Application for Tuition Assistance for Employee, Dependents, Spouse Form

Understanding the Application For Tuition Assistance For Employee, Dependents, Spouse

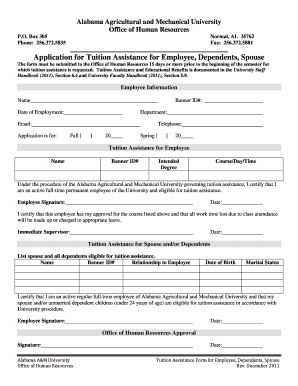

The Application For Tuition Assistance For Employee, Dependents, Spouse is a formal document used by employees to request financial assistance for educational expenses. This application is designed to support employees, their dependents, and spouses in pursuing educational opportunities. It typically outlines eligibility criteria, required documentation, and the process for submission. Understanding this application is crucial for those seeking to benefit from tuition assistance programs offered by their employers.

Key Elements of the Application For Tuition Assistance For Employee, Dependents, Spouse

This application includes several key components that are essential for a successful submission. These elements often include:

- Personal Information: Details about the employee, such as name, address, and employee ID.

- Dependent Information: Information regarding the dependents or spouse applying for assistance.

- Educational Institution Details: Name and address of the institution, along with the program of study.

- Tuition Costs: A breakdown of the tuition and associated fees being requested for assistance.

- Signature and Date: Required signatures to validate the application.

Steps to Complete the Application For Tuition Assistance For Employee, Dependents, Spouse

Completing the application involves several steps to ensure accuracy and compliance with employer guidelines:

- Gather necessary documentation, including proof of enrollment and tuition costs.

- Fill out the application form with accurate personal and educational information.

- Review the completed application for any errors or omissions.

- Obtain required signatures from the employee and, if applicable, the dependent or spouse.

- Submit the application through the designated method as outlined by the employer.

Eligibility Criteria for Tuition Assistance

Eligibility for tuition assistance can vary by employer but generally includes the following criteria:

- Employment status: The employee must be a full-time or part-time employee.

- Duration of employment: Some employers require a minimum period of employment before eligibility.

- Type of education: The program of study must be accredited and relevant to the employee's career.

- Dependent status: Dependents and spouses must meet specific criteria as defined by the employer.

Required Documents for Submission

When submitting the Application For Tuition Assistance, certain documents are typically required to support the request:

- Proof of Enrollment: Documentation from the educational institution confirming enrollment in a qualified program.

- Tuition Invoice: An official invoice detailing the tuition and fees associated with the course or program.

- Identification Documents: Employee identification and, if applicable, identification for dependents or spouses.

Form Submission Methods

The application can usually be submitted through various methods, depending on the employer's policies:

- Online Submission: Many employers provide a digital platform for submitting applications electronically.

- Mail: Applications can often be printed and mailed to the HR department.

- In-Person: Some employers may allow for direct submission to HR during office hours.

Quick guide on how to complete application for tuition assistance for employee dependents spouse

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The easiest way to edit and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Tuition Assistance For Employee, Dependents, Spouse

Create this form in 5 minutes!

How to create an eSignature for the application for tuition assistance for employee dependents spouse

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Tuition Assistance For Employee, Dependents, Spouse?

The Application For Tuition Assistance For Employee, Dependents, Spouse is a program designed to help employees and their families access financial support for educational expenses. This application allows eligible individuals to apply for tuition assistance, making higher education more accessible and affordable.

-

How can I apply for the Application For Tuition Assistance For Employee, Dependents, Spouse?

To apply for the Application For Tuition Assistance For Employee, Dependents, Spouse, you need to complete the online application form available on our website. Ensure you have all necessary documentation ready, such as proof of employment and dependent status, to streamline the process.

-

What are the eligibility requirements for the Application For Tuition Assistance For Employee, Dependents, Spouse?

Eligibility for the Application For Tuition Assistance For Employee, Dependents, Spouse typically includes being a full-time employee and having dependents who are enrolled in an accredited educational institution. Specific criteria may vary, so it's important to review the guidelines provided on our site.

-

Is there a cost associated with the Application For Tuition Assistance For Employee, Dependents, Spouse?

There is no direct cost to submit the Application For Tuition Assistance For Employee, Dependents, Spouse. However, the tuition assistance provided may have limits based on company policy, so it's advisable to check with your HR department for detailed information.

-

What benefits does the Application For Tuition Assistance For Employee, Dependents, Spouse offer?

The Application For Tuition Assistance For Employee, Dependents, Spouse offers signNow benefits, including financial support for educational expenses, increased employee satisfaction, and enhanced workforce skills. This program not only aids in personal development but also contributes to overall company growth.

-

How long does it take to process the Application For Tuition Assistance For Employee, Dependents, Spouse?

Processing times for the Application For Tuition Assistance For Employee, Dependents, Spouse can vary, but typically it takes 2-4 weeks. Applicants will receive notifications regarding their application status via email, ensuring they are informed throughout the process.

-

Can I track the status of my Application For Tuition Assistance For Employee, Dependents, Spouse?

Yes, you can track the status of your Application For Tuition Assistance For Employee, Dependents, Spouse through our online portal. Once your application is submitted, you will receive a confirmation email with instructions on how to monitor its progress.

Get more for Application For Tuition Assistance For Employee, Dependents, Spouse

- Control number fl p011 pkg form

- Control number fl p012 pkg form

- Control number fl p017 pkg form

- Control number fl p019 pkg form

- Control number fl p020 pkg form

- Designation of a health care surrogate statutes form

- California uniform anatomical gift act donor network west

- Control number fl p027 pkg form

Find out other Application For Tuition Assistance For Employee, Dependents, Spouse

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online