Pub 4687, EITC Due Diligence PDF Internal Revenue Service Form

Understanding the Pub 4687, EITC Due Diligence PDF

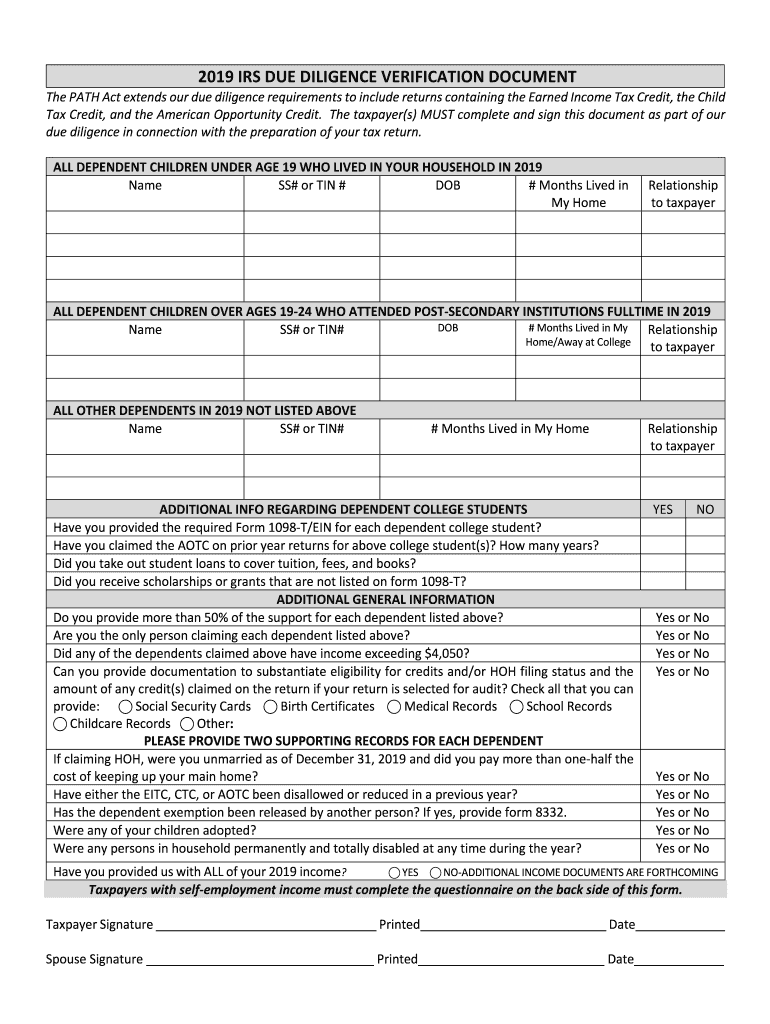

The Pub 4687, EITC Due Diligence PDF is a crucial document provided by the Internal Revenue Service (IRS) that outlines the necessary steps and requirements for tax preparers when claiming the Earned Income Tax Credit (EITC). This publication is designed to ensure that tax professionals conduct due diligence to verify that their clients meet the eligibility criteria for the EITC. It emphasizes the importance of accurate reporting and compliance with IRS regulations to avoid penalties.

How to Use the Pub 4687, EITC Due Diligence PDF

To effectively use the Pub 4687, tax preparers should familiarize themselves with its contents, which include guidelines on verifying client eligibility for the EITC. The document provides a checklist of questions that preparers must ask their clients to ensure compliance. It is essential to document the responses and maintain records of the due diligence process, as this can protect preparers from potential penalties associated with EITC claims.

Steps to Complete the Pub 4687, EITC Due Diligence PDF

Completing the Pub 4687 involves several key steps:

- Review the eligibility criteria for the EITC outlined in the publication.

- Engage with clients to gather necessary information regarding their income, filing status, and number of dependents.

- Utilize the checklist provided in the document to ensure all relevant questions are asked.

- Document the findings and retain records of the due diligence process for future reference.

Key Elements of the Pub 4687, EITC Due Diligence PDF

Several key elements are highlighted in the Pub 4687 that tax preparers must understand:

- Eligibility criteria for the EITC, including income limits and qualifying children.

- Documentation requirements to support EITC claims.

- Consequences of failing to meet due diligence requirements, including potential penalties.

- Specific questions that must be asked during the client interview process.

IRS Guidelines for EITC Due Diligence

The IRS provides specific guidelines within the Pub 4687 that tax preparers must follow to ensure compliance. These guidelines include:

- Detailed instructions on how to verify client eligibility for the EITC.

- Recommendations for maintaining accurate records of client interactions and documentation.

- Clarification on the importance of due diligence in preventing fraudulent claims.

Penalties for Non-Compliance with EITC Due Diligence

Failure to comply with the due diligence requirements outlined in the Pub 4687 can result in significant penalties for tax preparers. These penalties may include:

- Monetary fines for each instance of non-compliance.

- Increased scrutiny from the IRS on future tax returns.

- Potential loss of professional credentials or certifications.

Quick guide on how to complete pub 4687 eitc due diligence pdf internal revenue service

Easily Prepare Pub 4687, EITC Due Diligence PDF Internal Revenue Service on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Handle Pub 4687, EITC Due Diligence PDF Internal Revenue Service across any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Easiest Way to Modify and Electronically Sign Pub 4687, EITC Due Diligence PDF Internal Revenue Service

- Find Pub 4687, EITC Due Diligence PDF Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to apply your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form browsing, and errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and sign Pub 4687, EITC Due Diligence PDF Internal Revenue Service and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pub 4687 eitc due diligence pdf internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Pub 4687, EITC Due Diligence PDF Internal Revenue Service?

Pub 4687, EITC Due Diligence PDF Internal Revenue Service is a publication that outlines the due diligence requirements for tax preparers when claiming the Earned Income Tax Credit (EITC). It provides essential guidelines to ensure compliance and avoid penalties. Understanding this publication is crucial for tax professionals to effectively serve their clients.

-

How can airSlate SignNow help with Pub 4687, EITC Due Diligence PDF Internal Revenue Service compliance?

airSlate SignNow offers a streamlined solution for managing documents related to Pub 4687, EITC Due Diligence PDF Internal Revenue Service. With our eSigning capabilities, tax preparers can easily collect necessary signatures and maintain compliance. This ensures that all due diligence requirements are met efficiently.

-

What features does airSlate SignNow provide for handling EITC documentation?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents related to Pub 4687, EITC Due Diligence PDF Internal Revenue Service. These tools simplify the process of preparing and managing EITC claims, making it easier for tax professionals to stay organized and compliant.

-

Is airSlate SignNow cost-effective for small businesses dealing with EITC claims?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing EITC claims. Our pricing plans are flexible and cater to various business sizes, ensuring that you can access the necessary tools without breaking the bank. This makes it easier for small tax preparers to comply with Pub 4687, EITC Due Diligence PDF Internal Revenue Service requirements.

-

Can I integrate airSlate SignNow with other software for EITC processing?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, enhancing your workflow for EITC processing. This allows you to manage documents related to Pub 4687, EITC Due Diligence PDF Internal Revenue Service directly within your existing systems, improving efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for EITC due diligence?

Using airSlate SignNow for EITC due diligence provides numerous benefits, including improved document management, enhanced compliance, and faster processing times. By leveraging our platform, tax professionals can ensure they meet the requirements outlined in Pub 4687, EITC Due Diligence PDF Internal Revenue Service while providing excellent service to their clients.

-

How secure is airSlate SignNow for handling sensitive EITC documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive EITC documents. When dealing with information related to Pub 4687, EITC Due Diligence PDF Internal Revenue Service, you can trust that your data is safe and secure. Our platform is designed to meet industry standards for data protection.

Get more for Pub 4687, EITC Due Diligence PDF Internal Revenue Service

Find out other Pub 4687, EITC Due Diligence PDF Internal Revenue Service

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template