California Hotel Tax Exempt Form PDF

Understanding the California Hotel Tax Exempt Form PDF

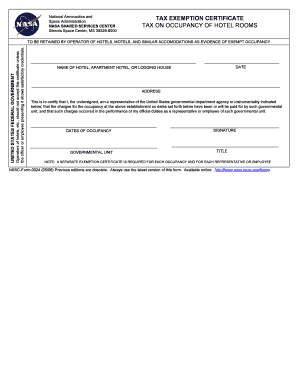

The California Hotel Tax Exempt Form PDF is a crucial document for individuals and organizations seeking exemption from transient occupancy taxes in the state of California. This form is designed specifically for entities such as government agencies, non-profit organizations, and certain educational institutions that qualify for tax exemption. By submitting this form, eligible parties can avoid paying the transient occupancy tax, which is typically levied on hotel stays. Understanding the purpose and requirements of this form is essential for ensuring compliance and maximizing potential savings.

Steps to Complete the California Hotel Tax Exempt Form PDF

Completing the California Hotel Tax Exempt Form PDF involves several key steps. First, gather all necessary information, including the name of the organization, tax identification number, and the specific reason for the exemption. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays in processing. It is important to review the form for any errors before submission. Finally, submit the completed form to the hotel or lodging provider where the stay will occur, as they will require this documentation to process the tax exemption.

Eligibility Criteria for the California Hotel Tax Exempt Form PDF

To qualify for the California Hotel Tax Exempt Form PDF, applicants must meet specific eligibility criteria. Generally, the form is available to government entities, non-profit organizations, and educational institutions that are exempt from paying state taxes. Additionally, the stay must be for official business or educational purposes, and the individual or organization must provide valid identification and documentation to support their claim for exemption. Understanding these criteria is essential to ensure that the application process is successful.

Required Documents for Submission

When submitting the California Hotel Tax Exempt Form PDF, certain documents are typically required to validate the exemption claim. These may include a copy of the organization's tax-exempt status letter, a government-issued identification, and any relevant documentation that supports the purpose of the stay. It is advisable to check with the specific hotel or lodging provider for any additional requirements they may have regarding documentation to ensure a smooth process.

Form Submission Methods

The California Hotel Tax Exempt Form PDF can be submitted through various methods, depending on the hotel's policies. Common submission methods include in-person delivery at the time of check-in, faxing the completed form to the hotel, or emailing it if the hotel allows for electronic submissions. Each hotel may have different preferences, so it is important to confirm the accepted submission methods to avoid complications during the check-in process.

Legal Use of the California Hotel Tax Exempt Form PDF

The legal use of the California Hotel Tax Exempt Form PDF is governed by state tax laws. It is essential for users to ensure that the form is completed accurately and submitted only by those who meet the eligibility criteria. Misuse of the form, such as submitting it without proper authorization or for ineligible stays, can result in penalties and loss of tax-exempt status. Understanding the legal implications of using this form is vital for compliance and to avoid potential legal issues.

Quick guide on how to complete california hotel tax exempt form pdf 100067283

Prepare California Hotel Tax Exempt Form Pdf seamlessly on any device

Online document administration has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage California Hotel Tax Exempt Form Pdf on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign California Hotel Tax Exempt Form Pdf with ease

- Locate California Hotel Tax Exempt Form Pdf and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign California Hotel Tax Exempt Form Pdf and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california hotel tax exempt form pdf 100067283

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of los angeles transient occupancy tax exemption form?

The city of los angeles transient occupancy tax exemption form is a document that allows eligible property owners to apply for an exemption from the transient occupancy tax. This form is essential for those renting out properties in Los Angeles, ensuring compliance with local tax regulations while maximizing potential savings.

-

How can I obtain the city of los angeles transient occupancy tax exemption form?

You can obtain the city of los angeles transient occupancy tax exemption form directly from the official Los Angeles city website or through local government offices. Additionally, airSlate SignNow provides a streamlined process to fill out and eSign this form, making it easier for you to submit your application.

-

What are the benefits of using airSlate SignNow for the city of los angeles transient occupancy tax exemption form?

Using airSlate SignNow for the city of los angeles transient occupancy tax exemption form offers several benefits, including ease of use, cost-effectiveness, and secure document management. Our platform allows you to complete and eSign the form quickly, ensuring you meet all deadlines without hassle.

-

Is there a fee associated with the city of los angeles transient occupancy tax exemption form?

While the city of los angeles transient occupancy tax exemption form itself does not have a fee, there may be associated costs depending on your property type and local regulations. Using airSlate SignNow can help you save time and money by simplifying the application process.

-

Can I track the status of my city of los angeles transient occupancy tax exemption form?

Yes, airSlate SignNow allows you to track the status of your city of los angeles transient occupancy tax exemption form in real-time. You will receive notifications and updates, ensuring you are always informed about your application progress.

-

What features does airSlate SignNow offer for managing the city of los angeles transient occupancy tax exemption form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document storage for managing the city of los angeles transient occupancy tax exemption form. These tools enhance your workflow, making it easier to handle multiple applications efficiently.

-

How does airSlate SignNow integrate with other tools for the city of los angeles transient occupancy tax exemption form?

airSlate SignNow seamlessly integrates with various business tools and applications, allowing you to manage the city of los angeles transient occupancy tax exemption form alongside your existing workflows. This integration helps streamline processes and improve overall efficiency.

Get more for California Hotel Tax Exempt Form Pdf

- Beef slaughter haccp plan form

- Mn dot statement of compliance form

- Tempus unlimited termination form

- Practice test new syllabus level 4 final indd form

- Ignou evaluation sheet pdf form

- Enriched learning opportunitiesbrian tucker acad form

- Residency verification form conroeisdnet

- 23 24 season sport of cheer tryout info form

Find out other California Hotel Tax Exempt Form Pdf

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed