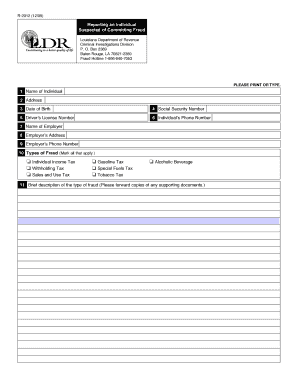

Department of Revenue Louisiana Form

What is the Department of Revenue Louisiana

The Department of Revenue Louisiana is the state agency responsible for administering tax laws and collecting revenue for the state. It oversees various tax programs, including income tax, sales tax, and corporate tax. The department also provides guidance and resources for taxpayers to ensure compliance with state tax regulations. Its mission is to enhance the quality of life in Louisiana by effectively managing the state's revenue system.

How to use the Department of Revenue Louisiana

Using the Department of Revenue Louisiana involves understanding the various services it offers. Taxpayers can access forms, file returns, and make payments through the department's official website. Additionally, the department provides resources such as tax guides and FAQs to assist individuals and businesses in navigating their tax obligations. For personalized assistance, taxpayers can contact the department directly via phone or email.

Steps to complete the Department of Revenue Louisiana forms

Completing forms from the Department of Revenue Louisiana requires careful attention to detail. Here are the general steps to follow:

- Identify the correct form needed for your specific tax situation.

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all information is complete.

- Review the form for errors before submission.

- Submit the form through the preferred method: online, by mail, or in person.

Required Documents

When dealing with the Department of Revenue Louisiana, specific documents are typically required to complete forms accurately. Commonly required documents include:

- W-2 forms for wage earners.

- 1099 forms for independent contractors.

- Proof of deductions and credits, such as receipts and invoices.

- Previous year’s tax returns for reference.

Form Submission Methods

The Department of Revenue Louisiana offers multiple methods for submitting forms, catering to the preferences of taxpayers:

- Online: Many forms can be completed and submitted electronically through the department's website.

- Mail: Taxpayers can print forms, fill them out, and send them to the appropriate address.

- In-Person: Individuals may also visit local offices to submit forms directly.

Penalties for Non-Compliance

Failing to comply with the regulations set by the Department of Revenue Louisiana can result in various penalties. These may include:

- Fines based on the amount of tax owed.

- Interest charges on unpaid taxes.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete department of revenue louisiana

Accomplish Department Of Revenue Louisiana effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the resources you require to generate, modify, and eSign your documents rapidly without any holdups. Manage Department Of Revenue Louisiana on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The optimal method to adjust and eSign Department Of Revenue Louisiana without hassle

- Find Department Of Revenue Louisiana and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize applicable sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device of your choice. Modify and eSign Department Of Revenue Louisiana and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Department of Revenue Louisiana in document management?

The Department of Revenue Louisiana plays a crucial role in ensuring compliance with state tax regulations. By utilizing airSlate SignNow, businesses can streamline their document management processes, making it easier to submit necessary forms and maintain compliance with the Department of Revenue Louisiana.

-

How can airSlate SignNow help with tax-related documents for the Department of Revenue Louisiana?

airSlate SignNow simplifies the process of preparing and signing tax-related documents required by the Department of Revenue Louisiana. With its user-friendly interface, businesses can quickly eSign and send documents, ensuring timely submissions and reducing the risk of errors.

-

What are the pricing options for airSlate SignNow for businesses dealing with the Department of Revenue Louisiana?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses interacting with the Department of Revenue Louisiana. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing essential features for document management.

-

What features does airSlate SignNow offer for compliance with the Department of Revenue Louisiana?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows that enhance compliance with the Department of Revenue Louisiana. These tools help ensure that all documents are accurately completed and submitted on time.

-

Can airSlate SignNow integrate with other software used for tax compliance with the Department of Revenue Louisiana?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier for businesses to manage their documents related to the Department of Revenue Louisiana. This integration helps streamline workflows and enhances overall efficiency.

-

What benefits does airSlate SignNow provide for businesses interacting with the Department of Revenue Louisiana?

By using airSlate SignNow, businesses can benefit from faster document turnaround times and improved accuracy when dealing with the Department of Revenue Louisiana. The platform's ease of use and cost-effectiveness make it an ideal solution for managing essential tax documents.

-

Is airSlate SignNow secure for handling sensitive documents related to the Department of Revenue Louisiana?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents, ensuring compliance with the Department of Revenue Louisiana's requirements. Your data is encrypted and securely stored, giving you peace of mind while managing your documents.

Get more for Department Of Revenue Louisiana

- State farm authorization and direction to pay form 159033

- Tsu class schedule form

- Ohio it 3 fillable form

- Victim impact statement template form

- Credit line certificate sample form

- Winloss request boyd gaming corporation form

- Honorary street name sign application form city of

- Please complete to receive your winloss statement todays form

Find out other Department Of Revenue Louisiana

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation