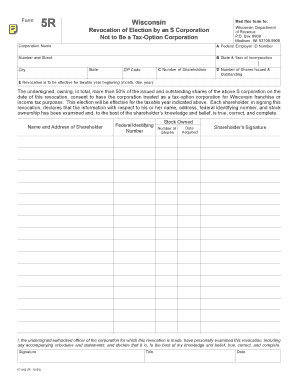

Form 5R Wisconsin Revocation of Election by an S Revenue Wi

What is the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi

The Form 5R Wisconsin Revocation Of Election By An S Revenue Wi is a specific document used by taxpayers in Wisconsin to revoke their election to be treated as an S corporation for tax purposes. This form is essential for businesses that initially opted for S corporation status but wish to revert to a different tax classification. The revocation must be filed with the Wisconsin Department of Revenue to ensure compliance with state tax regulations.

How to use the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi

To use the Form 5R, taxpayers must complete the document accurately, providing all required information about the business and the reason for revocation. Once completed, the form must be submitted to the Wisconsin Department of Revenue. It is crucial to ensure that the form is filed within the specified timeframe to avoid any penalties or complications regarding tax status.

Steps to complete the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi

Completing the Form 5R involves several key steps:

- Gather necessary information about the business, including the legal name, address, and tax identification number.

- Indicate the effective date of the revocation, ensuring it aligns with the current tax year.

- Provide a clear reason for the revocation, as this may impact future tax filings.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi

The legal use of the Form 5R is to formally notify the Wisconsin Department of Revenue of a business's decision to revoke its S corporation status. This action must comply with state laws and regulations governing business classifications. Proper use of the form ensures that the business is aligned with its intended tax structure and avoids potential legal issues related to misclassification.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5R are critical to maintaining compliance with tax regulations. Typically, the revocation must be submitted by the fifteenth day of the third month of the tax year in which the revocation is intended to take effect. Missing this deadline could result in the continuation of S corporation status for another year, which may not align with the business's current tax strategy.

Required Documents

When filing the Form 5R, certain documents may be required to support the revocation. These documents can include:

- Previous tax returns reflecting S corporation status.

- Any relevant correspondence with the Wisconsin Department of Revenue.

- Documentation explaining the reason for the revocation.

Quick guide on how to complete form 5r wisconsin revocation of election by an s revenue wi

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, adjust, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5r wisconsin revocation of election by an s revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi?

The Form 5R Wisconsin Revocation Of Election By An S Revenue Wi is a document used by businesses to revoke their election to be treated as an S corporation for tax purposes. This form is essential for ensuring compliance with Wisconsin tax regulations and allows businesses to revert to C corporation status if desired.

-

How can airSlate SignNow help with the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi. Our user-friendly interface simplifies the document management process, ensuring that you can complete your revocation quickly and securely.

-

What are the pricing options for using airSlate SignNow for the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need a basic plan for occasional use or a comprehensive solution for frequent document management, our pricing is designed to be cost-effective while providing all the necessary features for handling the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi.

-

What features does airSlate SignNow offer for managing the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi?

With airSlate SignNow, you can easily create, edit, and eSign the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi. Our platform includes features such as templates, automated workflows, and secure storage, making it easier to manage your documents efficiently.

-

Is airSlate SignNow compliant with legal standards for the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management. This ensures that your Form 5R Wisconsin Revocation Of Election By An S Revenue Wi is legally binding and meets all necessary regulatory requirements.

-

Can I integrate airSlate SignNow with other software for handling the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when managing the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi. This includes popular tools for accounting, CRM, and project management.

-

What are the benefits of using airSlate SignNow for the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi?

Using airSlate SignNow for the Form 5R Wisconsin Revocation Of Election By An S Revenue Wi offers numerous benefits, including time savings, enhanced security, and improved collaboration. Our platform allows you to manage documents efficiently, ensuring that your revocation process is smooth and hassle-free.

Get more for Form 5R Wisconsin Revocation Of Election By An S Revenue Wi

Find out other Form 5R Wisconsin Revocation Of Election By An S Revenue Wi

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed