Instructions Employee Withholding Allowance Certificate W 4 Form

What is the Instructions Employee Withholding Allowance Certificate W-4

The Instructions Employee Withholding Allowance Certificate W-4 is a crucial tax form used by employees in the United States to inform their employers of the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is withheld based on the employee's financial situation, including their marital status, number of dependents, and any additional income or deductions they expect to claim. Proper completion of the W-4 form is essential to avoid under-withholding or over-withholding, which can lead to tax liabilities or refunds at the end of the tax year.

Steps to complete the Instructions Employee Withholding Allowance Certificate W-4

Completing the W-4 form involves several key steps:

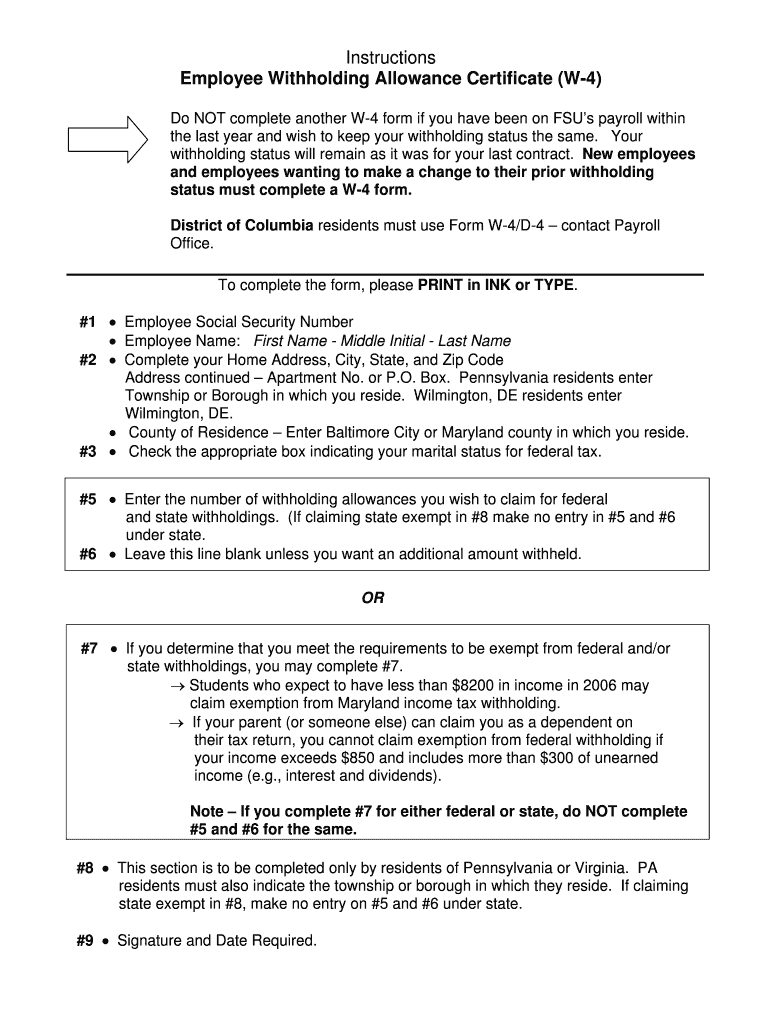

- Personal Information: Fill in your name, address, Social Security number, and filing status (single, married, or head of household).

- Multiple Jobs or Spouse Works: If applicable, indicate if you have more than one job or if your spouse works, as this can affect your withholding.

- Claim Dependents: If you have qualifying children or dependents, you can claim credits to reduce your withholding.

- Other Adjustments: Specify any additional income, deductions, or extra withholding amounts if desired.

- Signature and Date: Sign and date the form to certify that the information provided is accurate.

How to use the Instructions Employee Withholding Allowance Certificate W-4

The W-4 form is used to communicate your withholding preferences to your employer. After completing the form, submit it directly to your employer's payroll department. They will use the information to calculate the correct amount of federal income tax to withhold from each paycheck. It is important to review and update your W-4 whenever your financial situation changes, such as after a marriage, divorce, or the birth of a child, to ensure your withholding remains accurate.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the W-4 form. These guidelines include instructions on how to determine your withholding allowances based on your personal and financial situation. The IRS also updates the W-4 form periodically, so it is important to use the most current version and follow the latest instructions to ensure compliance with tax laws. For detailed guidance, employees can refer to the IRS website or consult a tax professional.

Legal use of the Instructions Employee Withholding Allowance Certificate W-4

The W-4 form is legally required for employers to accurately withhold federal income tax from employees' wages. Employees must provide truthful and complete information on the form to comply with tax regulations. Falsifying information on the W-4 can lead to penalties, including fines or additional tax liabilities. It is essential for both employees and employers to understand the legal implications of the W-4 form to ensure proper tax compliance.

Penalties for Non-Compliance

Failure to comply with the requirements of the W-4 form can result in significant penalties. If an employee under-withholds taxes, they may face a tax bill when filing their tax return, along with potential penalties and interest for underpayment. Employers who fail to withhold the correct amount may also face penalties from the IRS. It is crucial for both parties to ensure that the W-4 is completed accurately and updated as necessary to avoid these consequences.

Quick guide on how to complete instructions employee withholding allowance certificate w 4

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your files swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions Employee Withholding Allowance Certificate W 4

Create this form in 5 minutes!

How to create an eSignature for the instructions employee withholding allowance certificate w 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions Employee Withholding Allowance Certificate W 4?

The Instructions Employee Withholding Allowance Certificate W 4 provide guidance on how employees can determine their withholding allowances for federal income tax. This form helps employees communicate their tax situation to their employers, ensuring accurate withholding from their paychecks.

-

How can airSlate SignNow assist with the Instructions Employee Withholding Allowance Certificate W 4?

airSlate SignNow simplifies the process of completing and submitting the Instructions Employee Withholding Allowance Certificate W 4. Our platform allows users to fill out the form electronically, ensuring accuracy and compliance while saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the Instructions Employee Withholding Allowance Certificate W 4?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions provide access to features that streamline the completion and management of the Instructions Employee Withholding Allowance Certificate W 4, making it a valuable investment for any organization.

-

What features does airSlate SignNow offer for managing the Instructions Employee Withholding Allowance Certificate W 4?

airSlate SignNow includes features such as electronic signatures, document templates, and secure storage, all of which enhance the management of the Instructions Employee Withholding Allowance Certificate W 4. These tools ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the Instructions Employee Withholding Allowance Certificate W 4?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Instructions Employee Withholding Allowance Certificate W 4. This ensures that your data is synchronized across platforms, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the Instructions Employee Withholding Allowance Certificate W 4?

Using airSlate SignNow for the Instructions Employee Withholding Allowance Certificate W 4 provides numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. Our platform allows for quick document turnaround, ensuring that your employees' withholding information is always up to date.

-

How secure is airSlate SignNow when handling the Instructions Employee Withholding Allowance Certificate W 4?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive information, including the Instructions Employee Withholding Allowance Certificate W 4, ensuring that your data remains confidential and secure.

Get more for Instructions Employee Withholding Allowance Certificate W 4

- Sample pre adverse action letteremployment this letter form

- Job interview invitation letter examples the balance careers form

- All users subject to the federal trade commissions form

- Deadline for complying with federal trade commissions form

- Exhibit and witness list official federal forms justia

- 491 consent to proceedmisdemeanor form

- District clerkfamily court forms dallas county

- Vehicle leasing federal reserve form

Find out other Instructions Employee Withholding Allowance Certificate W 4

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile