Edu Student Tax Non Filing Statement This Non Filing Statement Should Be Completed If You Are Not Required to File a Federal Tax Form

Understanding the Edu Student Tax Non Filing Statement

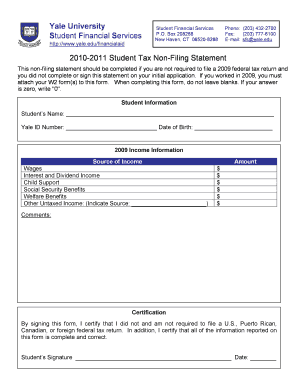

The Edu Student Tax Non Filing Statement is a crucial document for students who are not required to file a federal tax return. This statement serves to confirm that you have not filed a tax return and that you did not complete or sign this statement during your initial application. It is essential for students seeking financial aid or benefits that require proof of non-filing status.

How to Use the Edu Student Tax Non Filing Statement

This statement can be used to demonstrate your non-filing status when applying for financial aid, scholarships, or other programs that require income verification. To use the statement effectively, ensure that it is completed accurately and submitted alongside any required documentation. It is important to keep a copy for your records.

Steps to Complete the Edu Student Tax Non Filing Statement

Completing the Edu Student Tax Non Filing Statement involves several straightforward steps:

- Obtain the form from your educational institution or relevant financial aid office.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate that you are not required to file a federal tax return.

- Sign and date the statement to certify its accuracy.

Ensure that all information is correct to avoid any delays in processing your application.

Legal Use of the Edu Student Tax Non Filing Statement

This statement is legally recognized as a valid declaration of your tax status. It is important to use this document appropriately, as providing false information can lead to legal consequences. Always ensure that the statement is filled out truthfully and submitted as part of your application process.

Key Elements of the Edu Student Tax Non Filing Statement

The key elements of this statement include:

- Your personal identification details.

- A declaration of your non-filing status.

- Your signature and the date of completion.

Each of these elements is critical for validating your claim of non-filing status and ensuring compliance with any requirements set forth by financial aid programs.

Eligibility Criteria for the Edu Student Tax Non Filing Statement

To be eligible to use the Edu Student Tax Non Filing Statement, you must meet certain criteria:

- You are a student who did not earn enough income to require filing a federal tax return.

- You did not complete or sign this statement on your initial application.

- You are seeking financial assistance that requires proof of non-filing status.

Meeting these criteria ensures that you can use the statement effectively in your applications.

Quick guide on how to complete edu student tax non filing statement this non filing statement should be completed if you are not required to file a federal 12829426

Complete [SKS] easily on any device

Web-based document management has become favored by organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, since you can obtain the correct format and securely save it online. airSlate SignNow supplies you with all the resources required to create, modify, and electronically sign your papers swiftly without interruptions. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and electronically sign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, monotonous form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Adjust and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the edu student tax non filing statement this non filing statement should be completed if you are not required to file a federal 12829426

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Edu Student Tax Non Filing Statement?

The Edu Student Tax Non Filing Statement is a document that should be completed if you are not required to file a federal tax return. This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax Return And You Did Not Complete Or Sign This Statement On Your Initial Application. It helps clarify your tax status for educational institutions.

-

How do I complete the Edu Student Tax Non Filing Statement?

To complete the Edu Student Tax Non Filing Statement, you need to provide your personal information and confirm that you are not required to file a federal tax return. This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax Return And You Did Not Complete Or Sign This Statement On Your Initial Application. You can easily fill it out using airSlate SignNow's user-friendly interface.

-

Is there a cost associated with using airSlate SignNow for the Edu Student Tax Non Filing Statement?

airSlate SignNow offers a cost-effective solution for managing documents, including the Edu Student Tax Non Filing Statement. Pricing varies based on the features you choose, but it remains affordable for students and educational institutions. This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax Return And You Did Not Complete Or Sign This Statement On Your Initial Application.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features for document signing, including eSignature capabilities, templates, and secure storage. These features make it easy to manage the Edu Student Tax Non Filing Statement and other important documents. This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax Return And You Did Not Complete Or Sign This Statement On Your Initial Application.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow. You can connect it with tools like Google Drive, Dropbox, and more to streamline the process of managing the Edu Student Tax Non Filing Statement. This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax Return And You Did Not Complete Or Sign This Statement On Your Initial Application.

-

What are the benefits of using airSlate SignNow for the Edu Student Tax Non Filing Statement?

Using airSlate SignNow for the Edu Student Tax Non Filing Statement simplifies the process of document management and signing. It ensures that you can complete this Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax Return And You Did Not Complete Or Sign This Statement On Your Initial Application quickly and securely. Additionally, it saves time and reduces paperwork.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. When handling the Edu Student Tax Non Filing Statement, you can trust that your information is safe. This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax Return And You Did Not Complete Or Sign This Statement On Your Initial Application.

Get more for Edu Student Tax Non Filing Statement This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax

- General notice of default for contract for deed new jersey form

- New jersey seller disclosure form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497319052 form

- New jersey annual form

- Notice of default for past due payments in connection with contract for deed new jersey form

- Final notice of default for past due payments in connection with contract for deed new jersey form

- Assignment of contract for deed by seller new jersey form

- Notice of assignment of contract for deed new jersey form

Find out other Edu Student Tax Non Filing Statement This Non filing Statement Should Be Completed If You Are Not Required To File A Federal Tax

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now