Edu Student Tax Non Filing Statement This Non Filing Statement Should Be Completed If You Are Not Required to File a Federal Tax Form

Understanding the Edu Student Tax Non Filing Statement

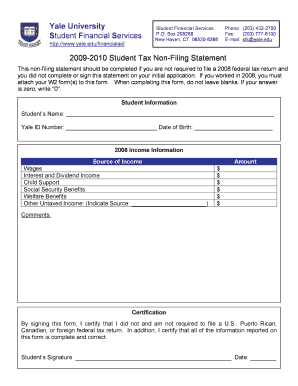

The Edu Student Tax Non Filing Statement is a crucial document for individuals who are not required to file a federal tax return. This statement serves to confirm that you did not complete or sign this statement during your initial application. It is essential for students who may need to provide proof of their tax status for financial aid or other educational purposes.

How to Use the Edu Student Tax Non Filing Statement

To effectively use the Edu Student Tax Non Filing Statement, you must first determine if you meet the criteria for non-filing. If you are not required to file a federal tax return, complete the statement accurately. This document can be submitted to educational institutions or financial aid offices to verify your tax status. Ensure that all information is correct to avoid any delays in processing your application.

Steps to Complete the Edu Student Tax Non Filing Statement

Completing the Edu Student Tax Non Filing Statement involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and details about your income.

- Clearly indicate that you are not required to file a federal tax return.

- Sign and date the statement to validate your claims.

- Submit the completed statement to the relevant educational institution or financial aid office.

Key Elements of the Edu Student Tax Non Filing Statement

When filling out the Edu Student Tax Non Filing Statement, pay attention to the following key elements:

- Your full name and address.

- Your Social Security number.

- A declaration stating that you are not required to file a federal tax return.

- Your signature and the date of completion.

Legal Use of the Edu Student Tax Non Filing Statement

The Edu Student Tax Non Filing Statement is legally recognized as a declaration of your tax status. It is often required by educational institutions for financial aid applications. By submitting this statement, you affirm that the information provided is true and accurate, which can have legal implications if found otherwise.

Eligibility Criteria for the Edu Student Tax Non Filing Statement

To be eligible for the Edu Student Tax Non Filing Statement, you must meet specific criteria:

- You must not have earned enough income to require filing a federal tax return.

- You should not have previously completed or signed this statement on your initial application.

Obtaining the Edu Student Tax Non Filing Statement

The Edu Student Tax Non Filing Statement can typically be obtained from your educational institution's financial aid office or their official website. Some institutions may provide a downloadable version of the statement, while others may require you to request it in person or via email. Always ensure you have the most current version of the statement to avoid any issues with your application.

Quick guide on how to complete edu student tax non filing statement this non filing statement should be completed if you are not required to file a federal

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow portions of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Edu Student Tax Non Filing Statement This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax

Create this form in 5 minutes!

How to create an eSignature for the edu student tax non filing statement this non filing statement should be completed if you are not required to file a federal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a student non-tax filer statement idoc?

Student CBFinAid ID: 2025-26 IDOC Non-Tax Filer's Statement. Each family member who did not submit and is not required to file a 2023 tax return must print, complete, sign, and upload (or mail) this form. Parents may file one combined form if both parents did not file a 2023 tax return.

-

What is the IRS non-filers form for college students?

If you and/or your parents have never filed taxes with the IRS, the IRS Verification of Non-Filing Letter must be requested by mail using the paper version of the IRS Form 4506-T available at .irs.gov/pub/irs-pdf/f4506t.pdf You will need to print, complete, sign and send the form by mail or fax to the IRS.

-

What is a student non-tax filer statement?

This non tax filing statement is required if the student and/or their spouse will not file and are not required to file a 2021 income tax return with the IRS. Complete this form and remit along with the 2021 IRS Verification of Non- filing Letter (this may be requested through irs.gov) and all W-2s.

-

How do I show evidence that I was not required to file a federal income tax return?

Mail or Fax the Completed IRS Form 4506-T to the address or FAX number provided on page 2 of form 4506-T. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Nonfiling letter at the address provided on their request within 5 to 10 days.

-

What do I put for student tax filing status on FAFSA?

Student Tax Filing Status (19) This question asks if a 2022 IRS 1040 or 1040-NR was (or will be) completed. It also asks about income earned in a foreign country or if the student filed a tax return in a U.S. territory. Married students are asked if they filed their 2022 tax return with their current spouse.

-

What is a non filers statement?

An IRS Verification of Non-filing Letter - provides proof that the IRS has no record of a filed Form 1040, for the year requested. Non-Tax filers can request an IRS Verification of Non-filing of their tax return status, free of charge, from. the IRS in one of three ways: • Online.

-

What does student's non tax filer's statement mean?

A signed statement indicating the person was not required to file taxes for that year by their tax authority and the name of the country where he/she resided. Documentation of all of the individual's earned income for the specified year. Each non-filer listed on the verification worksheet must provide a statement.

-

How do I get a non filing statement?

Online Request: .irs.gov. • ... Telephone Request: (800) 908-9946. • ... Paper Request Form: IRS Form 4506-T. • ... Individuals Who Are Unable to Obtain an IRS Verification of Non-Filing Letter. ... Individuals Who Are Subject to a Foreign Tax Authority (e.g. Foreign Citizens)

Get more for Edu Student Tax Non Filing Statement This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax

- New jersey annual form

- Notice of default for past due payments in connection with contract for deed new jersey form

- Final notice of default for past due payments in connection with contract for deed new jersey form

- Assignment of contract for deed by seller new jersey form

- Notice of assignment of contract for deed new jersey form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement new jersey form

- Buyers home inspection checklist new jersey form

- Sellers information for appraiser provided to buyer new jersey

Find out other Edu Student Tax Non Filing Statement This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself