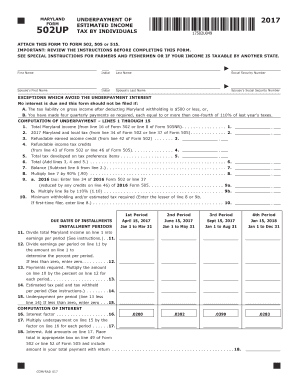

TAX by INDIVIDUALS Form

What is the TAX BY INDIVIDUALS

The tax by individuals form is a crucial document used by residents in the United States to report their income and calculate their tax obligations to the federal government. This form is essential for individuals who earn income from various sources, including wages, self-employment, investments, and other taxable activities. It serves as a means for the Internal Revenue Service (IRS) to assess and collect taxes owed by individuals based on their earnings during the tax year.

Steps to complete the TAX BY INDIVIDUALS

Completing the tax by individuals form involves several steps to ensure accurate reporting of income and deductions. Here are the key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Identify applicable deductions and credits that may reduce your taxable income.

- Fill out the form accurately, ensuring all personal information and financial data are correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail by the designated deadline.

Legal use of the TAX BY INDIVIDUALS

The tax by individuals form must be completed and submitted in compliance with federal tax laws. It is legally binding once signed and submitted, making it essential for individuals to provide truthful and accurate information. Failure to comply with these legal requirements can result in penalties, including fines or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the tax by individuals form are critical to avoid penalties. Typically, the deadline for submitting this form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is also important to note that individuals can request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the tax by individuals form, several documents are necessary to accurately report income and claim deductions. Key documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income received

- Receipts for deductible expenses

- Previous year’s tax return for reference

IRS Guidelines

The IRS provides specific guidelines for completing the tax by individuals form, which include instructions on how to report various types of income, claim deductions, and calculate tax liabilities. It is essential for individuals to familiarize themselves with these guidelines to ensure compliance and to maximize potential refunds or minimize tax liabilities. The IRS updates these guidelines annually, so reviewing the most current information is advisable.

Quick guide on how to complete tax by individuals

Complete [SKS] effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely save it online. airSlate SignNow offers all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to edit and eSign [SKS] without any hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

Can the W-9 tax form be filled out under a company’s name or only under an individual's name?

According to the instructions for line 1, which is where the name should be entered, it appears a company name is acceptable:b. Sole proprietor or single-member LLC. Enter your individual name as shown on your 1040/1040A/1040EZ on line 1. You may enter your business, trade, or “doing business as” (DBA) name on line 2.c. Partnership, LLC that is not a single-member LLC, C corporation, or S corporation. Enter the entity's name as shown on the entity's tax return on line 1 and any business, trade, or DBA name on line 2.d. Other entities. Enter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on line 2.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

Do people in the UK care about losing their free movement rights after Brexit?

Not for me it doesn’t and let’s be honest here, what does the freedom of movement actually enable?The basic premise is it allows folk in countries within the EU to up sticks and go to any other country within the EU - no questions asked (more or less). The upshot being, anyone can go where they please and legitimately claim the same as those who were born, have lived, earned and paid taxes in the target country.That’s the nuts and bolts of it in 4 lines.As you can imagine, the freedom of movement policy has meant the UK has flourished in certain sectors because we have been able to recruit intelligent and hardworking individuals that, perhaps, were denied the chance to progress in their own country.It has also meant we have taken in an inordinate amount of lazy, free-loading loafers who; contribute nothing to the country other than being a drain on the economy, who commit crimes and ultimately, treat the UK and its denizens with utter contempt.What’s going to change when we leave the EU? Well, let me tell you a story:I work all over the world in North/South America, Asia and the Middle East and have to fill out a visa form for almost every country I work in. Do I kick up a fuss about it? Do I scream blue murder at the inconvenience of having to fill out - yet more - paperwork? Do I blame the establishments concerned for employing unnecessarily bureaucratic measures?No.I take the 5 minutes it takes to fill the form out and submit it. Sometimes, I have to send it to or go with my passport to the Embassy. Do I care? Not in the slightest and do you know why I don’t care?Because these measures are in place to protect the welfare of the country I’m visiting.The UK moving out of the EU puts a stop to the freedom of movement. We don't enjoy it anywhere else in the world and yet, it doesn’t prevent us from travelling, working or emigrating to those places. That is exactly how it should be and how the UK will be once we leave.Yes, we will have to apply for a visa to enter European countries. We will lose the obvious benefit of being able to easily recruit genuine candidates to come and work here without the need for said visas - but are those really valid issues or insurmountable obstacles? Nope, because if a candidate is good enough and credible, they’ll get in and we’ll welcome them.By taking back control of our borders we prevent the undesirables from coming in and taking the piss, and that far, far outweighs any potential negatives.So, in answer to your question; do I care about losing my freedom of movement in the EU?No, I welcome it because, with respect to public and economic welfare, it’s the most responsible decision we’ve ever made.

-

How can you make online form filling fun?

Personally, I feel filling forms are never fun, We can just make it less boring with some techniques. As far as,the fun element is concerned, they can always be added through visual aids. Our mind fundamentally is more of a visual tool than that of a Textual tool. Even the fun elements can be added as part of design, here are some suggestions:Lets reduce the Cognitive load with adding simple interaction elements like Buttons, sliders, drop down menu. The idea is to include the natural human tendency to act in a certain way. A lot of animations and Jquery can actually make the form unusable.The Visual Load can be reduced with keeping the basic eye movements under consideration while designing the fields. In below image we can see how designing form in certain way can lower visual load. The Motor load can be diminished with the use of larger intuitive buttons.I am writing down some of the ideas that I know with which we can make Form Filling Less cumbersome if not playful or fun, You may add in comments too.The idea is create Engagement/Interactions not forms. E.g. Take for example Tripit. This application for managing your travel plans by using your travel confirmation emails could easily have asked all new members to sign up through a registration form. Instead, to the join the service new members simply have to send Tripit a travel confirmation email. From this email, Tripit creates an account and extracts the information it needs to create a rich travel plan for new members. No form required. People sign up for Tripit by using it and learning what the application can do for them.A different type of Sign Up form Minimize the Key Inputs, try to make it point and click for web and Touch oriented for Mobiles.Using Web Services for Login : Web services allow people to log-in to a new service using their profile and contact information from other Web sites. The idea here is to make use of information people have already provided elsewhere instead of having them fill it all in again on your sign-up form.Other Communication Tools like Email. Tripit already uses it, Posterous, which is a blogging service, let you write a blog post in your email, attach a photo, send it over to Posterous, and they'll essentially publish that whole thing for you, no need to ever get out of your email client. The idea is that input can come from anywhere. You can use your email client to provide input. You can use your IM client to provide input. You can use Twitter, or you can use your calendar. You can use book marklets or browser extensions. Mad Libs forms ask people the same questions found in typical sign-up forms in a narrative format. They present input fields to people as blanks within sentences. Create Data Extractions points at various points of user interaction. Asking people for information once they are already using an application is often more successful than asking them before they start using the application. These days linkedin.com is trying to do the same.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What is your view on Subramanian Swamy’s statement of abolishing income tax?

Q : What's your take on Subramanian Swamy calling for the abolition of IT?A : Even if the message is right, it has to be shared at at the right time and at a right place. I do not think the present time is right to abolish Income Tax. Income Tax is direct tax which the tax payer has to pay from his pocket while GST is indirect tax which is included in the price of the product itself. Needless to mention that all the people whether poor or rich pay GST whereas only those who have their income above taxable limit pay income tax. Therefore, in a way GST is compulsory while while paying Income Tax the businessman do resort to certain accounting jugglery to evade tax.Ideally the direct taxes should get more revenue to government treasury than indirect taxes so that the burden of taxes goes on shoulder of the rich than the poor. However in India whose population is around 132+ crore not even 10 crore people pay income tax. Although the gross revenue figure out of income tax has increased by around 84% since 2014, it it still less. The tax base needs to be enhanced to include more and more people. This is still not the case in India.Many film actors like the Bachchans and the Kapoors are agriculturists who club their unaccounted income as agricultural income and evade the tax. These are really rich people who should be paying 30% income tax, however, because of the prevailing legal provisions these people legalize their black money without paying any tax. Therefore, for abolishing income tax, I don’t think this is the right time. Let at least 25% of middle aged Indians start paying some income tax and more specifically the some tax be levied on agriculture. After this move the threshold income tax rates can be lowered and basic exemption limits can be enhanced.However, the income tax cannot be abolished.

-

Business Taxes: What is the partner identifying number on Schedule K-1 of an LLC?

The LLC itself does not generate a Schedule K-1.A Schedule K-1 is generated when a Form 1120S or a Form 1065 is completed.How does this relate to an LLC?Well, here’s the deal.When you form an LLC, you will have either one single member, or you sill have multiple members.At this point, you, or you and your other members, will decide how you want the LLC to be treated for tax purposes by the IRS.If you are a single-member LLC, commonly referred to as a SMLLC, you can elect to have the LLC disregarded and you can act as though you are a sole proprietor and report the income and expenses on the appropriate schedule of your personal Form 1040. You can also elect to be taxed as a corporation, choose Subchapter S status, and be treated as an S Corp.But if you are a multi-member LLC, commonly referred to as a MMLLC, you must elect to be treated for tax purposes as a Partnership, unless you elect to be treated as a corporation.Since your question is about a “partner” instead of a “shareholder” I will assume that you have a MMLLC that is being treated as a Partnership for tax purposes by the IRS.So, what you are asking about is a “Schedule K-1 (Form 1065) Partner’s Share of Income, Deduction, Credits, etc.”The number that you are looking for is in Part II, Box E, “Partner’s Identifying Number.”Look just below at Box F, “Partner’s name and address.” If this is the name of an individual, then the number you are looking for is the individual’s Social Security Number. If the name is a legal entity, the number will be an EIN.You can go to Internal Revenue Service to find copies of these forms to look at.I hope this helps.Good Luck.Michael Lantrip

Related searches to TAX BY INDIVIDUALS

Create this form in 5 minutes!

How to create an eSignature for the tax by individuals

How to create an eSignature for your Tax By Individuals in the online mode

How to create an electronic signature for the Tax By Individuals in Google Chrome

How to make an electronic signature for putting it on the Tax By Individuals in Gmail

How to generate an eSignature for the Tax By Individuals from your smart phone

How to generate an electronic signature for the Tax By Individuals on iOS devices

How to make an eSignature for the Tax By Individuals on Android

People also ask

-

What is the role of airSlate SignNow in managing TAX BY INDIVIDUALS?

airSlate SignNow provides an efficient platform for individuals to manage their TAX BY INDIVIDUALS through seamless document signing and sharing. Its user-friendly interface helps ensure that all tax documents are sent and signed promptly, reducing the risk of errors.

-

How does airSlate SignNow ensure security for documents related to TAX BY INDIVIDUALS?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like TAX BY INDIVIDUALS. The platform employs industry-leading encryption and secure data storage practices to protect all documents, ensuring that your tax-related information is safe.

-

What are the pricing plans available for airSlate SignNow for managing TAX BY INDIVIDUALS?

airSlate SignNow offers several pricing plans to cater to various needs, including options suitable for managing TAX BY INDIVIDUALS. These plans are designed to be cost-effective, providing valuable features for both individuals and businesses seeking to streamline their document processes.

-

Can I integrate airSlate SignNow with other tools I use for TAX BY INDIVIDUALS?

Yes, airSlate SignNow provides easy integration with several third-party applications and software used for managing TAX BY INDIVIDUALS. This flexibility allows users to enhance their workflow and effectively combine document signing with existing tax management tools.

-

What features does airSlate SignNow offer for handling TAX BY INDIVIDUALS?

airSlate SignNow offers a range of features tailored for users dealing with TAX BY INDIVIDUALS, including customizable templates, automatic reminders, and advanced tracking of document statuses. These features make it easy to keep track of important tax documents and ensure timely completion.

-

Is airSlate SignNow user-friendly for individuals processing TAX BY INDIVIDUALS?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it accessible for individuals who might not be tech-savvy when handling TAX BY INDIVIDUALS. The straightforward interface allows for quick navigation and efficient document processing.

-

How can airSlate SignNow benefit my workflow for TAX BY INDIVIDUALS?

Using airSlate SignNow can signNowly enhance your workflow for TAX BY INDIVIDUALS by reducing paper clutter and speeding up the signature process. The platform allows for real-time collaboration, which means quicker responses and faster completion of tax-related documents.

Get more for TAX BY INDIVIDUALS

- Please sign exactly as name appears below form

- Nfcu form 562a fillable

- How to print pre authorized deposit form with rbc canada

- Deutsche bank app form

- Revenue sharing agreement template form

- Gedi2017003v3 db x trackers msci world trn index etf db x form

- Bonds und standby letters of credit conditions for guarantee form

- Returning student application for admission 13 form

Find out other TAX BY INDIVIDUALS

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template