Payroll Deduction Form Drexel University Drexel

What is the Payroll Deduction Form Drexel University Drexel

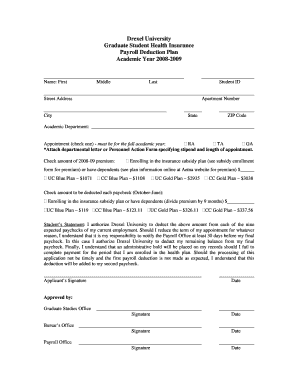

The Payroll Deduction Form Drexel University Drexel is a crucial document used by employees to authorize deductions from their paychecks for various purposes. These deductions may include contributions to retirement plans, health insurance premiums, or other employee benefits. By completing this form, employees ensure that the specified amounts are automatically deducted from their salaries, simplifying the management of their financial commitments.

How to use the Payroll Deduction Form Drexel University Drexel

Using the Payroll Deduction Form involves several straightforward steps. First, employees must download the form from the Drexel University website or obtain a physical copy from the human resources department. Next, they should fill in the required information, including personal details and the specific deductions they wish to authorize. After completing the form, employees need to submit it to the appropriate department, typically human resources or payroll, for processing. It is essential to keep a copy for personal records.

Steps to complete the Payroll Deduction Form Drexel University Drexel

Completing the Payroll Deduction Form requires careful attention to detail. Here are the steps to follow:

- Download or request the Payroll Deduction Form.

- Fill in your personal information, including your name, employee ID, and department.

- Specify the type of deduction you wish to authorize, such as retirement contributions or health insurance premiums.

- Indicate the amount or percentage to be deducted from each paycheck.

- Sign and date the form to validate your request.

- Submit the completed form to the human resources or payroll department.

Legal use of the Payroll Deduction Form Drexel University Drexel

The Payroll Deduction Form is legally binding once signed by the employee. It serves as a formal agreement between the employee and Drexel University regarding the deductions from their pay. Employees should ensure that they understand the implications of the deductions, including how they affect their overall compensation and tax liabilities. Compliance with university policies and federal regulations is essential to avoid potential legal issues.

Key elements of the Payroll Deduction Form Drexel University Drexel

Several key elements are essential for the Payroll Deduction Form to be valid and effective:

- Employee Information: Full name, employee ID, and department.

- Deduction Type: Clearly specify the deduction category, such as retirement or health insurance.

- Deduction Amount: Indicate the exact amount or percentage to be deducted.

- Signature: The employee's signature is required to authorize the deductions.

- Date: The date of signing is crucial for record-keeping purposes.

Form Submission Methods

Employees can submit the Payroll Deduction Form through various methods. The most common options include:

- Online Submission: If available, employees can upload the completed form through the university's payroll portal.

- Mail: The form can be mailed to the human resources or payroll department, ensuring it is sent to the correct address.

- In-Person: Employees may also choose to deliver the form directly to the relevant department during office hours.

Quick guide on how to complete payroll deduction form drexel university drexel

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature with the Sign feature, which only takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and maintain effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Payroll Deduction Form Drexel University Drexel

Create this form in 5 minutes!

How to create an eSignature for the payroll deduction form drexel university drexel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Payroll Deduction Form Drexel University Drexel?

The Payroll Deduction Form Drexel University Drexel is a document that allows employees to authorize deductions from their paychecks for various purposes, such as contributions to retirement plans or charitable donations. This form simplifies the process of managing payroll deductions and ensures that contributions are made consistently and accurately.

-

How can I access the Payroll Deduction Form Drexel University Drexel?

You can easily access the Payroll Deduction Form Drexel University Drexel through the official Drexel University website or by contacting the HR department. Additionally, airSlate SignNow provides a streamlined process for filling out and submitting this form electronically, making it more convenient for employees.

-

What are the benefits of using the Payroll Deduction Form Drexel University Drexel?

Using the Payroll Deduction Form Drexel University Drexel offers several benefits, including automated deductions, reduced paperwork, and improved accuracy in payroll processing. This form helps ensure that your contributions are deducted on time, allowing you to focus on your work without worrying about manual payments.

-

Is there a cost associated with the Payroll Deduction Form Drexel University Drexel?

There is typically no direct cost for employees to use the Payroll Deduction Form Drexel University Drexel. However, if you choose to utilize airSlate SignNow for electronic signing and submission, there may be associated fees depending on the plan you select. It's advisable to review the pricing details on the airSlate SignNow website.

-

Can I modify my Payroll Deduction Form Drexel University Drexel after submission?

Yes, you can modify your Payroll Deduction Form Drexel University Drexel after submission, but you will need to complete a new form to update your deductions. It's important to notify your HR department of any changes to ensure that your payroll deductions reflect your current preferences.

-

What features does airSlate SignNow offer for the Payroll Deduction Form Drexel University Drexel?

airSlate SignNow offers features such as electronic signatures, document tracking, and secure storage for the Payroll Deduction Form Drexel University Drexel. These features enhance the efficiency of the form submission process, making it easier for employees to manage their payroll deductions securely and conveniently.

-

How does airSlate SignNow integrate with Drexel University's payroll system?

airSlate SignNow can seamlessly integrate with Drexel University's payroll system, allowing for automatic updates and processing of the Payroll Deduction Form Drexel University Drexel. This integration ensures that all deductions are accurately reflected in the payroll system, reducing the risk of errors and improving overall efficiency.

Get more for Payroll Deduction Form Drexel University Drexel

- Plea of guilty and affidavit for court supervision form

- Formsprocedures court listing

- Pro hac vice state bar of new mexico form

- In the court of appeals of the state of new mexico no 33801 form

- Max koenig v state of indiana 2009 indiana court of form

- Local rules of civil procedure for the superior courts of form

- Local rulesdistrict of new mexicounited states form

- Rules ampamp statutes nm courts form

Find out other Payroll Deduction Form Drexel University Drexel

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter