Form W 4

What is the Form W-4

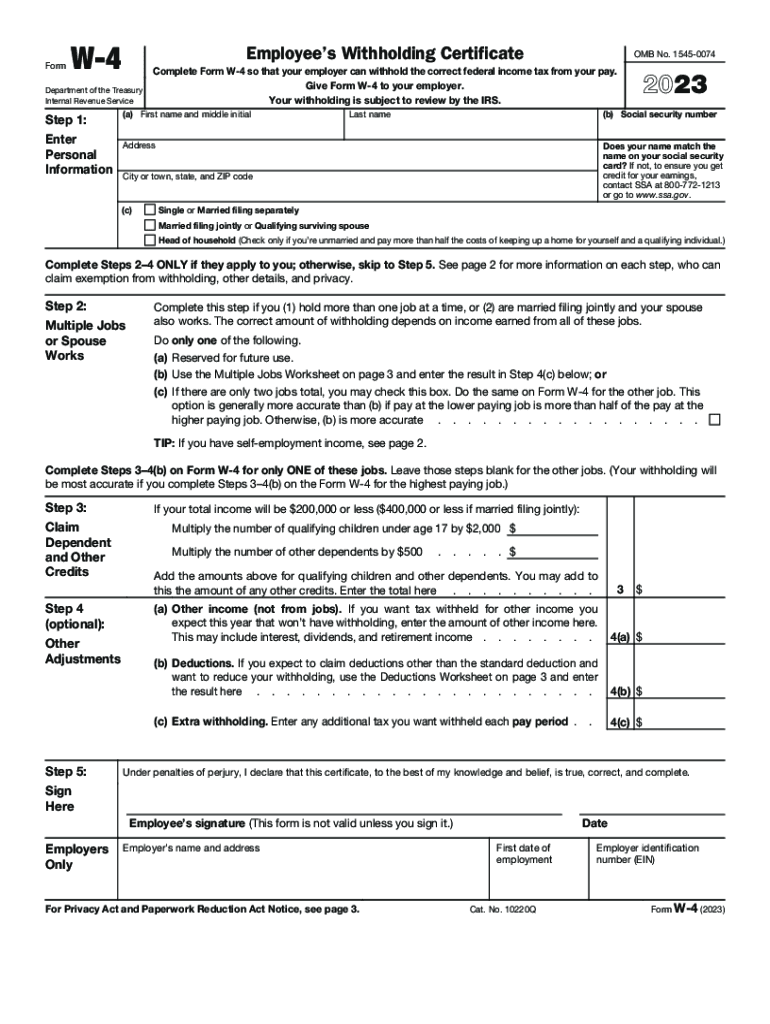

The Form W-4, also known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer of the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is deducted based on the employee's financial situation, including factors such as marital status, number of dependents, and additional income. Proper completion of the W-4 can help prevent underpayment or overpayment of taxes throughout the year.

How to Use the Form W-4

Using the Form W-4 is essential for employees to manage their tax withholding effectively. To use the form, an employee must fill it out accurately and submit it to their employer. The form allows individuals to indicate their filing status, claim allowances, and request additional withholding if necessary. Employees should review their W-4 periodically, especially after major life changes such as marriage, divorce, or the birth of a child, as these events can affect tax withholding needs.

Steps to Complete the Form W-4

Completing the Form W-4 involves several key steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status.

- Claim Dependents: If applicable, indicate the number of dependents you are claiming and any tax credits.

- Other Income: Report any additional income you expect to receive that may not have tax withheld.

- Additional Withholding: Specify any extra amount you want withheld from each paycheck.

- Signature: Sign and date the form to validate your information.

After completing the form, submit it to your employer's payroll department for processing.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the Form W-4. Employees are encouraged to use the IRS Tax Withholding Estimator tool to determine the appropriate amount of withholding. The IRS updates the form periodically, so it is important to use the most current version. Additionally, employers must keep the W-4 on file and update it as needed, especially when an employee submits a new version or when there are changes in tax law that affect withholding.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the Form W-4, it is recommended that employees complete and submit it as soon as they start a new job or experience a significant life change. Employers should implement the new withholding instructions as soon as possible, typically by the next payroll period. Employees should also be aware of the annual tax filing deadline, which usually falls on April 15, to ensure that their withholding aligns with their overall tax obligations.

Penalties for Non-Compliance

Failure to accurately complete and submit the Form W-4 can lead to penalties for both employees and employers. Employees may face underpayment penalties if not enough tax is withheld from their paychecks, resulting in a tax bill when filing their annual return. Employers may also incur penalties for failing to withhold the proper amount of taxes or for not maintaining accurate records of employee W-4 forms. It is essential for both parties to ensure compliance to avoid financial repercussions.

Quick guide on how to complete form w 4 677259146

Effortlessly Prepare Form W 4 on Any Device

Managing documents online has gained popularity among companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Form W 4 on any device with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The Easiest Way to Update and Electronically Sign Form W 4 with Ease

- Locate Form W 4 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and possesses the same legal authority as a traditional wet signature.

- Review the information and click the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, boring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Form W 4 and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4 677259146

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 4 and why is it important?

Form W 4 is a tax form used by employees to indicate their tax situation to their employer. This form is crucial as it determines the amount of federal income tax withheld from your paycheck. Understanding how to fill out Form W 4 correctly can help you avoid underpayment or overpayment of taxes.

-

How can airSlate SignNow help with Form W 4?

airSlate SignNow simplifies the process of completing and signing Form W 4 by providing an easy-to-use digital platform. You can fill out the form, eSign it, and send it securely to your employer, all in one place. This streamlines the process and ensures that your information is accurate and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form W 4?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of a secure, efficient solution for managing documents like Form W 4. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form W 4?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for Form W 4. These tools enhance the user experience by making it easy to manage and monitor the status of your forms. Additionally, you can integrate with other applications to streamline your workflow.

-

Can I integrate airSlate SignNow with other software for Form W 4 management?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage Form W 4 alongside your existing tools. This flexibility helps you maintain a seamless workflow and enhances productivity by connecting your document management processes.

-

What are the benefits of using airSlate SignNow for Form W 4?

Using airSlate SignNow for Form W 4 offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform reduces the risk of errors associated with manual entry and provides a secure environment for sensitive information. This ensures that your tax documents are handled efficiently and safely.

-

Is airSlate SignNow user-friendly for completing Form W 4?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete Form W 4. The intuitive interface guides you through the process, ensuring that you can fill out and sign the form without any technical difficulties. This accessibility is ideal for users of all skill levels.

Get more for Form W 4

- Get the free backflow prevention assembly certified test form

- Bringing off exchange consumers to covered california form

- 2020 form eden press the original privacy catalog fill

- Spelman college office of the registrar350 spelman lane s form

- American equity partial withdrawal request form

- Mdec counties only unless you are filing into a restricted case type adoption emergency evaluation form

- Ucmc 218 form

- Transcript information office of the registrar baylor

Find out other Form W 4

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free