Federal Direct Parent PLUS Loans FREQUENTLY ASKED Form

Understanding Federal Direct Parent PLUS Loans

The Federal Direct Parent PLUS Loan program is designed to help parents of dependent undergraduate students pay for college expenses. This loan allows parents to borrow funds to cover the cost of their child's education, including tuition, room and board, and other related expenses. The loans are issued directly by the federal government, making them a reliable option for families seeking financial assistance.

Parents can borrow up to the full cost of attendance, minus any other financial aid received by the student. The interest rate is fixed, and repayment begins shortly after the loan is disbursed. This program is particularly beneficial for families who may not qualify for other types of financial aid.

Eligibility Criteria for Federal Direct Parent PLUS Loans

To qualify for a Federal Direct Parent PLUS Loan, parents must meet specific eligibility requirements. These include:

- Being the biological or adoptive parent of a dependent undergraduate student.

- The student must be enrolled at least half-time in an eligible degree program at a participating institution.

- Parents must not have an adverse credit history, which is assessed during the application process.

Meeting these criteria is essential for parents to access the funds necessary to support their child's education.

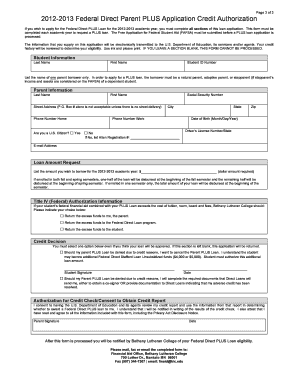

Application Process for Federal Direct Parent PLUS Loans

The application process for Federal Direct Parent PLUS Loans is straightforward. Parents must follow these steps:

- Complete the Free Application for Federal Student Aid (FAFSA) to determine eligibility for federal student aid.

- Visit the Federal Student Aid website to apply for a Parent PLUS Loan.

- Provide the necessary personal and financial information, including details about the student and the school.

- Review and accept the terms of the loan, including the interest rate and repayment schedule.

Once the application is submitted, the loan will be processed, and parents will receive notification of approval or denial based on their credit history.

Steps to Complete the Federal Direct Parent PLUS Loan Application

Completing the Federal Direct Parent PLUS Loan application involves several key steps:

- Gather necessary documentation, including Social Security numbers, income information, and details about the student’s school.

- Access the online application through the Federal Student Aid website.

- Fill out the application form accurately, ensuring all information is current and complete.

- Submit the application and await confirmation of processing.

Following these steps carefully can help ensure a smooth application experience.

Repayment and Loan Management for Federal Direct Parent PLUS Loans

After receiving a Federal Direct Parent PLUS Loan, understanding repayment options is crucial. Parents have several repayment plans available, including:

- Standard Repayment Plan: Fixed monthly payments over ten years.

- Graduated Repayment Plan: Lower payments that increase every two years, designed for those expecting income growth.

- Income-Contingent Repayment Plan: Payments based on income, family size, and loan amount.

Parents should consider their financial situation and future income when selecting a repayment plan to ensure manageable monthly payments.

Common Questions About Federal Direct Parent PLUS Loans

Many parents have questions about the Federal Direct Parent PLUS Loan program. Some frequently asked questions include:

- What is the interest rate for Parent PLUS Loans?

- Can I defer payments while my child is in school?

- What happens if I cannot repay the loan?

Understanding these common inquiries can help parents navigate the loan process more effectively and make informed decisions regarding their financial obligations.

Quick guide on how to complete federal direct parent plus loans frequently asked

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your paperwork swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Direct Parent PLUS Loans FREQUENTLY ASKED

Create this form in 5 minutes!

How to create an eSignature for the federal direct parent plus loans frequently asked

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Federal Direct Parent PLUS Loans?

Federal Direct Parent PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for college. These loans are not based on financial need and can cover the full cost of attendance minus any other financial aid received. Understanding the details of Federal Direct Parent PLUS Loans is crucial for parents looking to support their child's education.

-

How do I apply for Federal Direct Parent PLUS Loans?

To apply for Federal Direct Parent PLUS Loans, parents must complete the Free Application for Federal Student Aid (FAFSA) and then submit a PLUS loan application through the U.S. Department of Education. This process is straightforward and can be done online. For more information, refer to the Federal Direct Parent PLUS Loans FREQUENTLY ASKED section on our website.

-

What are the interest rates for Federal Direct Parent PLUS Loans?

The interest rates for Federal Direct Parent PLUS Loans are fixed and set by the federal government each year. As of the latest updates, the rates are competitive compared to private loans, making them an attractive option for parents. For the most current rates, check the Federal Direct Parent PLUS Loans FREQUENTLY ASKED section.

-

What are the repayment options for Federal Direct Parent PLUS Loans?

Repayment options for Federal Direct Parent PLUS Loans include standard, graduated, and extended repayment plans. Additionally, parents can also consider income-driven repayment plans if they qualify. Understanding these options is essential, and you can find more details in the Federal Direct Parent PLUS Loans FREQUENTLY ASKED section.

-

Are there any fees associated with Federal Direct Parent PLUS Loans?

Yes, Federal Direct Parent PLUS Loans do have an origination fee that is deducted from the loan amount. This fee can vary, so it's important to check the latest information. For a comprehensive breakdown of fees, refer to the Federal Direct Parent PLUS Loans FREQUENTLY ASKED section.

-

Can Federal Direct Parent PLUS Loans be consolidated?

Yes, Federal Direct Parent PLUS Loans can be consolidated into a Direct Consolidation Loan. This can simplify repayment by combining multiple loans into one. For more information on the consolidation process, visit the Federal Direct Parent PLUS Loans FREQUENTLY ASKED section.

-

What are the benefits of using Federal Direct Parent PLUS Loans?

The benefits of Federal Direct Parent PLUS Loans include fixed interest rates, flexible repayment options, and the ability to borrow up to the full cost of attendance. These loans also offer deferment options while the student is in school. For a detailed overview of benefits, check the Federal Direct Parent PLUS Loans FREQUENTLY ASKED section.

Get more for Federal Direct Parent PLUS Loans FREQUENTLY ASKED

- Oklahoma landlord 497323145 form

- Guaranty or guarantee of payment of rent oklahoma form

- Letter from landlord to tenant as notice of default on commercial lease oklahoma form

- Residential or rental lease extension agreement oklahoma form

- Commercial rental lease application questionnaire oklahoma form

- Apartment lease rental application questionnaire oklahoma form

- Residential rental lease application oklahoma form

- Salary verification form for potential lease oklahoma

Find out other Federal Direct Parent PLUS Loans FREQUENTLY ASKED

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form