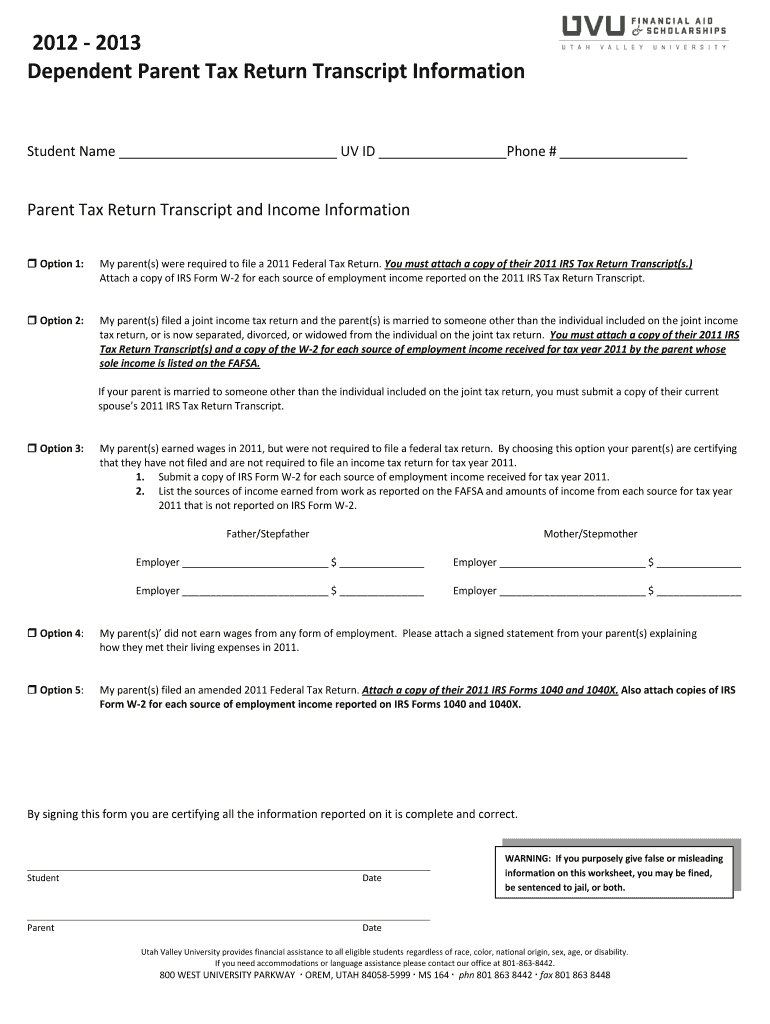

Dependent Parent Tax Return Transcript Information UVU

What is the Dependent Parent Tax Return Transcript Information UVU

The Dependent Parent Tax Return Transcript Information UVU is a document provided by the Internal Revenue Service (IRS) that contains information from the tax return of a dependent parent. This transcript is crucial for various financial aid applications, including those for educational institutions. It helps verify the income and tax filing status of a dependent parent, which can impact eligibility for financial assistance. The transcript includes details such as adjusted gross income, tax liability, and filing status, making it an essential resource for students and their families.

How to obtain the Dependent Parent Tax Return Transcript Information UVU

To obtain the Dependent Parent Tax Return Transcript Information UVU, individuals can request it directly from the IRS. This can be done through several methods:

- Online: Use the IRS website to access the Get Transcript tool, where you can view and download the transcript.

- By Mail: Complete Form 4506-T, Request for Transcript of Tax Return, and submit it to the IRS. The transcript will be mailed to the address on file.

- By Phone: Call the IRS at to request a transcript over the phone.

It is advisable to have the necessary identification information ready, such as Social Security numbers and filing status, to expedite the process.

Steps to complete the Dependent Parent Tax Return Transcript Information UVU

Completing the Dependent Parent Tax Return Transcript Information UVU involves several key steps:

- Gather necessary documents, including the dependent parent's Social Security number and tax information.

- Determine the method of obtaining the transcript (online, by mail, or by phone).

- If requesting by mail, fill out Form 4506-T accurately, ensuring all information is correct.

- Submit the request through the chosen method and wait for the IRS to process it.

- Once received, review the transcript for accuracy and ensure it meets the requirements for financial aid applications.

Key elements of the Dependent Parent Tax Return Transcript Information UVU

The Dependent Parent Tax Return Transcript Information UVU includes several key elements that are important for verification purposes:

- Adjusted Gross Income (AGI): This figure represents the total income of the dependent parent, adjusted for specific deductions.

- Tax Filing Status: Indicates whether the dependent parent filed as single, married filing jointly, married filing separately, or head of household.

- Tax Liability: The total amount of tax owed by the dependent parent for the given tax year.

- Dependent Information: Details about any dependents claimed on the tax return, including the student.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Dependent Parent Tax Return Transcript Information UVU. It is important to follow these guidelines to ensure compliance:

- Transcripts must be requested for the correct tax year, typically the year prior to the financial aid application.

- Ensure that the information on the transcript matches the details provided in financial aid forms to avoid discrepancies.

- Keep the transcript secure, as it contains sensitive personal information.

Eligibility Criteria

Eligibility for obtaining the Dependent Parent Tax Return Transcript Information UVU typically requires that the individual requesting the transcript is either the dependent parent or has legal authorization to access the parent's tax information. The IRS may require proof of identity, such as a Social Security number and other identifying information, to process the request.

Quick guide on how to complete dependent parent tax return transcript information uvu

Prepare [SKS] seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize our tools to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then press the Done button to save your modifications.

- Select your preferred method to share your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and eSign [SKS] to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Dependent Parent Tax Return Transcript Information UVU

Create this form in 5 minutes!

How to create an eSignature for the dependent parent tax return transcript information uvu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dependent Parent Tax Return Transcript Information UVU?

The Dependent Parent Tax Return Transcript Information UVU refers to the specific tax documentation required for dependent students at Utah Valley University. This transcript provides essential financial information that can impact financial aid eligibility and is crucial for accurate reporting.

-

How can airSlate SignNow help with obtaining Dependent Parent Tax Return Transcript Information UVU?

airSlate SignNow streamlines the process of requesting and signing documents related to the Dependent Parent Tax Return Transcript Information UVU. Our platform allows users to easily send, receive, and eSign necessary forms, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for Dependent Parent Tax Return Transcript Information UVU?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Our cost-effective solutions ensure that you can manage your Dependent Parent Tax Return Transcript Information UVU efficiently without breaking the bank.

-

What features does airSlate SignNow offer for managing Dependent Parent Tax Return Transcript Information UVU?

airSlate SignNow provides features such as document templates, real-time tracking, and secure eSigning, all tailored to assist with Dependent Parent Tax Return Transcript Information UVU. These tools enhance productivity and ensure compliance with necessary regulations.

-

Can I integrate airSlate SignNow with other applications for Dependent Parent Tax Return Transcript Information UVU?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage your Dependent Parent Tax Return Transcript Information UVU alongside other tools you may already be using. This enhances workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for Dependent Parent Tax Return Transcript Information UVU?

Using airSlate SignNow for Dependent Parent Tax Return Transcript Information UVU provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the document management process, allowing you to focus on what matters most.

-

How secure is airSlate SignNow when handling Dependent Parent Tax Return Transcript Information UVU?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your Dependent Parent Tax Return Transcript Information UVU, ensuring that your sensitive data remains confidential and safe from unauthorized access.

Get more for Dependent Parent Tax Return Transcript Information UVU

- Ontario landlord and tenant law no written lease am i in form

- Form 18 lockoututility shut off masslegalhelp

- Amended nineteenth year action plan honolulu form

- Form an llc or corporation incorporate onlinebizfilings

- Installment purchase and security agreement clydesdale form

- State summary mechanics lien lawfullerton ampamp knowles form

- Rcw 1827114 disclosure statement requiredprerequisite form

- Installment sale and security agreement legal form

Find out other Dependent Parent Tax Return Transcript Information UVU

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed