name form 530 form 531 form 532 social security

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the essential tools to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important parts of the documents or mask sensitive data with tools that airSlate SignNow offers for that very purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and select the Done button to save your modifications.

- Choose how you want to send your form: via email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misarranged files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clear form schedule 6 cigar tax on cigars below cap attach this schedule to name form 530 form 531 form 532 social security

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap?

The Clear Form Schedule 6 Cigar Tax On Cigars Below Cap is a specific form required for reporting cigar taxes. It must be attached to Name Form 530, Form 531, or Form 532. This form helps ensure compliance with tax regulations for businesses dealing with cigars.

-

How do I complete the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap?

To complete the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap, you need to provide your Social Security Number, Business ID Number (BIN), and other relevant details. Make sure to check the appropriate box for Type Of Schedule, specifically selecting 6A for Untaxed cigars. Accurate completion is crucial for proper tax reporting.

-

What are the benefits of using airSlate SignNow for submitting the Clear Form Schedule 6?

Using airSlate SignNow for submitting the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap streamlines the eSigning process. It offers a user-friendly interface, ensuring that you can easily attach this schedule to Name Form 530, Form 531, or Form 532. Additionally, it enhances compliance and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for cigar tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive and provides access to features that simplify the process of completing forms like the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various tax management software and platforms. This allows you to efficiently manage your documents, including the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap, alongside your existing systems, enhancing your workflow.

-

What types of businesses benefit from using the Clear Form Schedule 6?

Businesses involved in the sale of cigars, such as retailers and distributors, benefit signNowly from using the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap. It ensures they remain compliant with tax regulations while simplifying the reporting process. This is essential for maintaining good standing with tax authorities.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents, including the Clear Form Schedule 6 Cigar Tax On Cigars Below Cap. It employs advanced encryption and secure storage solutions to protect sensitive information like your Social Security Number and Business ID Number. You can trust that your data is safe.

Get more for Clear Form Schedule 6 Cigar Tax On Cigars Below Cap Attach This Schedule To Name Form 530 Form 531 Form 532 Social Security Numb

- Free kentucky boat bill of sale formpdfword doc

- Application for religious institution letter of exemption florida fldoe form

- Oil and gas operating expense data oil and gas operating expense data form

- Get the city of tulsa license and permit center pdffiller form

- City of tulsa stationary engineer license renewal form

- Form notice of insurers primary liability determination

- Notice of insurers primary liability determination nopld form dli mn

- Department of workforce servicesdepartment of workforce services utahcourt forms and instructions utah courtsmotor vehicle

Find out other Clear Form Schedule 6 Cigar Tax On Cigars Below Cap Attach This Schedule To Name Form 530 Form 531 Form 532 Social Security Numb

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation