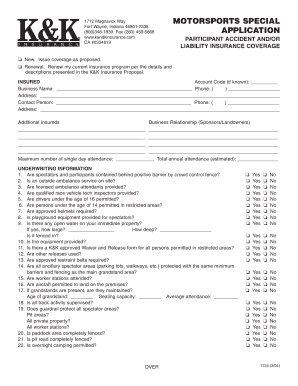

MOTORSPORTS SPECIAL APPLICATION K&K Insurance Form

What is the MOTORSPORTS SPECIAL APPLICATION K&K Insurance

The MOTORSPORTS SPECIAL APPLICATION K&K Insurance is a specialized insurance form designed for motorsports enthusiasts and professionals. This application caters to a variety of motorsport activities, including racing events, exhibitions, and related activities. It provides coverage tailored to the unique risks associated with motorsports, ensuring that participants and organizers are adequately protected against potential liabilities.

How to use the MOTORSPORTS SPECIAL APPLICATION K&K Insurance

To use the MOTORSPORTS SPECIAL APPLICATION K&K Insurance, individuals or organizations must complete the form accurately. This involves providing detailed information about the motorsport event, participants, and any associated risks. The application should be submitted to K&K Insurance for review. Once approved, the insurance coverage will be activated, providing necessary protection for the specified motorsport activities.

Steps to complete the MOTORSPORTS SPECIAL APPLICATION K&K Insurance

Completing the MOTORSPORTS SPECIAL APPLICATION K&K Insurance involves several key steps:

- Gather necessary information about the event, including date, location, and type of motorsport.

- Provide details about participants and any vehicles involved.

- Outline specific risks associated with the event.

- Review the application for accuracy before submission.

- Submit the completed application to K&K Insurance for processing.

Key elements of the MOTORSPORTS SPECIAL APPLICATION K&K Insurance

Several key elements are essential when filling out the MOTORSPORTS SPECIAL APPLICATION K&K Insurance:

- Event Details: Information about the motorsport event, including its name, location, and date.

- Participant Information: Names and details of all participants involved in the event.

- Risk Assessment: A thorough assessment of potential risks associated with the event.

- Coverage Needs: Specific types of coverage required for the event, such as liability or property damage.

Legal use of the MOTORSPORTS SPECIAL APPLICATION K&K Insurance

The legal use of the MOTORSPORTS SPECIAL APPLICATION K&K Insurance is crucial for ensuring compliance with local and state regulations. Participants must ensure that the coverage meets all legal requirements for motorsport events in their jurisdiction. This includes understanding liability laws and ensuring that the insurance policy provides adequate protection against potential legal claims.

Eligibility Criteria

Eligibility for the MOTORSPORTS SPECIAL APPLICATION K&K Insurance typically includes:

- Individuals or organizations hosting motorsport events.

- Participants involved in sanctioned racing activities.

- Compliance with local regulations and safety standards.

Quick guide on how to complete motorsports special application kampk insurance

Complete [SKS] seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from the device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MOTORSPORTS SPECIAL APPLICATION K&K Insurance

Create this form in 5 minutes!

How to create an eSignature for the motorsports special application kampk insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MOTORSPORTS SPECIAL APPLICATION K&K Insurance?

The MOTORSPORTS SPECIAL APPLICATION K&K Insurance is a specialized insurance product designed to meet the unique needs of motorsports businesses. It provides coverage for various risks associated with motorsports activities, ensuring that businesses can operate safely and confidently.

-

How does airSlate SignNow facilitate the signing process for MOTORSPORTS SPECIAL APPLICATION K&K Insurance?

airSlate SignNow streamlines the signing process for MOTORSPORTS SPECIAL APPLICATION K&K Insurance by allowing users to send and eSign documents electronically. This not only speeds up the process but also enhances security and reduces paperwork, making it easier for businesses to manage their insurance needs.

-

What are the pricing options for MOTORSPORTS SPECIAL APPLICATION K&K Insurance?

Pricing for MOTORSPORTS SPECIAL APPLICATION K&K Insurance varies based on the specific coverage needs and the type of motorsports activities involved. It's best to consult with a K&K Insurance representative to get a tailored quote that fits your business requirements.

-

What features does airSlate SignNow offer for managing MOTORSPORTS SPECIAL APPLICATION K&K Insurance documents?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure storage for managing MOTORSPORTS SPECIAL APPLICATION K&K Insurance documents. These features help ensure that all documents are organized and accessible, making the management process efficient.

-

What are the benefits of using airSlate SignNow for MOTORSPORTS SPECIAL APPLICATION K&K Insurance?

Using airSlate SignNow for MOTORSPORTS SPECIAL APPLICATION K&K Insurance provides numerous benefits, including faster turnaround times, reduced administrative costs, and improved compliance. The platform's user-friendly interface makes it easy for businesses to manage their insurance documents effectively.

-

Can airSlate SignNow integrate with other tools for MOTORSPORTS SPECIAL APPLICATION K&K Insurance?

Yes, airSlate SignNow can integrate with various tools and software that businesses may already be using for MOTORSPORTS SPECIAL APPLICATION K&K Insurance. This integration capability enhances workflow efficiency and ensures that all systems work seamlessly together.

-

Is airSlate SignNow secure for handling MOTORSPORTS SPECIAL APPLICATION K&K Insurance documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect MOTORSPORTS SPECIAL APPLICATION K&K Insurance documents. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for MOTORSPORTS SPECIAL APPLICATION K&K Insurance

- Mesa daa echodyne form

- Ssa 4608 form

- Objections and requisitions on title form

- Download the employment application marcus theatres form

- Eduqas poetry anthology revision pdf form

- Ccgatacgcggtatcccagggctaattuaa form

- Fill the application of university of pretoria form

- Short form contract and clearance certificate regent co

Find out other MOTORSPORTS SPECIAL APPLICATION K&K Insurance

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form