COMINSPECT INC Nachi Form

What is CP575 A Notice?

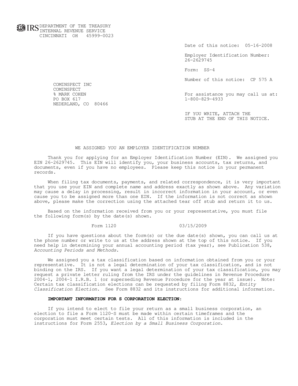

The CP575 A Notice is an important document issued by the Internal Revenue Service (IRS) that serves as confirmation of an employer's identification number (EIN). This notice is typically sent to businesses after they have successfully applied for an EIN. The CP575 A Notice contains essential information, including the EIN itself, the name of the business, and the address associated with the EIN. Understanding this notice is crucial for businesses as it is often required for tax filings, opening bank accounts, and applying for business licenses.

How to Use CP575 A Notice

The CP575 A Notice is used primarily for verification purposes. When a business needs to provide proof of its EIN, this notice serves as an official document. It is commonly required when filing taxes, applying for loans, or completing other official business transactions. Businesses should keep this notice in a secure location, as it contains sensitive information that is necessary for various legal and financial processes.

Steps to Complete CP575 A Notice

While the CP575 A Notice itself does not require completion, businesses must ensure that the information on the notice is accurate. If there are discrepancies, it is important to contact the IRS to correct any errors. Keeping the notice organized and accessible is also essential for future reference. Businesses should note the EIN and ensure that it is used consistently across all forms and applications to avoid confusion.

IRS Guidelines for CP575 A Notice

The IRS provides specific guidelines regarding the use and retention of the CP575 A Notice. It is advisable for businesses to retain this notice for at least four years after the date it was issued. This retention period aligns with the IRS's recommendation for keeping tax records. Additionally, businesses should be aware of the importance of the EIN in various tax-related processes, including payroll and reporting income.

Required Documents for EIN Application

To obtain a CP575 A Notice, a business must first apply for an EIN. The application process typically requires several documents, including:

- Completed Form SS-4, Application for Employer Identification Number

- Legal structure documentation (e.g., articles of incorporation for corporations)

- Identification of the responsible party (usually the owner or principal officer)

Once the application is submitted, the IRS will process it and issue the CP575 A Notice if approved.

Penalties for Non-Compliance

Failure to obtain or properly use an EIN can lead to significant penalties for businesses. The IRS may impose fines for late filings or for failing to file required tax documents. Additionally, businesses that do not comply with federal tax regulations may face audits or other enforcement actions. It is crucial for businesses to understand their responsibilities regarding the CP575 A Notice and the EIN to avoid these consequences.

Quick guide on how to complete cominspect inc nachi

Complete COMINSPECT INC Nachi effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without interruptions. Manage COMINSPECT INC Nachi on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign COMINSPECT INC Nachi without hassle

- Obtain COMINSPECT INC Nachi and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from a device of your choice. Edit and eSign COMINSPECT INC Nachi and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cominspect inc nachi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cp575 a notice?

A cp575 a notice is an official document issued by the IRS that confirms your Employer Identification Number (EIN). This notice is essential for businesses to establish their tax identity and is often required for various financial transactions.

-

How can airSlate SignNow help with cp575 a notice?

airSlate SignNow allows you to easily upload, sign, and send your cp575 a notice electronically. This streamlines the process of managing important tax documents, ensuring that you can handle your paperwork efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for cp575 a notice?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, allowing you to manage your cp575 a notice and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing cp575 a notice?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage. These tools make it easy to manage your cp575 a notice and other important documents in one centralized location.

-

Can I integrate airSlate SignNow with other software for cp575 a notice management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software. This allows you to manage your cp575 a notice alongside other business processes, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for cp575 a notice?

Using airSlate SignNow for your cp575 a notice offers numerous benefits, including faster processing times, enhanced security, and reduced paper usage. This not only saves time but also contributes to a more sustainable business practice.

-

How secure is airSlate SignNow when handling cp575 a notice?

airSlate SignNow prioritizes security with features like encryption and secure access controls. When handling your cp575 a notice, you can trust that your sensitive information is protected against unauthorized access.

Get more for COMINSPECT INC Nachi

- Course evaluation form physical therapy private practice

- Florida department of health intern registration application form

- Echocardiogram report pdf sound form

- Communicable disease guideline chart for child care centers form

- P11d 15 form

- Zumba registration form 244300719

- Mo wc65b form

- Homecoming court application form

Find out other COMINSPECT INC Nachi

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney