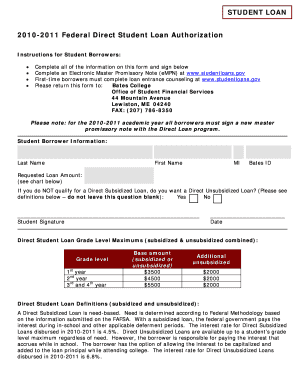

Federal Direct Student Loan Bates College Form

What is the Federal Direct Student Loan at Bates College

The Federal Direct Student Loan is a federal financial aid program designed to help students at Bates College cover the costs of their education. This loan is issued directly by the U.S. Department of Education, allowing students to borrow funds to pay for tuition, fees, and other educational expenses. Unlike private loans, the Federal Direct Student Loan typically offers lower interest rates and more flexible repayment options, making it a more accessible choice for many students.

Eligibility Criteria for the Federal Direct Student Loan at Bates College

To qualify for the Federal Direct Student Loan at Bates College, students must meet several criteria:

- Be enrolled at least half-time in an eligible degree or certificate program.

- Complete the Free Application for Federal Student Aid (FAFSA) to determine financial need.

- Maintain satisfactory academic progress as defined by Bates College.

- Be a U.S. citizen or an eligible non-citizen.

Meeting these criteria is essential to access the financial support provided by this loan program.

Steps to Complete the Federal Direct Student Loan at Bates College

Completing the application process for the Federal Direct Student Loan involves several key steps:

- Complete the FAFSA to assess your financial need and eligibility.

- Receive your Student Aid Report (SAR) and review it for accuracy.

- Consult with the financial aid office at Bates College to discuss your loan options.

- Accept the loan offer through the Bates College financial aid portal.

- Complete the required loan entrance counseling and sign the Master Promissory Note (MPN).

Following these steps will help ensure that you successfully obtain the funds you need for your education.

Required Documents for the Federal Direct Student Loan at Bates College

When applying for the Federal Direct Student Loan, students will need to provide specific documentation, including:

- Completed FAFSA form.

- Student Aid Report (SAR) from the FAFSA.

- Proof of enrollment status (if applicable).

- Any additional documents requested by the Bates College financial aid office.

Having these documents ready can streamline the application process and help avoid delays.

How to Use the Federal Direct Student Loan at Bates College

Once awarded the Federal Direct Student Loan, students can use the funds for various educational expenses. These may include:

- Tuition and fees.

- Room and board costs.

- Books and supplies.

- Other related educational expenses.

It is important for students to budget carefully and use the loan funds responsibly to cover necessary costs throughout their academic journey.

Application Process & Approval Time for the Federal Direct Student Loan at Bates College

The application process for the Federal Direct Student Loan typically begins with the submission of the FAFSA. Once submitted, students can expect the following timeline:

- FAFSA processing time: Generally, one to two weeks.

- Loan offer notification: Usually within a few weeks after FAFSA processing.

- Loan disbursement: Funds are typically disbursed at the beginning of each semester.

Students should stay in contact with the financial aid office to ensure they meet all deadlines and requirements for timely processing.

Quick guide on how to complete federal direct student loan bates college

Complete [SKS] with ease on any platform

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to find the suitable form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly and without interruptions. Handle [SKS] on any platform utilizing airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to edit and eSign [SKS] effortlessly

- Find [SKS] and select Get Form to initiate.

- Leverage the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Direct Student Loan Bates College

Create this form in 5 minutes!

How to create an eSignature for the federal direct student loan bates college

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Federal Direct Student Loan at Bates College?

A Federal Direct Student Loan at Bates College is a federal loan program that allows students to borrow directly from the government to help cover their educational expenses. These loans typically offer lower interest rates and flexible repayment options, making them an attractive choice for students. Understanding the specifics of this loan can help you manage your finances effectively during your studies.

-

How can I apply for a Federal Direct Student Loan at Bates College?

To apply for a Federal Direct Student Loan at Bates College, you need to complete the Free Application for Federal Student Aid (FAFSA). This application will determine your eligibility for federal loans and other financial aid. Once your FAFSA is processed, Bates College will provide you with information on the loan amounts you qualify for.

-

What are the benefits of a Federal Direct Student Loan at Bates College?

The benefits of a Federal Direct Student Loan at Bates College include lower interest rates compared to private loans, flexible repayment plans, and potential loan forgiveness options. Additionally, these loans do not require a credit check, making them accessible to a wider range of students. This financial support can signNowly ease the burden of educational costs.

-

What are the interest rates for Federal Direct Student Loans at Bates College?

Interest rates for Federal Direct Student Loans at Bates College are set by the federal government and can vary each academic year. Typically, these rates are lower than those of private loans, making them a cost-effective option for students. It's important to check the current rates when applying to understand your potential repayment obligations.

-

Are there any fees associated with Federal Direct Student Loans at Bates College?

Yes, there are some fees associated with Federal Direct Student Loans at Bates College, including an origination fee that is deducted from the loan amount. This fee is typically a small percentage of the total loan. Understanding these fees can help you budget effectively for your education expenses.

-

Can I consolidate my Federal Direct Student Loans from Bates College?

Yes, you can consolidate your Federal Direct Student Loans from Bates College through a Direct Consolidation Loan. This process allows you to combine multiple federal loans into a single loan with one monthly payment. Consolidation can simplify your repayment process and may offer additional benefits, such as extended repayment terms.

-

What happens if I can't repay my Federal Direct Student Loan at Bates College?

If you find yourself unable to repay your Federal Direct Student Loan at Bates College, it's crucial to contact your loan servicer immediately. They can provide options such as deferment, forbearance, or income-driven repayment plans to help manage your payments. Taking proactive steps can prevent default and protect your credit score.

Get more for Federal Direct Student Loan Bates College

- Final notice of default for past due payments in connection with contract for deed nevada form

- Assignment of contract for deed by seller nevada form

- Notice of assignment of contract for deed nevada form

- Nv purchase 497320473 form

- Buyers home inspection checklist nevada form

- Sellers information for appraiser provided to buyer nevada

- Handbook real estate 497320476 form

- Subcontractors agreement nevada form

Find out other Federal Direct Student Loan Bates College

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself