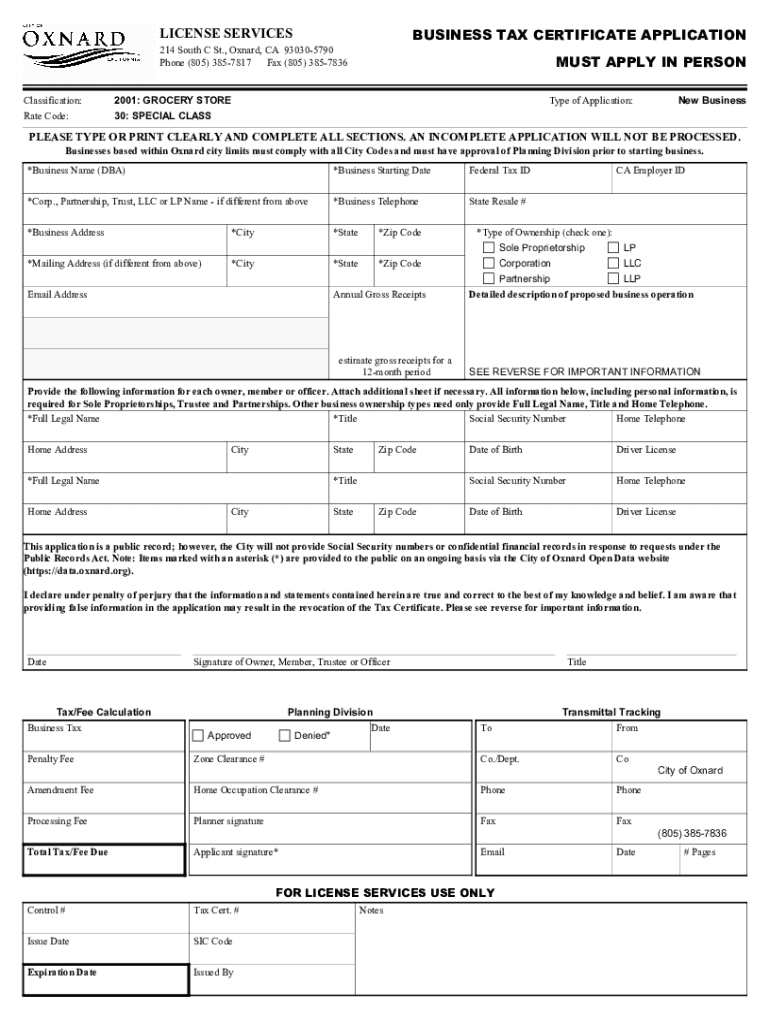

Business Tax Certificate Application City of Oxnard Form

Understanding the California Business Tax Certificate Application

The California business tax certificate is a crucial document that allows businesses to operate legally within various cities in California, including Oxnard. This certificate serves as proof that a business has registered with the local government and is compliant with local tax regulations. It is essential for businesses of all types, including sole proprietorships, partnerships, and corporations, to ensure they meet local requirements to avoid penalties.

Steps to Complete the Business Tax Certificate Application

Completing the business tax certificate application involves several key steps. First, gather necessary information about your business, including the business name, address, ownership structure, and type of services offered. Next, access the application form, which can typically be found on the city’s official website or at the local city hall. Fill out the form accurately, ensuring all sections are completed. After completing the form, submit it along with any required fees, which may vary by city. Finally, keep a copy of the submitted application for your records.

Required Documents for the Application

When applying for a California business tax certificate, specific documents are typically required. These may include:

- A valid form of identification, such as a driver's license or passport.

- Proof of business address, which can be a utility bill or lease agreement.

- Business formation documents if applicable, such as Articles of Incorporation for corporations or partnership agreements.

- Any relevant permits or licenses specific to your industry.

Ensuring that you have all required documents ready can streamline the application process.

Who Issues the Business Tax Certificate

The business tax certificate is typically issued by the city or local government where the business is located. Each city may have its own specific department responsible for handling business licenses and tax certificates, often found within the finance or revenue department. It is important to check with the local city government for specific details regarding the issuance process and any unique requirements that may apply.

Penalties for Non-Compliance

Failure to obtain a business tax certificate can result in significant penalties. Businesses operating without this certificate may face fines, back taxes, and even legal action from local authorities. Additionally, non-compliance can hinder a business's ability to secure loans, contracts, or permits necessary for operation. Therefore, it is essential for business owners to prioritize obtaining and maintaining their business tax certificate to avoid these potential repercussions.

Application Process & Approval Time

The application process for a California business tax certificate may vary by city, but generally, it involves submitting the completed application form along with required documents and fees. Upon submission, the local government will review the application to ensure all information is accurate and complete. The approval time can range from a few days to several weeks, depending on the city’s workload and specific procedures. It is advisable to apply well in advance of starting business operations to ensure compliance and avoid delays.

Quick guide on how to complete business tax certificate application city of oxnard

Prepare Business Tax Certificate Application City Of Oxnard effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Business Tax Certificate Application City Of Oxnard on any device using airSlate SignNow's Android or iOS applications and simplify any document-centered process today.

How to modify and eSign Business Tax Certificate Application City Of Oxnard with ease

- Find Business Tax Certificate Application City Of Oxnard and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Business Tax Certificate Application City Of Oxnard and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business tax certificate application city of oxnard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California business tax certificate?

A California business tax certificate is a document that allows businesses to operate legally within the state of California. It serves as proof that a business has registered with the local government and is compliant with tax regulations. Obtaining this certificate is essential for any business looking to establish itself in California.

-

How can I obtain a California business tax certificate?

To obtain a California business tax certificate, you need to apply through your local city or county government office. The process typically involves filling out an application form and paying a fee. Once approved, you will receive your certificate, allowing you to operate legally in California.

-

What are the costs associated with a California business tax certificate?

The costs for a California business tax certificate can vary depending on the city or county where you are applying. Generally, fees range from $50 to several hundred dollars. It's important to check with your local government for specific pricing and any additional costs that may apply.

-

What are the benefits of having a California business tax certificate?

Having a California business tax certificate provides legitimacy to your business and allows you to operate legally within the state. It also enables you to open a business bank account, apply for loans, and enter into contracts. Additionally, it helps you build trust with customers and suppliers.

-

Can I renew my California business tax certificate online?

Yes, many local government offices in California offer online renewal options for business tax certificates. This makes it convenient to maintain your compliance without having to visit an office in person. Check your local government website for specific instructions on the renewal process.

-

Does airSlate SignNow help with the California business tax certificate process?

While airSlate SignNow does not directly assist with obtaining a California business tax certificate, it provides an efficient platform for eSigning and managing documents related to your application. This can streamline the process and ensure that all necessary paperwork is completed quickly and securely.

-

What features does airSlate SignNow offer for businesses?

airSlate SignNow offers a range of features including eSigning, document templates, and secure cloud storage. These tools help businesses manage their documentation efficiently, making it easier to handle processes like obtaining a California business tax certificate. The platform is user-friendly and cost-effective, catering to businesses of all sizes.

Get more for Business Tax Certificate Application City Of Oxnard

Find out other Business Tax Certificate Application City Of Oxnard

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple