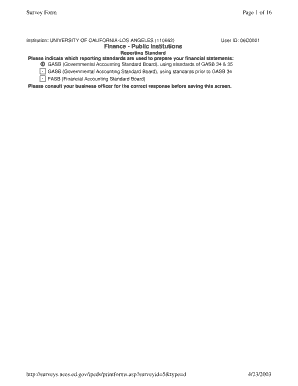

Reporting Standard Form

What is the Reporting Standard

The Reporting Standard refers to a set of guidelines and requirements established for the accurate reporting of financial and operational data. It is essential for ensuring transparency and compliance within various sectors, particularly in the context of tax obligations and financial disclosures. The standard outlines the necessary information that businesses and individuals must provide to relevant authorities, ensuring that all parties adhere to consistent practices.

How to use the Reporting Standard

Using the Reporting Standard involves understanding the specific requirements applicable to your situation. This includes identifying the relevant forms and documentation needed for compliance. Users should gather all necessary financial records, ensure accuracy in reporting, and submit the required information to the appropriate regulatory body. Familiarity with the guidelines can help streamline the process and reduce the likelihood of errors.

Steps to complete the Reporting Standard

Completing the Reporting Standard typically involves several key steps:

- Gather necessary documentation, including financial statements and tax records.

- Review the specific requirements for your business type or individual circumstances.

- Fill out the required forms accurately, ensuring all information is complete.

- Submit the forms by the designated deadline to avoid penalties.

Each step is crucial for ensuring compliance and avoiding potential issues with regulatory authorities.

Legal use of the Reporting Standard

The legal use of the Reporting Standard is critical for maintaining compliance with federal and state regulations. Businesses must adhere to the guidelines to avoid legal repercussions, including fines or audits. Understanding the legal implications of the Reporting Standard ensures that all submitted information is accurate and truthful, safeguarding against potential legal challenges.

Filing Deadlines / Important Dates

Filing deadlines for the Reporting Standard can vary based on the type of report and the entity involved. It is essential to stay informed about these dates to ensure timely submission. Common deadlines include:

- Annual reports, typically due on a specific date each year.

- Quarterly updates, which may have different submission timelines.

- Any special deadlines related to changes in tax laws or regulations.

Missing these deadlines can result in penalties or additional scrutiny from regulatory bodies.

Required Documents

To comply with the Reporting Standard, specific documents are generally required. These may include:

- Financial statements, such as balance sheets and income statements.

- Tax forms relevant to your business or personal situation.

- Supporting documentation for any claims or deductions.

Ensuring that all required documents are prepared and submitted can facilitate a smoother reporting process.

Quick guide on how to complete reporting standard

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related operation today.

How to modify and eSign [SKS] without stress

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Reporting Standard

Create this form in 5 minutes!

How to create an eSignature for the reporting standard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Reporting Standard in airSlate SignNow?

The Reporting Standard in airSlate SignNow refers to the comprehensive analytics and reporting features that allow businesses to track document status, user engagement, and overall performance. This ensures that organizations can maintain compliance and optimize their document workflows effectively.

-

How does airSlate SignNow ensure compliance with Reporting Standards?

airSlate SignNow adheres to industry-specific Reporting Standards by providing secure eSignature solutions that meet legal requirements. Our platform includes audit trails and detailed reporting capabilities, ensuring that all signed documents are compliant and easily retrievable for audits.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Each plan includes access to essential features, including those related to Reporting Standards, ensuring that you can effectively manage your document workflows without breaking the bank.

-

What features does airSlate SignNow offer related to Reporting Standards?

Key features related to Reporting Standards in airSlate SignNow include real-time tracking, customizable reporting dashboards, and automated notifications. These tools empower businesses to gain insights into their document processes and make data-driven decisions.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can streamline document management and enhance efficiency. The platform's adherence to Reporting Standards ensures that you maintain compliance while reducing turnaround times for document approvals and signatures.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow capabilities. These integrations support compliance with Reporting Standards by allowing you to consolidate data and reporting across platforms.

-

Is training available for using Reporting Standard features?

Absolutely! airSlate SignNow provides comprehensive training resources, including tutorials and webinars, to help users understand and utilize Reporting Standard features effectively. Our support team is also available to assist with any specific queries.

Get more for Reporting Standard

Find out other Reporting Standard

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document