Enforcement of Judgment Levy on Personal Property Bank Form

Understanding the Enforcement of Judgment Levy on Personal Property

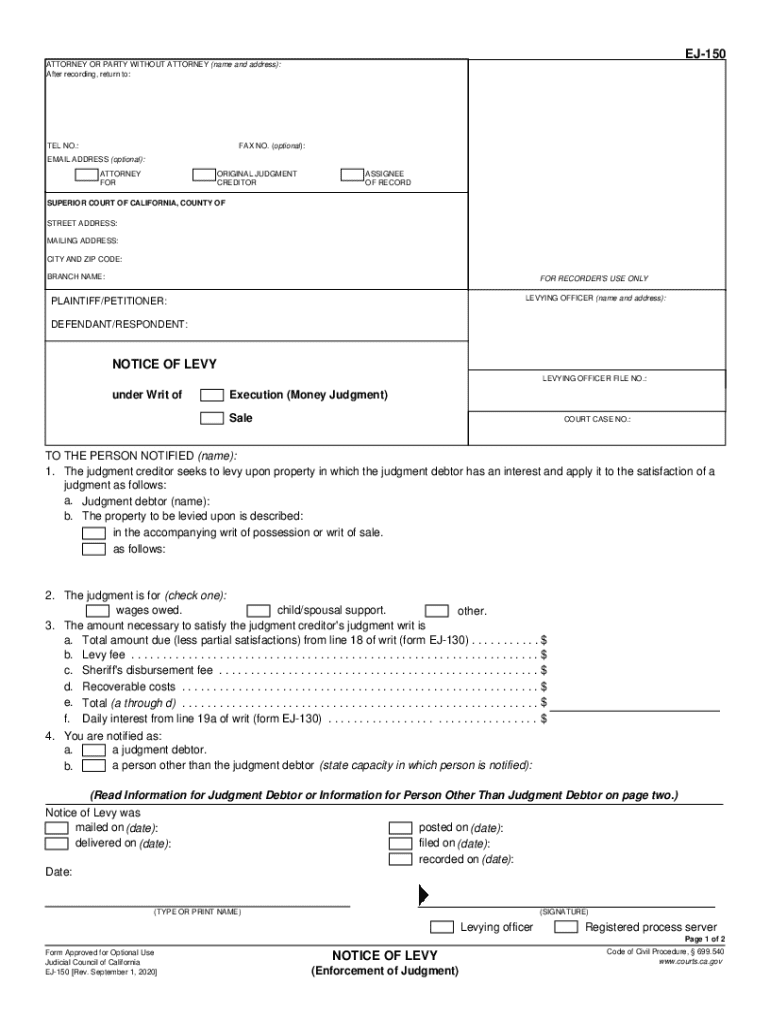

The Enforcement of Judgment Levy on Personal Property, commonly referred to as the EJ 150, is a legal process that allows a creditor to collect on a judgment by seizing a debtor's personal property. This form is particularly relevant in California, where specific laws govern the process. The levy can target various types of personal property, including bank accounts, vehicles, and other assets. It is essential for creditors to understand the legal framework surrounding this process to ensure compliance and effectiveness.

Steps to Complete the EJ 150 Form

Completing the EJ 150 form involves several key steps to ensure that the levy is executed correctly. First, the creditor must gather all necessary information about the judgment debtor, including their name, address, and details of the judgment. Next, the creditor should fill out the EJ 150 form accurately, providing all required details. Once completed, the form needs to be filed with the appropriate court, along with any necessary fees. After filing, the creditor must serve the form to the debtor and any relevant third parties, such as banks or employers, to initiate the levy process.

Legal Use of the EJ 150 Notice of Levy

The EJ 150 notice of levy serves a critical legal function in the enforcement of judgments. It formally notifies the debtor and any third parties that a levy has been placed on the debtor's property. This notice must comply with California's legal requirements, including proper service and timely filing. Failure to adhere to these regulations can result in delays or the invalidation of the levy. Therefore, understanding the legal implications and requirements of the EJ 150 is vital for creditors seeking to enforce a judgment.

Required Documents for Filing the EJ 150

When filing the EJ 150 form, several documents are necessary to support the process. These typically include a copy of the judgment, proof of service of the judgment, and any other documentation that verifies the debt owed. It is crucial for creditors to ensure that all documents are complete and accurate to avoid complications during the levy process. Missing or incorrect documents can lead to delays or legal challenges.

State-Specific Rules for the EJ 150 Levy Process

Each state has its own specific rules and regulations governing the enforcement of judgment levies, and California is no exception. Creditors must familiarize themselves with state laws that dictate how the EJ 150 can be used, including time limits for filing, exemptions for certain types of property, and procedures for serving the notice of levy. Understanding these state-specific rules is essential for successful enforcement and compliance with legal standards.

Examples of Using the EJ 150 Notice of Levy

Practical examples of using the EJ 150 notice of levy can provide valuable insights for creditors. For instance, if a creditor has obtained a judgment against a debtor who has a bank account, they can file the EJ 150 to levy the funds directly from the bank. Similarly, if a debtor owns a vehicle, the creditor may use the notice to seize the vehicle as part of the enforcement process. Each scenario illustrates the versatility of the EJ 150 in various collection situations.

Quick guide on how to complete enforcement of judgment levy on personal property bank

Effortlessly Prepare Enforcement Of Judgment Levy On Personal Property bank on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Enforcement Of Judgment Levy On Personal Property bank on any device with airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The Simplest Way to Modify and Electronically Sign Enforcement Of Judgment Levy On Personal Property bank with Ease

- Find Enforcement Of Judgment Levy On Personal Property bank and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Enforcement Of Judgment Levy On Personal Property bank and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the enforcement of judgment levy on personal property bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ej 150 in the context of airSlate SignNow?

The ej 150 refers to a specific feature set within airSlate SignNow that enhances document signing and management. This feature allows users to streamline their workflows, making it easier to send and eSign documents efficiently. By utilizing ej 150, businesses can improve their overall productivity and reduce turnaround times.

-

How does ej 150 improve document signing processes?

ej 150 simplifies the document signing process by providing an intuitive interface and automated workflows. Users can easily send documents for eSignature, track their status, and receive notifications when actions are completed. This efficiency helps businesses save time and ensures that important documents are signed promptly.

-

What are the pricing options for ej 150 features?

airSlate SignNow offers competitive pricing for its ej 150 features, catering to businesses of all sizes. Pricing plans are designed to be cost-effective, allowing users to choose a plan that fits their budget and needs. You can explore various subscription options on the airSlate SignNow website to find the best fit for your organization.

-

Can ej 150 integrate with other software applications?

Yes, ej 150 is designed to seamlessly integrate with various software applications, enhancing its functionality. This includes popular tools like CRM systems, project management software, and cloud storage services. These integrations allow businesses to create a cohesive workflow that maximizes efficiency.

-

What benefits does ej 150 offer for businesses?

The ej 150 feature set provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for document transactions. By adopting ej 150, businesses can streamline their operations and focus on core activities rather than getting bogged down by manual processes. This ultimately leads to improved customer satisfaction and faster service delivery.

-

Is ej 150 suitable for small businesses?

Absolutely! ej 150 is tailored to meet the needs of small businesses by offering a user-friendly and cost-effective solution for document management. Small businesses can leverage ej 150 to enhance their operational efficiency without incurring high costs, making it an ideal choice for startups and growing companies.

-

How secure is the ej 150 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, and the ej 150 feature is built with robust security measures. This includes encryption, secure access controls, and compliance with industry standards to protect sensitive information. Users can trust that their documents are safe while using ej 150 for eSigning.

Get more for Enforcement Of Judgment Levy On Personal Property bank

Find out other Enforcement Of Judgment Levy On Personal Property bank

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer