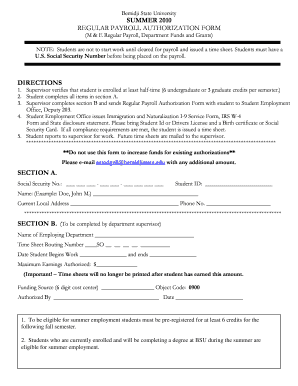

REGULAR PAYROLL AUTHORIZATION FORM

What is the Regular Payroll Authorization Form

The Regular Payroll Authorization Form is a crucial document used by employers to obtain permission from employees to withhold specific amounts from their paychecks. This form typically includes details such as the employee's name, Social Security number, and the specific deductions authorized, which may include taxes, health insurance premiums, retirement contributions, and other payroll deductions. By completing this form, employees ensure that their payroll deductions are handled accurately and in accordance with their preferences.

How to Use the Regular Payroll Authorization Form

To effectively use the Regular Payroll Authorization Form, employees should first obtain the form from their employer or the human resources department. After filling out the required information, employees should review the details carefully to ensure accuracy. Once completed, the form should be submitted to the appropriate department for processing. Employers will then use this information to adjust payroll deductions accordingly, ensuring that employees' preferences are respected in each pay period.

Steps to Complete the Regular Payroll Authorization Form

Completing the Regular Payroll Authorization Form involves several straightforward steps:

- Obtain the form from your employer or HR department.

- Fill in your personal information, including your name and Social Security number.

- Specify the deductions you authorize, such as taxes or benefits.

- Review the form for accuracy to avoid any payroll errors.

- Sign and date the form to validate your authorization.

- Submit the completed form to your employer's payroll or HR department.

Key Elements of the Regular Payroll Authorization Form

Several key elements are essential for the Regular Payroll Authorization Form to be valid and effective:

- Employee Information: This includes the employee's full name, address, and Social Security number.

- Deductions: A clear list of the deductions the employee authorizes, including amounts and frequency.

- Signature: The employee's signature is necessary to confirm their consent for the specified deductions.

- Date: The date of signing helps track when the authorization was granted.

Legal Use of the Regular Payroll Authorization Form

The Regular Payroll Authorization Form must comply with federal and state labor laws to ensure that employee rights are protected. Employers are required to maintain confidentiality regarding the information provided in the form. Additionally, any deductions made must be lawful, and employees should be informed about their rights regarding payroll deductions. It is advisable for both employers and employees to keep a copy of the signed form for their records.

Examples of Using the Regular Payroll Authorization Form

Common scenarios for using the Regular Payroll Authorization Form include:

- Employees wishing to enroll in health insurance plans offered by their employer.

- Authorizing contributions to retirement plans, such as a 401(k).

- Setting up automatic deductions for charitable contributions directly from their paycheck.

- Adjusting tax withholding amounts based on personal financial situations.

Quick guide on how to complete regular payroll authorization form

Complete [SKS] effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your PC.

Eliminate lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from a device of your choice. Alter and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to REGULAR PAYROLL AUTHORIZATION FORM

Create this form in 5 minutes!

How to create an eSignature for the regular payroll authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a REGULAR PAYROLL AUTHORIZATION FORM?

A REGULAR PAYROLL AUTHORIZATION FORM is a document that allows employees to authorize their employer to deduct specific amounts from their paychecks for various purposes. This form ensures that payroll deductions are processed accurately and efficiently, streamlining the payroll process for both employers and employees.

-

How can airSlate SignNow help with REGULAR PAYROLL AUTHORIZATION FORMs?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning REGULAR PAYROLL AUTHORIZATION FORMs. With our solution, businesses can easily manage payroll authorizations, ensuring compliance and reducing paperwork while enhancing the overall efficiency of payroll processing.

-

What are the benefits of using a REGULAR PAYROLL AUTHORIZATION FORM?

Using a REGULAR PAYROLL AUTHORIZATION FORM helps ensure that payroll deductions are authorized and documented, reducing the risk of errors. It also provides clarity for employees regarding their deductions, fostering trust and transparency in the payroll process.

-

Is there a cost associated with using airSlate SignNow for REGULAR PAYROLL AUTHORIZATION FORMs?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow businesses to manage REGULAR PAYROLL AUTHORIZATION FORMs efficiently without breaking the bank, making it an ideal choice for organizations of all sizes.

-

Can I integrate airSlate SignNow with other payroll systems for REGULAR PAYROLL AUTHORIZATION FORMs?

Absolutely! airSlate SignNow offers seamless integrations with various payroll systems, allowing you to streamline the process of managing REGULAR PAYROLL AUTHORIZATION FORMs. This integration ensures that all payroll data is synchronized, reducing manual entry and potential errors.

-

How secure is the information on a REGULAR PAYROLL AUTHORIZATION FORM when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect the information on REGULAR PAYROLL AUTHORIZATION FORMs, ensuring that sensitive employee data remains confidential and secure throughout the signing process.

-

Can I customize my REGULAR PAYROLL AUTHORIZATION FORM using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your REGULAR PAYROLL AUTHORIZATION FORM to meet your specific business needs. You can add your company logo, adjust the layout, and include any additional fields necessary to capture all relevant information.

Get more for REGULAR PAYROLL AUTHORIZATION FORM

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497323007 form

- Oklahoma tenant landlord form

- Ok tenant landlord form

- Letter from tenant to landlord with demand that landlord repair broken windows oklahoma form

- Ok tenant landlord 497323011 form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497323012 form

- Oklahoma letter demand form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings oklahoma form

Find out other REGULAR PAYROLL AUTHORIZATION FORM

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online