Flexible Spending Account Eligible Medical Expenses Form

What is the Flexible Spending Account Eligible Medical Expenses

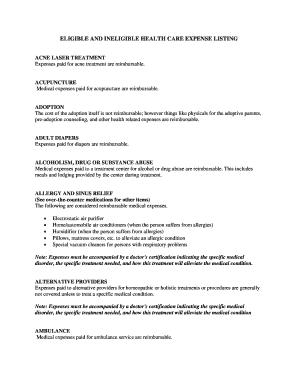

A Flexible Spending Account (FSA) allows employees to set aside pre-tax dollars for eligible medical expenses. These accounts are typically offered by employers as part of a benefits package. Eligible medical expenses include a wide range of healthcare costs that are not covered by insurance. Understanding what qualifies as eligible can help individuals maximize their FSA benefits.

Common eligible expenses include:

- Co-payments for doctor visits

- Prescription medications

- Medical equipment, such as crutches or blood sugar monitors

- Dental care, including cleanings and fillings

- Vision care, such as glasses and contact lenses

How to use the Flexible Spending Account Eligible Medical Expenses

Using an FSA for eligible medical expenses involves a straightforward process. First, employees must contribute to their FSA through payroll deductions. Once funds are available, they can pay for eligible expenses directly or submit claims for reimbursement.

To pay directly, employees can use an FSA debit card, which is linked to their account. For reimbursement, they must keep receipts and submit a claim form to their FSA administrator. It is essential to ensure that all expenses are eligible under IRS guidelines to avoid issues.

Key elements of the Flexible Spending Account Eligible Medical Expenses

Several key elements define the use of an FSA for eligible medical expenses. These include:

- Contribution limits, which are set annually by the IRS

- Use-it-or-lose-it rule, meaning funds must be used within the plan year or they will be forfeited

- Eligible expenses, which must align with IRS definitions to qualify for reimbursement

Understanding these elements is crucial for effective management of FSA funds and ensuring compliance with tax laws.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding what constitutes eligible medical expenses for FSAs. According to IRS Publication 502, eligible expenses must be primarily for the prevention or alleviation of physical or mental defects. This includes costs related to diagnosis, treatment, and prevention of diseases.

It is important to consult the IRS guidelines regularly, as they can change. Employees should also keep thorough records of all transactions to substantiate claims made against their FSA.

Examples of using the Flexible Spending Account Eligible Medical Expenses

Examples of how to effectively use an FSA for eligible medical expenses can provide clarity. Consider the following scenarios:

- A family incurs costs for a child’s orthodontic treatment. The payments made to the orthodontist can be reimbursed through the FSA.

- An individual purchases prescription glasses. The cost can be covered using FSA funds, provided the purchase is documented.

- A person pays for a flu shot at a pharmacy. This expense is eligible for reimbursement from the FSA.

These examples illustrate the practical application of an FSA in managing healthcare costs.

Required Documents

To utilize an FSA for eligible medical expenses, certain documents are necessary. Employees must retain receipts that detail the date, amount, and type of service or product purchased. Additionally, a claim form may need to be completed and submitted to the FSA administrator.

Documentation should clearly show that the expense is eligible under IRS guidelines. Keeping organized records will facilitate a smoother reimbursement process and ensure compliance with FSA rules.

Filing Deadlines / Important Dates

Filing deadlines for FSA claims are critical to ensure that employees do not lose their contributions. Typically, claims must be submitted by a specific date following the end of the plan year. Employers may also offer a grace period or a carryover option, allowing some funds to roll over into the next year.

It is essential to be aware of these deadlines and any specific rules set by the employer’s FSA plan to avoid forfeiting funds.

Quick guide on how to complete flexible spending account eligible medical expenses

Effortlessly prepare [SKS] on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers a fantastic environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to adjust and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Flexible Spending Account Eligible Medical Expenses

Create this form in 5 minutes!

How to create an eSignature for the flexible spending account eligible medical expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Flexible Spending Account Eligible Medical Expenses?

Flexible Spending Account Eligible Medical Expenses refer to a range of healthcare costs that can be reimbursed using funds from a Flexible Spending Account (FSA). These expenses typically include medical, dental, and vision care costs that are not covered by insurance. Understanding these expenses is crucial for maximizing your FSA benefits.

-

How can airSlate SignNow help with managing Flexible Spending Account Eligible Medical Expenses?

airSlate SignNow provides a streamlined solution for managing documents related to Flexible Spending Account Eligible Medical Expenses. With our eSignature capabilities, you can easily sign and send necessary forms, ensuring timely submissions for reimbursements. This simplifies the process and helps you keep track of your eligible expenses.

-

Are there any fees associated with using airSlate SignNow for FSA documentation?

airSlate SignNow offers a cost-effective solution with transparent pricing plans that cater to various business needs. While there may be subscription fees, there are no hidden costs when managing your Flexible Spending Account Eligible Medical Expenses. This allows you to budget effectively while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for handling FSA claims?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure document storage, all designed to facilitate the management of Flexible Spending Account Eligible Medical Expenses. These features help you streamline the claims process, reduce paperwork, and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other financial software for FSA management?

Yes, airSlate SignNow offers integrations with various financial and HR software solutions, making it easier to manage your Flexible Spending Account Eligible Medical Expenses. This integration allows for seamless data transfer and ensures that all relevant information is readily accessible, enhancing your overall efficiency.

-

What benefits does using airSlate SignNow provide for FSA documentation?

Using airSlate SignNow for your Flexible Spending Account Eligible Medical Expenses documentation offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of errors and delays in reimbursement.

-

Is airSlate SignNow compliant with FSA regulations?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations regarding Flexible Spending Account Eligible Medical Expenses. Our platform ensures that your documentation meets legal standards, providing peace of mind as you manage your FSA claims and reimbursements.

Get more for Flexible Spending Account Eligible Medical Expenses

- Condolence friendcolleague in hospital form

- Sample letter of lost documents hungary skydive blog form

- Sample forms nmbar

- Agreement to continue business between surviving partners form

- Relief of delegated responsibilities form

- Sample letter for b2 to f1 pearl bridgefinancial form

- Form of agreement and assignment of partnership interest

- 6 messages to the court clerk that could help your filingone form

Find out other Flexible Spending Account Eligible Medical Expenses

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now