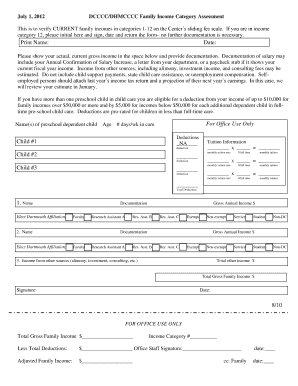

DCCCCDHMC Income Category Assessment Form

What is the DCCCCDHMC Income Category Assessment

The DCCCCDHMC Income Category Assessment is a specific evaluation tool used to categorize income for various purposes, including tax assessments and eligibility determinations for certain programs. This assessment helps to clarify the income levels of individuals or entities, ensuring compliance with relevant regulations and guidelines. It is particularly important for organizations that need to report income accurately to federal and state authorities.

How to use the DCCCCDHMC Income Category Assessment

To effectively use the DCCCCDHMC Income Category Assessment, individuals or organizations must first gather all relevant financial information. This includes income statements, tax returns, and any other documentation that reflects the financial status. Once the necessary documents are collected, users can complete the assessment form by entering the required data accurately. It is essential to review the information for completeness and correctness before submission to avoid potential issues.

Steps to complete the DCCCCDHMC Income Category Assessment

Completing the DCCCCDHMC Income Category Assessment involves several key steps:

- Gather all necessary financial documents, including income statements and tax returns.

- Fill out the assessment form with accurate income details.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, whether online or by mail.

Following these steps ensures that the assessment is completed correctly and efficiently.

Legal use of the DCCCCDHMC Income Category Assessment

The DCCCCDHMC Income Category Assessment is legally recognized for various financial and regulatory purposes. Organizations must use this assessment to comply with federal and state regulations regarding income reporting. Accurate completion of the assessment is crucial, as inaccuracies can lead to legal repercussions, including fines or penalties. It is advisable to consult with legal or financial experts when navigating the complexities of income categorization.

Required Documents

When preparing to complete the DCCCCDHMC Income Category Assessment, several documents are typically required:

- Recent income statements.

- Tax returns for the previous year.

- Any additional documentation that supports income claims, such as pay stubs or bank statements.

Having these documents readily available will facilitate a smoother assessment process.

Examples of using the DCCCCDHMC Income Category Assessment

There are various scenarios in which the DCCCCDHMC Income Category Assessment can be utilized:

- Individuals applying for government assistance programs may need to provide this assessment to determine eligibility.

- Businesses may use the assessment to ensure compliance with tax regulations and accurately report income.

- Financial institutions might require this assessment when evaluating loan applications to assess the borrower's income stability.

These examples illustrate the practical applications of the assessment in real-world situations.

Quick guide on how to complete dccccdhmc income category assessment

Complete [SKS] effortlessly on any device

Digital document management has become a favored choice among businesses and individuals. It offers a suitable eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select your method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dccccdhmc income category assessment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DCCCCDHMC Income Category Assessment?

The DCCCCDHMC Income Category Assessment is a comprehensive evaluation tool designed to categorize income levels for various demographics. It helps organizations understand financial standings and make informed decisions based on income data. Utilizing this assessment can enhance your strategic planning and resource allocation.

-

How can the DCCCCDHMC Income Category Assessment benefit my business?

Implementing the DCCCCDHMC Income Category Assessment can provide valuable insights into your target audience's financial capabilities. This information allows businesses to tailor their services and marketing strategies effectively. By understanding income categories, you can optimize your offerings to meet customer needs.

-

What features does the DCCCCDHMC Income Category Assessment offer?

The DCCCCDHMC Income Category Assessment includes features such as detailed income analysis, demographic segmentation, and customizable reporting. These features enable businesses to gain a deeper understanding of their customer base. Additionally, the assessment is designed to be user-friendly, ensuring ease of use for all team members.

-

Is the DCCCCDHMC Income Category Assessment cost-effective?

Yes, the DCCCCDHMC Income Category Assessment is designed to be a cost-effective solution for businesses of all sizes. By providing essential insights without the need for extensive resources, it helps organizations save time and money. Investing in this assessment can lead to better financial decisions and improved profitability.

-

Can the DCCCCDHMC Income Category Assessment integrate with other tools?

Absolutely! The DCCCCDHMC Income Category Assessment can seamlessly integrate with various business tools and software. This integration allows for streamlined data management and enhances the overall efficiency of your operations. By connecting with existing systems, you can maximize the value of the assessment.

-

How do I get started with the DCCCCDHMC Income Category Assessment?

Getting started with the DCCCCDHMC Income Category Assessment is simple. You can sign up for a free trial on our website to explore its features. Once you're ready, our team will guide you through the setup process to ensure you can leverage the assessment effectively.

-

What industries can benefit from the DCCCCDHMC Income Category Assessment?

The DCCCCDHMC Income Category Assessment is beneficial across various industries, including finance, healthcare, and education. Any organization that requires a clear understanding of income demographics can utilize this assessment. It helps tailor services and improve outsignNow strategies for diverse sectors.

Get more for DCCCCDHMC Income Category Assessment

- I declarant executed a declaration on the form

- Revised uniform anatomical gift act donation

- Fillable online montana revocation of anatomical gift act form

- Kalispell attorney providing employment law representation form

- Control number mt p027 pkg form

- Control number mt p023 pkg form

- Control number mt p029 pkg form

- Montana mortgage formsus legal forms

Find out other DCCCCDHMC Income Category Assessment

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure