Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

What is the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

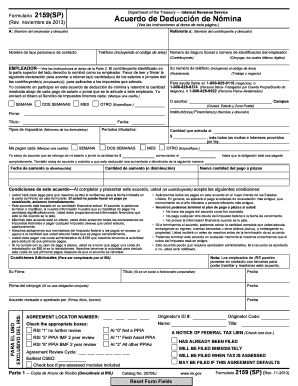

The Form 2159 SP Rev 1 Payroll Deduction Agreement is an official document used by the Internal Revenue Service (IRS) to facilitate payroll deductions for certain tax obligations. This form allows taxpayers to authorize their employer to withhold a specified amount from their wages to cover tax liabilities. It is particularly relevant for individuals who are unable to pay their tax debts in full and wish to set up a manageable payment plan through payroll deductions.

How to use the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

Using the Form 2159 SP Rev 1 involves several steps. First, the taxpayer must fill out the form accurately, providing necessary personal information such as name, Social Security number, and employment details. After completing the form, it should be submitted to the employer for processing. The employer will then set up the payroll deduction as specified in the agreement. It is important for the taxpayer to keep a copy of the completed form for their records.

Steps to complete the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

Completing the Form 2159 SP Rev 1 requires careful attention to detail. Here are the steps to follow:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the amount you wish to have deducted from your paycheck.

- Provide your employer's information, including their name and address.

- Sign and date the form to authorize the deductions.

- Submit the completed form to your employer for processing.

Key elements of the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

The Form 2159 SP Rev 1 includes several key elements that are essential for its effectiveness. These elements include:

- Taxpayer Information: Personal details of the taxpayer, including name and Social Security number.

- Employer Information: Details of the employer who will process the payroll deductions.

- Deduction Amount: The specific amount to be deducted from each paycheck.

- Authorization Signature: The taxpayer's signature, which indicates consent for the deductions.

Legal use of the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

The legal use of the Form 2159 SP Rev 1 is governed by IRS regulations. Taxpayers must ensure that the form is filled out correctly and submitted in accordance with IRS guidelines. Failure to comply with the terms outlined in the form can result in penalties or additional tax liabilities. It is advisable for taxpayers to consult with a tax professional if they have questions about their obligations or the implications of using this form.

Who Issues the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

The Form 2159 SP Rev 1 is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax administration and ensures that taxpayers comply with federal tax laws. The form is part of the IRS's efforts to provide taxpayers with options for managing their tax liabilities through payroll deductions.

Quick guide on how to complete form 2159 sp rev 1 payroll deduction agreement irs

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly popular among both corporations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most effective method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

Create this form in 5 minutes!

How to create an eSignature for the form 2159 sp rev 1 payroll deduction agreement irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs?

The Form 2159 SP Rev 1 Payroll Deduction Agreement Irs is a document used to authorize payroll deductions for specific purposes, such as tax payments or contributions. This form ensures compliance with IRS regulations and helps streamline the payroll process for both employers and employees.

-

How can airSlate SignNow help with the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs. Our solution simplifies the document management process, ensuring that all parties can easily access and sign the agreement securely.

-

What are the pricing options for using airSlate SignNow for the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need basic features or advanced integrations for managing the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs, we have a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities specifically for the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs. These tools enhance efficiency and ensure compliance with IRS standards.

-

Are there any benefits to using airSlate SignNow for the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs?

Using airSlate SignNow for the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. Our solution helps businesses maintain compliance while providing a user-friendly experience.

-

Can I integrate airSlate SignNow with other software for the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs?

Yes, airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow for the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs. This ensures that your document management processes are cohesive and efficient.

-

Is it easy to eSign the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs using airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign the Form 2159 SP Rev 1 Payroll Deduction Agreement Irs. Our intuitive interface allows users to sign documents quickly and securely from any device, enhancing the overall user experience.

Get more for Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

- Daily reading comprehension grade 2 pdf download form

- Volunteer application and appointment form csudh

- Subway job application form

- Mythological studies program reader appointment form

- Checklist 90 form

- Gwu consent form

- Geometry pap name angle puzzle practice period date 1 form

- Team evaluation form template

Find out other Form 2159 SP Rev 1 Payroll Deduction Agreement Irs

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation