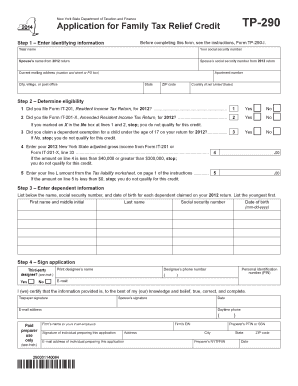

TP 290 New York State Department of Taxation and Finance Application for Family Tax Relief Credit Step 1 Enter Identifying Infor Form

Understanding the NY Family Tax Relief Credit

The NY Family Tax Relief Credit is designed to provide financial assistance to eligible families in New York State. This credit aims to alleviate some of the tax burdens faced by families, making it easier to manage living expenses. To qualify, taxpayers must meet specific eligibility criteria, including income limits and family size. This credit is particularly beneficial for low- to moderate-income households, helping them retain more of their earnings for essential needs.

Eligibility Criteria for the NY Family Tax Relief Credit

To qualify for the NY Family Tax Relief Credit, applicants must meet several requirements:

- Be a resident of New York State for the tax year.

- Have an adjusted gross income below the specified threshold.

- Claim at least one qualifying child as a dependent.

- File a New York State tax return, even if no tax is owed.

It's essential to review the current eligibility guidelines, as they may change annually based on state regulations and budget considerations.

Steps to Complete the TP-290 Application

Filling out the TP-290 form for the NY Family Tax Relief Credit involves several key steps:

- Gather necessary documents, including your Social Security number and income statements.

- Complete the identifying information section of the form accurately.

- Provide details about your dependents, ensuring you meet the criteria for each.

- Review the completed form for accuracy before submission.

Following these steps carefully can help ensure a smooth application process and reduce the likelihood of delays.

Required Documents for the TP-290 Form

When applying for the NY Family Tax Relief Credit using the TP-290 form, you will need to provide specific documentation:

- Proof of residency in New York State.

- Social Security numbers for all dependents.

- Income statements, such as W-2s or 1099s.

- Any other relevant tax documents that support your application.

Having these documents ready can expedite the application process and help ensure that your submission is complete.

Form Submission Methods for the TP-290

The TP-290 form can be submitted through various methods, allowing for flexibility based on individual preferences:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can depend on your comfort level with technology and the urgency of your application.

Application Process and Approval Time

Once the TP-290 form is submitted, applicants can expect a specific timeline for processing:

- Initial processing typically takes four to six weeks.

- Applicants may receive notifications regarding the status of their application.

- In some cases, additional information may be requested, which can extend the approval time.

Staying informed about the application status can help you manage expectations and plan accordingly.

Quick guide on how to complete tp 290 new york state department of taxation and finance application for family tax relief credit step 1 enter identifying

Complete TP 290 New York State Department Of Taxation And Finance Application For Family Tax Relief Credit Step 1 Enter Identifying Infor effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage TP 290 New York State Department Of Taxation And Finance Application For Family Tax Relief Credit Step 1 Enter Identifying Infor on any device with airSlate SignNow Android or iOS apps and enhance any document-centered workflow today.

The easiest way to modify and electronically sign TP 290 New York State Department Of Taxation And Finance Application For Family Tax Relief Credit Step 1 Enter Identifying Infor without hassle

- Locate TP 290 New York State Department Of Taxation And Finance Application For Family Tax Relief Credit Step 1 Enter Identifying Infor and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to send your form, by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced files, tiresome form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign TP 290 New York State Department Of Taxation And Finance Application For Family Tax Relief Credit Step 1 Enter Identifying Infor and maintain excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tp 290 new york state department of taxation and finance application for family tax relief credit step 1 enter identifying

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NY family tax relief credit?

The NY family tax relief credit is a tax benefit designed to provide financial assistance to families in New York. It aims to reduce the tax burden on eligible families, making it easier for them to manage their finances. Understanding this credit can help you maximize your tax savings.

-

How can airSlate SignNow help with the NY family tax relief credit application?

airSlate SignNow simplifies the process of applying for the NY family tax relief credit by allowing you to easily eSign and send necessary documents. Our platform ensures that your application is completed accurately and submitted on time. This can signNowly reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time tracking, which are essential for managing tax documents related to the NY family tax relief credit. These tools help streamline the process, ensuring that all necessary paperwork is organized and accessible. This efficiency can save you time and effort during tax season.

-

Is airSlate SignNow cost-effective for families applying for tax credits?

Yes, airSlate SignNow is a cost-effective solution for families looking to apply for the NY family tax relief credit. Our pricing plans are designed to fit various budgets, ensuring that you can access essential document management tools without breaking the bank. This affordability makes it easier for families to manage their tax-related needs.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, enhancing your ability to manage the NY family tax relief credit application process. This integration allows for seamless data transfer and document management, making it easier to keep track of your tax filings. You can streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. These features are particularly beneficial when dealing with the NY family tax relief credit, as they ensure that your sensitive information is protected while allowing for efficient document handling. This can lead to a smoother tax filing experience.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure storage solutions. This is crucial when dealing with sensitive information related to the NY family tax relief credit. Our commitment to security ensures that your documents are safe from unauthorized access and potential bsignNowes.

Get more for TP 290 New York State Department Of Taxation And Finance Application For Family Tax Relief Credit Step 1 Enter Identifying Infor

- Landlord tenant sublease package montana form

- Buy sell agreement package montana form

- Option to purchase package montana form

- Amendment of lease package montana form

- Annual financial checkup package montana form

- Montana bill sale form

- Living wills and health care package montana form

- Last will and testament package montana form

Find out other TP 290 New York State Department Of Taxation And Finance Application For Family Tax Relief Credit Step 1 Enter Identifying Infor

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online