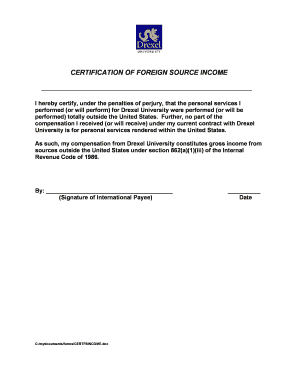

CERTIFICATION of FOREIGN SOURCE INCOME Drexel University Drexel Form

What is the Certification of Foreign Source Income at Drexel University?

The Certification of Foreign Source Income is a form utilized by Drexel University to document income received from foreign sources. This certification is essential for tax purposes, particularly for international students, faculty, or staff who may have foreign income that impacts their tax obligations in the United States. By completing this form, individuals can ensure compliance with IRS regulations regarding foreign income reporting, which is crucial for maintaining their tax status and avoiding penalties.

How to Use the Certification of Foreign Source Income

To effectively use the Certification of Foreign Source Income, individuals must first gather all relevant information regarding their foreign income sources. This includes details such as the type of income, the country from which it originates, and any applicable tax treaties. Once the necessary information is compiled, the form can be filled out accurately, ensuring that all sections are completed. It is advisable to review the form for accuracy before submission to avoid any potential issues with the IRS.

Steps to Complete the Certification of Foreign Source Income

Completing the Certification of Foreign Source Income involves several key steps:

- Gather all necessary documentation related to foreign income.

- Fill out the form with accurate details, ensuring that each section is addressed.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate department at Drexel University.

Following these steps will help ensure that the certification is processed smoothly and complies with all legal requirements.

Key Elements of the Certification of Foreign Source Income

The key elements of the Certification of Foreign Source Income include personal identification information, details about the foreign income, and any relevant tax treaty provisions. Additionally, the form may require a declaration of the individual's tax status and a signature to affirm the accuracy of the information provided. Understanding these elements is crucial for proper completion and compliance with IRS guidelines.

Required Documents for the Certification of Foreign Source Income

When completing the Certification of Foreign Source Income, individuals must provide specific documentation to support their claims. Required documents typically include:

- Proof of foreign income, such as pay stubs or tax documents.

- Documentation of any foreign tax payments made.

- Information on any applicable tax treaties between the United States and the foreign country.

Having these documents ready will facilitate a smoother completion and submission process.

IRS Guidelines for Reporting Foreign Income

The IRS has established clear guidelines for reporting foreign income, which are essential for individuals completing the Certification of Foreign Source Income. These guidelines dictate how foreign income should be reported on U.S. tax returns, including the necessity of disclosing all foreign income sources, potential deductions, and credits available for foreign taxes paid. Familiarizing oneself with these guidelines is crucial for compliance and to avoid penalties.

Quick guide on how to complete certification of foreign source income drexel university drexel

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow offers all the tools necessary to create, edit, and electronically sign your documents quickly and without delay. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your preferred device. Edit and electronically sign [SKS] and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel

Create this form in 5 minutes!

How to create an eSignature for the certification of foreign source income drexel university drexel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel?

The CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel is a document that verifies income earned from foreign sources for tax purposes. This certification is essential for students and employees who need to report foreign income accurately. It ensures compliance with IRS regulations and helps avoid potential tax issues.

-

How can airSlate SignNow assist with the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel. With its user-friendly interface, you can easily manage your documents and ensure they are signed securely and efficiently. This saves time and reduces the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel?

airSlate SignNow offers flexible pricing plans that cater to different needs, including individual and business options. You can choose a plan that fits your budget while ensuring you have access to all necessary features for managing the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel. Check the website for the latest pricing details.

-

What features does airSlate SignNow offer for the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for handling the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel. These features enhance efficiency and ensure that your documents are processed quickly and securely.

-

Are there any benefits to using airSlate SignNow for the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel?

Using airSlate SignNow for the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform allows you to manage your documents from anywhere, making it convenient for busy professionals and students alike.

-

Can airSlate SignNow integrate with other tools for managing the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel?

Yes, airSlate SignNow integrates seamlessly with various tools and applications, enhancing your workflow for the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel. This integration allows you to connect with popular platforms like Google Drive, Dropbox, and more, ensuring that all your documents are easily accessible.

-

Is airSlate SignNow secure for handling the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for managing the CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel. The platform uses advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel

- 123 distribution inc form

- Hunterdon county lawyers compare top attorneys in form

- Hsbc bank usa plaintiff v john new york law journal form

- Esquire mens fashion cocktails politics interviews form

- New jersey lawyers compare top attorneys in new jersey form

- Unapproved opinions week of aug 10new jersey law journal form

- Abc day camps inc form

- Justia free law ampampamp legal information for lawyers

Find out other CERTIFICATION OF FOREIGN SOURCE INCOME Drexel University Drexel

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online