NONTAX FILER INFORMATION Concordia University

What is the NONTAX FILER INFORMATION Concordia University

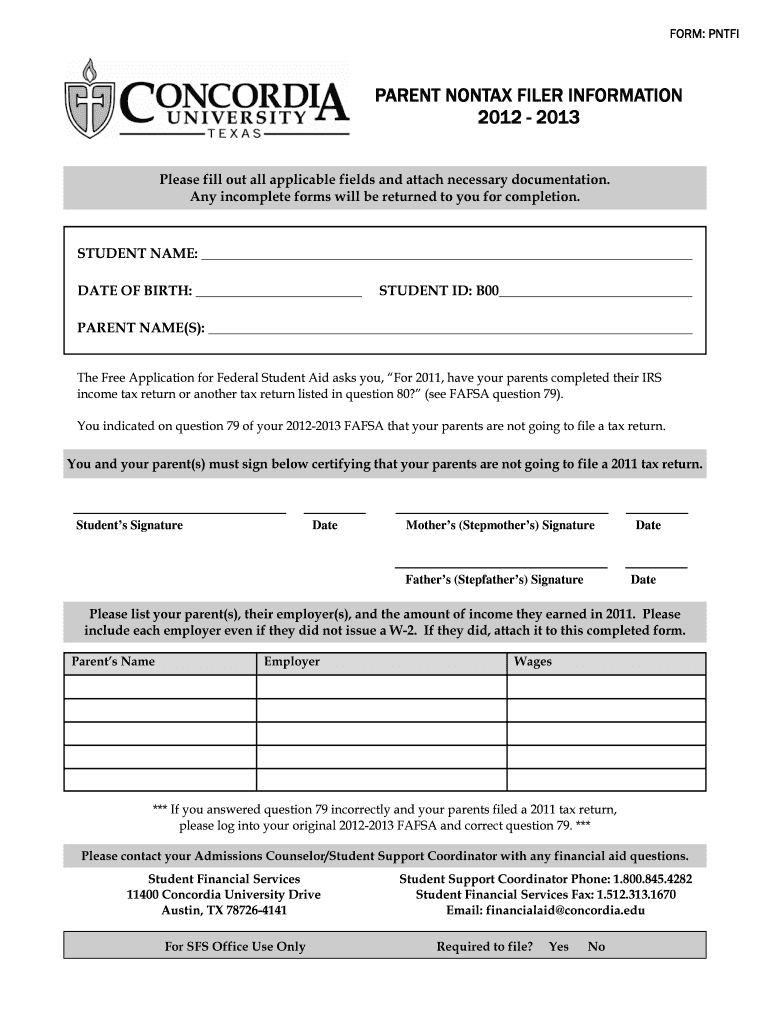

The NONTAX FILER INFORMATION form from Concordia University is designed for individuals who do not file a federal income tax return. This form is often required for students who may need to demonstrate their financial situation for various purposes, such as applying for financial aid or scholarships. It serves as a declaration of income and financial status, providing necessary information to the university to assess eligibility for aid programs.

How to use the NONTAX FILER INFORMATION Concordia University

Using the NONTAX FILER INFORMATION form involves gathering relevant financial details and completing the form accurately. Applicants should collect information regarding any income received, even if it does not necessitate filing a tax return. Once the form is filled out, it can be submitted to the appropriate department at Concordia University, typically the financial aid office. It is important to ensure that all information is truthful and complete to avoid delays in processing.

Steps to complete the NONTAX FILER INFORMATION Concordia University

Completing the NONTAX FILER INFORMATION form involves several key steps:

- Gather financial documents, including any income statements or proof of earnings.

- Fill out the form with accurate personal information, including name, address, and contact details.

- Provide details about any income received, specifying the source and amount.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated office at Concordia University, either online or in person.

Required Documents

When completing the NONTAX FILER INFORMATION form, certain documents may be required to substantiate the information provided. Commonly required documents include:

- Income statements from employers or other sources.

- Bank statements that reflect financial activity.

- Any relevant documentation that supports claims of income or financial status.

Eligibility Criteria

Eligibility to use the NONTAX FILER INFORMATION form typically applies to individuals who do not meet the income threshold for filing a federal tax return. This may include students, dependents, or individuals with limited income sources. It is essential to review Concordia University's specific eligibility criteria to ensure compliance with their requirements.

Form Submission Methods

The NONTAX FILER INFORMATION form can be submitted through various methods, depending on the preferences of the applicant and the university's guidelines. Common submission methods include:

- Online submission through the university's financial aid portal.

- Mailing a hard copy of the form to the financial aid office.

- In-person submission at the designated office on campus.

Quick guide on how to complete nontax filer information concordia university

Complete [SKS] seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly and without hassle. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, endless form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign [SKS] and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NONTAX FILER INFORMATION Concordia University

Create this form in 5 minutes!

How to create an eSignature for the nontax filer information concordia university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NONTAX FILER INFORMATION Concordia University form?

The NONTAX FILER INFORMATION Concordia University form is a document required for students who do not file taxes. This form helps the university assess financial aid eligibility and ensures that students receive the support they need. Completing this form accurately is crucial for a smooth financial aid process.

-

How can airSlate SignNow assist with submitting NONTAX FILER INFORMATION Concordia University?

airSlate SignNow provides an easy-to-use platform for electronically signing and submitting the NONTAX FILER INFORMATION Concordia University form. With its intuitive interface, users can quickly fill out the necessary fields and securely send their documents. This streamlines the submission process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for NONTAX FILER INFORMATION Concordia University?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for students and educational institutions. The cost is competitive and reflects the value of a reliable eSigning solution. Investing in airSlate SignNow can save time and enhance the efficiency of submitting NONTAX FILER INFORMATION Concordia University.

-

What features does airSlate SignNow offer for NONTAX FILER INFORMATION Concordia University?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features ensure that the NONTAX FILER INFORMATION Concordia University form is handled efficiently and securely. Users can also collaborate with others easily, making the process more streamlined.

-

Can I integrate airSlate SignNow with other tools for NONTAX FILER INFORMATION Concordia University?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including Google Drive, Dropbox, and CRM systems. This allows users to manage their NONTAX FILER INFORMATION Concordia University documents alongside other important files. Integration enhances productivity and simplifies the workflow.

-

What are the benefits of using airSlate SignNow for NONTAX FILER INFORMATION Concordia University?

Using airSlate SignNow for NONTAX FILER INFORMATION Concordia University offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that documents are signed and submitted quickly, which can expedite financial aid processing. Additionally, users can access their documents anytime, anywhere.

-

How secure is airSlate SignNow when handling NONTAX FILER INFORMATION Concordia University?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When handling NONTAX FILER INFORMATION Concordia University, users can trust that their sensitive information is protected. The platform also offers audit trails to track document activity, ensuring transparency and accountability.

Get more for NONTAX FILER INFORMATION Concordia University

Find out other NONTAX FILER INFORMATION Concordia University

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP