Employee Payroll Deduction Form Glenville State College

What is the Employee Payroll Deduction Form Glenville State College

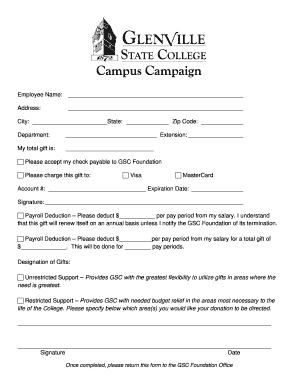

The Employee Payroll Deduction Form Glenville State College is a document that allows employees to authorize specific deductions from their paychecks. These deductions may include contributions to retirement plans, health insurance premiums, or other benefits offered by the college. By completing this form, employees ensure that their contributions are deducted consistently and accurately from their wages, facilitating financial planning and compliance with institutional policies.

How to use the Employee Payroll Deduction Form Glenville State College

To use the Employee Payroll Deduction Form, employees must first obtain the form from the college’s human resources department or the designated online portal. After acquiring the form, employees should carefully read the instructions provided. They will need to fill in personal information, specify the type of deductions they wish to authorize, and indicate the amounts. Once completed, the form should be submitted to the appropriate department for processing.

Steps to complete the Employee Payroll Deduction Form Glenville State College

Completing the Employee Payroll Deduction Form involves several key steps:

- Obtain the form from the human resources department or online.

- Fill in your personal details, including name, employee ID, and department.

- Select the types of deductions you wish to authorize, such as health insurance or retirement contributions.

- Specify the amount to be deducted from each paycheck.

- Review the completed form for accuracy.

- Submit the form to the designated office for processing.

Key elements of the Employee Payroll Deduction Form Glenville State College

The key elements of the Employee Payroll Deduction Form include:

- Employee Information: Personal details such as name, employee ID, and contact information.

- Deduction Types: Options for various deductions, including health insurance, retirement plans, and other benefits.

- Deduction Amounts: Specific amounts to be deducted from each paycheck.

- Signature: Employee’s signature to authorize the deductions.

- Date: The date on which the form is completed and submitted.

Form Submission Methods

Employees can submit the Employee Payroll Deduction Form through several methods:

- In-Person: Deliver the completed form directly to the human resources office.

- Mail: Send the form via postal service to the designated department.

- Online: If available, submit the form electronically through the college’s online portal.

Eligibility Criteria

Eligibility to use the Employee Payroll Deduction Form typically includes being an active employee of Glenville State College. Employees must also be enrolled in the specific benefits programs they wish to deduct from their pay. It is essential to review any additional requirements or restrictions that may apply based on the type of deductions being requested.

Quick guide on how to complete employee payroll deduction form glenville state college

Complete [SKS] effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest method to alter and eSign [SKS] with minimal effort

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign [SKS] to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Employee Payroll Deduction Form Glenville State College

Create this form in 5 minutes!

How to create an eSignature for the employee payroll deduction form glenville state college

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employee Payroll Deduction Form Glenville State College?

The Employee Payroll Deduction Form Glenville State College is a document that allows employees to authorize deductions from their paychecks for various purposes, such as benefits or contributions. This form simplifies the payroll process and ensures accurate deductions are made according to employee preferences.

-

How can I access the Employee Payroll Deduction Form Glenville State College?

You can easily access the Employee Payroll Deduction Form Glenville State College through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the specific form you need. This streamlined process saves time and enhances efficiency.

-

What are the benefits of using the Employee Payroll Deduction Form Glenville State College?

Using the Employee Payroll Deduction Form Glenville State College offers several benefits, including improved accuracy in payroll processing and enhanced employee satisfaction. It allows for easy management of deductions, ensuring that employees have control over their contributions and benefits.

-

Is the Employee Payroll Deduction Form Glenville State College customizable?

Yes, the Employee Payroll Deduction Form Glenville State College can be customized to meet the specific needs of your organization. With airSlate SignNow, you can modify the form fields and options to align with your payroll policies and employee requirements.

-

What features does airSlate SignNow offer for the Employee Payroll Deduction Form Glenville State College?

airSlate SignNow provides features such as electronic signatures, secure document storage, and easy sharing options for the Employee Payroll Deduction Form Glenville State College. These features enhance the user experience and ensure that all documents are handled securely and efficiently.

-

How does airSlate SignNow ensure the security of the Employee Payroll Deduction Form Glenville State College?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect the Employee Payroll Deduction Form Glenville State College. This ensures that sensitive employee information remains confidential and secure throughout the signing process.

-

Can the Employee Payroll Deduction Form Glenville State College be integrated with other software?

Yes, the Employee Payroll Deduction Form Glenville State College can be easily integrated with various HR and payroll software solutions. This integration allows for seamless data transfer and enhances overall efficiency in managing employee payroll deductions.

Get more for Employee Payroll Deduction Form Glenville State College

Find out other Employee Payroll Deduction Form Glenville State College

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast