ELIGIBLE and INELIGIBLE HEALTH CARE EXPENSE LISTING Form

What is the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING

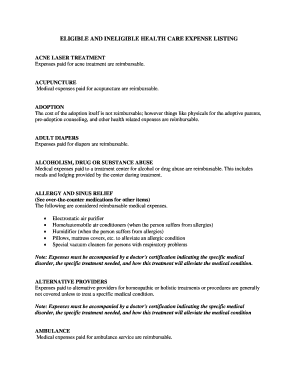

The ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING is a comprehensive document that outlines which health care expenses can be reimbursed under various health plans, including Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). This listing is essential for individuals and businesses to understand what qualifies for tax-free reimbursement. By clearly defining eligible and ineligible expenses, it helps users make informed decisions about their health care spending and tax implications.

How to use the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING

Using the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING involves reviewing the document to identify which expenses can be claimed for reimbursement. Users should start by familiarizing themselves with the categories of expenses listed, such as medical, dental, and vision care. Each category will specify which items are eligible, such as prescription medications or dental cleanings, and which are not, such as cosmetic procedures. Keeping this listing handy when planning health care expenditures can ensure compliance with tax regulations and maximize benefits.

Key elements of the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING

Key elements of the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING include detailed categories of health care expenses, definitions of eligible items, and examples of ineligible expenses. Categories typically cover areas such as preventive care, treatment costs, and wellness programs. The document may also include notes on specific conditions or requirements for certain expenses to qualify, such as the need for a prescription for over-the-counter medications. Understanding these elements is crucial for accurate expense tracking and reimbursement claims.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that govern the use of health care expense listings. These guidelines specify what constitutes a qualified medical expense for tax purposes. Users should refer to IRS publications, such as Publication 502, which details eligible medical and dental expenses. Adhering to these guidelines ensures compliance and helps avoid potential penalties during tax filing. It is important to stay updated on any changes to IRS regulations that may affect eligible expenses.

Examples of using the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING

Examples of using the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING include scenarios such as submitting a claim for a prescription medication or a visit to a physical therapist. For instance, if an individual incurs costs for a routine check-up or vaccinations, these expenses are typically eligible for reimbursement. Conversely, expenses like gym memberships or cosmetic surgery would be classified as ineligible. These examples illustrate the practical application of the listing in everyday health care decisions.

Eligibility Criteria

Eligibility criteria for health care expenses often depend on the type of account being used, such as an FSA or HSA. Generally, expenses must be incurred for medical care that is necessary and primarily for the prevention or treatment of a physical or mental condition. Additionally, expenses must not be reimbursed by other means, such as insurance. Understanding these criteria is vital for ensuring that claims are valid and compliant with tax laws.

Quick guide on how to complete eligible and ineligible health care expense listing

Accomplish [SKS] effortlessly on any gadget

Digital document management has gained traction with companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any gadget with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign [SKS] smoothly

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING

Create this form in 5 minutes!

How to create an eSignature for the eligible and ineligible health care expense listing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING?

The ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING is a comprehensive guide that outlines which health care expenses can be reimbursed under various health plans. Understanding this listing helps individuals and businesses manage their health care spending effectively and ensures compliance with IRS regulations.

-

How can airSlate SignNow assist with managing the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING?

airSlate SignNow provides tools that streamline the documentation process for health care expenses. By using our platform, businesses can easily create, send, and eSign documents related to the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING, ensuring that all necessary paperwork is handled efficiently.

-

Are there any costs associated with accessing the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING through airSlate SignNow?

While airSlate SignNow offers various pricing plans, accessing the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING itself is typically included in the service. Our cost-effective solutions are designed to provide value while helping you manage health care expenses seamlessly.

-

What features does airSlate SignNow offer for handling health care expense documentation?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows that simplify the management of health care expense documentation. These features are particularly useful for ensuring that all submissions related to the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING are accurate and timely.

-

Can I integrate airSlate SignNow with other software to manage health care expenses?

Yes, airSlate SignNow offers integrations with various software solutions, allowing you to manage health care expenses more effectively. By integrating with accounting or HR systems, you can streamline the process of tracking the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for health care expense management?

Using airSlate SignNow for health care expense management provides numerous benefits, including improved accuracy, faster processing times, and enhanced compliance with regulations. By leveraging our platform, you can ensure that your documentation related to the ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING is handled with care and precision.

-

Is airSlate SignNow suitable for both individuals and businesses managing health care expenses?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses. Whether you are managing personal health care expenses or overseeing a company's ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING, our platform provides the tools you need for effective management.

Get more for ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING

- Field trips due 45 days before trip number of chaperones form

- Of block form

- Global opportunities for missions and service projects form

- This letter is intended to acknowledge that we have received the above mentioned file on form

- This letter is meant to follow the letter that we sent you on d a t e form

- Enclosed please find a copy of a letter recently received regarding the property which is the form

- Agreement to remove house form

- Enclosed please find a copy of the cancellation which you recently forwarded to our office form

Find out other ELIGIBLE AND INELIGIBLE HEALTH CARE EXPENSE LISTING

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement