SALARY THRESHOLD the Annual Rate of Basic Pay for This Position is Equal to or Greater Form

What is the salary threshold the annual rate of basic pay for this position is equal to or greater

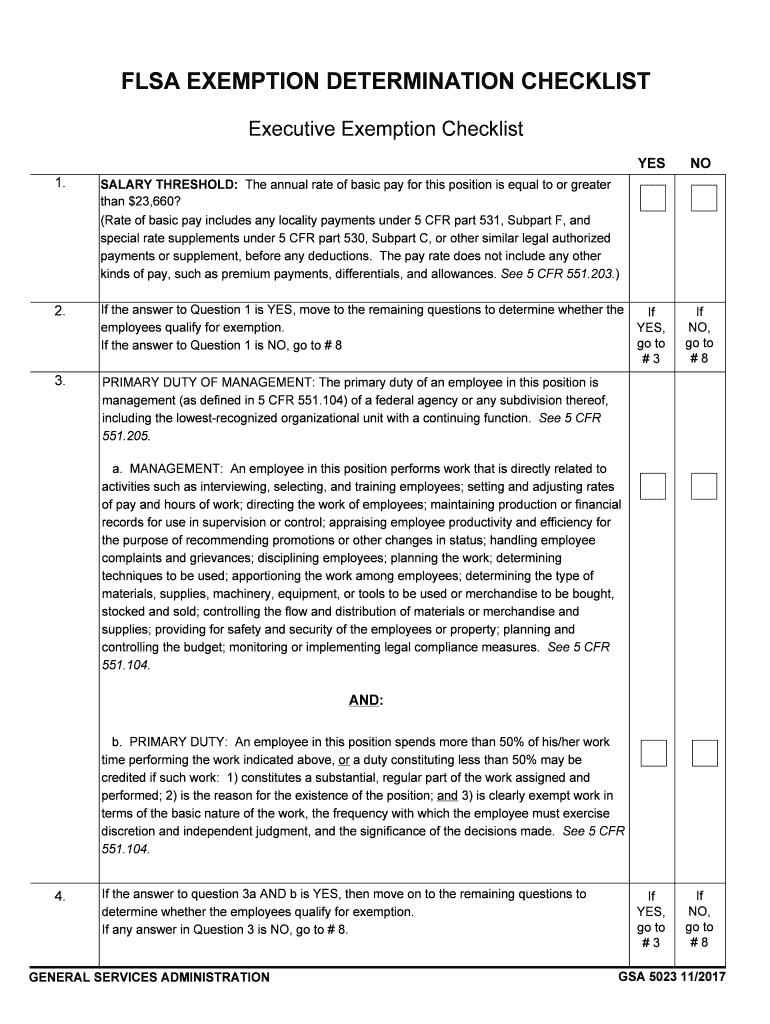

The salary threshold the annual rate of basic pay for this position is equal to or greater refers to a minimum compensation level set for specific job roles. This threshold is often used to determine eligibility for overtime pay under the Fair Labor Standards Act (FLSA). It ensures that employees receive fair compensation for their work, particularly in positions that may require additional hours beyond the standard workweek. Understanding this threshold is essential for both employers and employees to ensure compliance with labor laws and to protect workers' rights.

How to use the salary threshold the annual rate of basic pay for this position is equal to or greater

Using the salary threshold effectively involves understanding its implications for employment contracts and payroll systems. Employers should regularly review their compensation structures to ensure they meet or exceed this threshold. Employees should be aware of their rights regarding compensation and overtime eligibility. When filling out forms related to employment or salary negotiations, clearly stating the salary threshold helps in establishing fair pay practices and can aid in discussions about compensation adjustments.

Steps to complete the salary threshold the annual rate of basic pay for this position is equal to or greater

Completing the salary threshold form requires several key steps:

- Gather relevant employment information, including job title and current salary.

- Review the applicable salary threshold for your position as defined by the FLSA or state regulations.

- Ensure that your compensation meets or exceeds this threshold.

- Fill out the form accurately, providing all necessary details related to your employment and salary.

- Submit the completed form to the appropriate department or authority for review.

Legal use of the salary threshold the annual rate of basic pay for this position is equal to or greater

The legal use of the salary threshold is crucial for compliance with labor laws. Employers must adhere to the established thresholds to avoid penalties and ensure that employees receive their entitled overtime pay. The salary threshold is also a critical factor in determining employee classification, which affects benefits and labor rights. Understanding the legal framework surrounding this threshold helps organizations maintain compliance and protect their workforce.

Key elements of the salary threshold the annual rate of basic pay for this position is equal to or greater

Key elements of the salary threshold include:

- The specific dollar amount that constitutes the threshold, which may vary by state and job classification.

- The criteria for determining which positions are exempt from overtime pay based on their salary level.

- The implications for employee rights and employer responsibilities in terms of compensation and work hours.

State-specific rules for the salary threshold the annual rate of basic pay for this position is equal to or greater

State-specific rules can vary significantly regarding the salary threshold. Some states have established higher thresholds than the federal minimum, reflecting local economic conditions and cost of living. Employers should familiarize themselves with their state's regulations to ensure compliance. This knowledge is essential for accurately classifying employees and determining their eligibility for overtime pay.

Quick guide on how to complete salary threshold the annual rate of basic pay for this position is equal to or greater

Complete SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater with ease

- Find SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater and click Acquire Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Signature tool, which takes mere seconds and has the same legal validity as a conventional wet-ink signature.

- Review all the details and click on the Finished button to preserve your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from your chosen device. Modify and electronically sign SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salary threshold the annual rate of basic pay for this position is equal to or greater

How to generate an eSignature for the Salary Threshold The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater online

How to make an electronic signature for the Salary Threshold The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater in Chrome

How to generate an electronic signature for signing the Salary Threshold The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater in Gmail

How to create an eSignature for the Salary Threshold The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater from your mobile device

How to create an electronic signature for the Salary Threshold The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater on iOS

How to generate an eSignature for the Salary Threshold The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater on Android

People also ask

-

What is the SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater?

The SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater signifies the minimum salary criteria set for a particular position. It ensures that employees receive compensation that meets or exceeds this benchmark, reflecting fair pay standards in the marketplace. Understanding this threshold helps businesses maintain compliant and competitive salary structures.

-

How does airSlate SignNow streamline document signing related to salary thresholds?

airSlate SignNow simplifies the process of signing documents that pertain to the SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater. Our platform allows businesses to create, send, and eSign salary-related documents quickly and securely, ensuring compliance with established pay standards. This efficiency enhances productivity and speeds up the hiring process.

-

What features can help me manage documents related to salary thresholds?

airSlate SignNow offers a range of features designed for managing important documents, including customizable templates for salary agreements and eSignature capabilities. Additionally, the solution includes audit trails and reporting capabilities that enable organizations to ensure compliance regarding the SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater. These features safeguard your business and enhance transparency.

-

Is airSlate SignNow cost-effective for managing salary threshold documents?

Yes, airSlate SignNow is a cost-effective solution for managing salary threshold documents. Our pricing plans are designed to cater to businesses of all sizes, ensuring that you don't have to sacrifice quality for affordability. By streamlining the document signing process, you can save on administrative costs while ensuring compliance with the SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater.

-

Can airSlate SignNow integrate with other HR and payroll systems?

Absolutely! airSlate SignNow seamlessly integrates with various HR and payroll systems to enhance workforce management. This integration allows for smooth processes concerning the SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater and ensures that all relevant salary data is easily accessible and manageable. Effortlessly connect your tools for improved efficiency.

-

What benefits can businesses expect from using airSlate SignNow in relation to salary thresholds?

By using airSlate SignNow, businesses can expect increased efficiency in handling documents related to the SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater. The platform minimizes paperwork, reduces errors, and offers faster turnaround times on important documents. This improvement allows HR teams to focus more on strategic initiatives rather than administrative tasks.

-

How secure is airSlate SignNow when handling sensitive salary documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information related to the SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater. We use advanced encryption methods and secure cloud storage to protect your documents. Additionally, eSignature features are compliant with legal standards, ensuring your data remains confidential and secure.

Get more for SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater

- Charitable solicitation registrationnational council ofdonation request letters what you need to say4 brilliant and useful form

- Business expense report form

- Math teacher recommendation eaglebrook school eaglebrook form

- Georgetown school report form

- Iu south bend student government association issueconcern form iusb

- Wire transfer ampamp form

- Fill request for verifications university of california irvine form

- Az grade ages form

Find out other SALARY THRESHOLD The Annual Rate Of Basic Pay For This Position Is Equal To Or Greater

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement