PDF Donation Form the University of Texas at Austin

What is the PDF Donation Form The University Of Texas At Austin

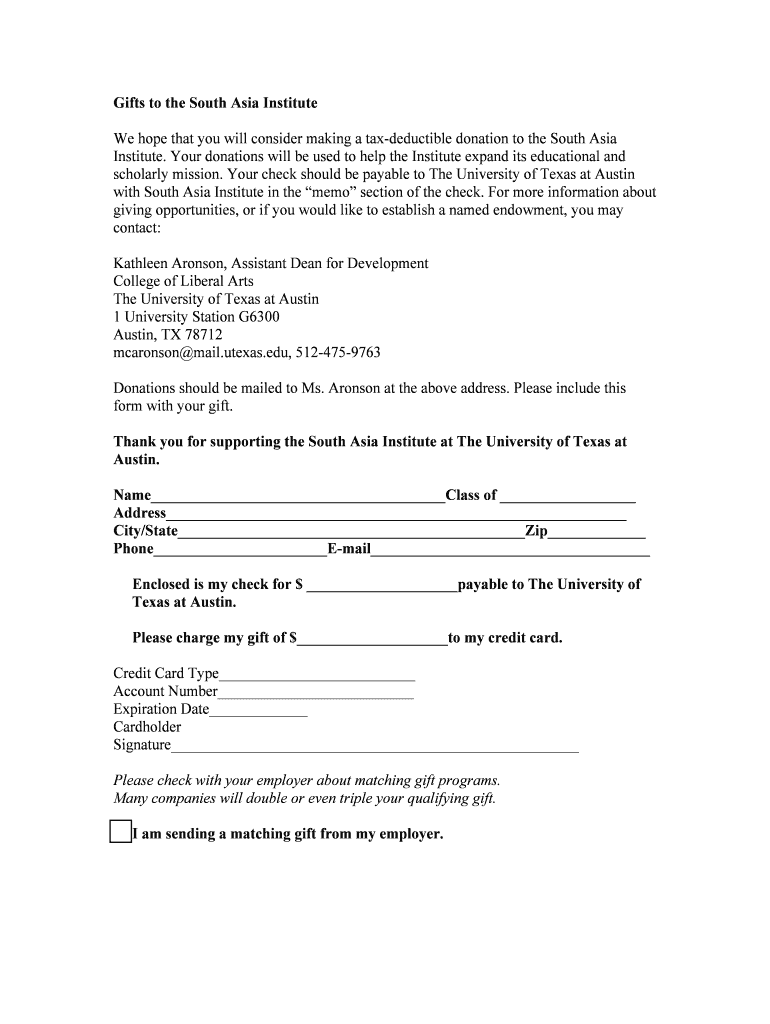

The PDF Donation Form for The University of Texas at Austin is a document designed for individuals wishing to make charitable contributions to the university. This form facilitates the collection of essential donor information, ensuring that contributions are properly recorded and acknowledged. It serves as an official record of the donation, which can be important for both the donor and the institution for tax and accounting purposes.

How to use the PDF Donation Form The University Of Texas At Austin

To effectively use the PDF Donation Form, donors should first download the form from the university's official website. Once downloaded, the form can be filled out digitally or printed for manual completion. It is important to provide accurate information, including the donor's name, contact details, and the amount being donated. After completing the form, donors should submit it along with their contribution, ensuring it reaches the appropriate department at the university.

Steps to complete the PDF Donation Form The University Of Texas At Austin

Completing the PDF Donation Form involves several straightforward steps:

- Download the PDF Donation Form from the university's website.

- Open the form using a PDF reader or print it out.

- Fill in the required fields, including donor information and donation amount.

- Review the completed form for accuracy.

- Sign the form if required.

- Submit the form along with your donation via the specified method.

Key elements of the PDF Donation Form The University Of Texas At Austin

The key elements of the PDF Donation Form include:

- Donor Information: Name, address, and contact details of the donor.

- Donation Amount: The total amount being donated.

- Designation: Specific funds or programs the donation is intended for.

- Payment Method: Options for how the donation will be made, such as credit card or check.

- Signature: A space for the donor’s signature to validate the donation.

Form Submission Methods

Donors can submit the PDF Donation Form through various methods, including:

- Online Submission: If the form is filled out digitally, it may be submitted via email to the designated department.

- Mail: Printed forms can be mailed to the university's donation processing address.

- In-Person: Donors may also choose to deliver the form in person at the university's development office.

Legal use of the PDF Donation Form The University Of Texas At Austin

The PDF Donation Form is legally binding once signed by the donor. It serves as a formal agreement between the donor and The University of Texas at Austin, outlining the terms of the donation. Donors should retain a copy of the completed form for their records, as it may be required for tax purposes. The university is responsible for using the donations in accordance with the donor's wishes as specified on the form.

Quick guide on how to complete pdf donation form the university of texas at austin

Effortlessly Prepare [SKS] on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to easily find the right form and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electrically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure confidential information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure exceptional communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PDF Donation Form The University Of Texas At Austin

Create this form in 5 minutes!

How to create an eSignature for the pdf donation form the university of texas at austin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PDF Donation Form The University Of Texas At Austin?

The PDF Donation Form The University Of Texas At Austin is a digital document designed to facilitate donations to the university. It allows donors to fill out their information and submit contributions easily and securely. This form is essential for streamlining the donation process and ensuring that contributions are accurately recorded.

-

How can I access the PDF Donation Form The University Of Texas At Austin?

You can access the PDF Donation Form The University Of Texas At Austin directly from the university's official website or through the airSlate SignNow platform. Simply navigate to the donations section, and you will find the form available for download or online completion. This ensures that you have a convenient way to contribute.

-

Is there a fee associated with using the PDF Donation Form The University Of Texas At Austin?

Using the PDF Donation Form The University Of Texas At Austin through airSlate SignNow is cost-effective, with no hidden fees for donors. The platform offers various pricing plans for organizations, but individuals can fill out and submit the form without incurring any charges. This makes it accessible for everyone wishing to support the university.

-

What features does the PDF Donation Form The University Of Texas At Austin offer?

The PDF Donation Form The University Of Texas At Austin includes features such as electronic signatures, secure data submission, and customizable fields. These features enhance the user experience by making the donation process straightforward and efficient. Additionally, the form can be easily integrated with other systems for tracking donations.

-

How does the PDF Donation Form The University Of Texas At Austin benefit donors?

The PDF Donation Form The University Of Texas At Austin benefits donors by providing a simple and efficient way to contribute. It ensures that all information is securely captured and processed, allowing donors to feel confident in their contributions. Furthermore, the digital format allows for quick access and submission from anywhere.

-

Can I integrate the PDF Donation Form The University Of Texas At Austin with other tools?

Yes, the PDF Donation Form The University Of Texas At Austin can be integrated with various tools and platforms, including CRM systems and payment processors. This integration helps streamline the donation process and enhances data management for the university. By using airSlate SignNow, organizations can ensure a seamless experience for both donors and administrators.

-

What security measures are in place for the PDF Donation Form The University Of Texas At Austin?

The PDF Donation Form The University Of Texas At Austin is designed with robust security measures to protect donor information. airSlate SignNow employs encryption and secure data storage to ensure that all submissions are safe from unauthorized access. Donors can trust that their personal and financial information is handled with the utmost care.

Get more for PDF Donation Form The University Of Texas At Austin

- Swimming pool incident report form

- Conflict resolution workshop delta sigma theta form

- Neuroaffective relational model pdf form

- Financial state at muk form

- Housing and meal plan withdrawal form panther central pc pitt

- Makss survey form

- Cullman county new notary application amp order form alabama

- Dcya qualification recognition form

Find out other PDF Donation Form The University Of Texas At Austin

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy