The UCM Short Term Loan Program is Available to Assist Students Who Need Financial Help $500 or Less Form

Understanding the UCM Short Term Loan Program

The UCM Short Term Loan Program is designed to provide financial assistance to students who require immediate funding of five hundred dollars or less. This program aims to support students facing unexpected expenses that could hinder their academic progress. The loans are typically offered with favorable terms to ensure accessibility for all eligible students. Understanding the details of this program can help students make informed decisions about their financial needs.

Eligibility Criteria for the Loan Program

To qualify for the UCM Short Term Loan Program, students must meet specific eligibility requirements. Generally, applicants should be enrolled at the university, demonstrate financial need, and provide documentation of their current situation. Additionally, students must be in good academic standing and not have any outstanding loans from previous semesters. Meeting these criteria is essential for a smooth application process.

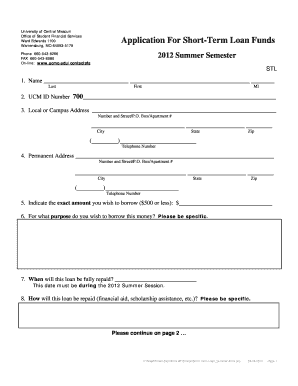

Application Process for the Loan

The application process for the UCM Short Term Loan Program involves several straightforward steps. First, students need to fill out the loan application form, which can typically be found on the university's financial aid website. After completing the form, students must submit it along with any required documentation, such as proof of enrollment and financial need. Once submitted, the financial aid office will review the application and notify the student of the decision. Approval times may vary, so it is advisable to apply as early as possible.

Key Elements of the Loan Program

Several key elements define the UCM Short Term Loan Program. These include the maximum loan amount of five hundred dollars, the repayment terms, and the interest rates, which are often minimal or nonexistent. The program is intended to be a short-term solution, with repayment typically expected within a few months. Understanding these elements can help students plan their finances effectively and ensure timely repayment.

Steps to Complete the Loan Application

Completing the loan application for the UCM Short Term Loan Program involves a series of steps:

- Access the loan application form from the university's financial aid website.

- Fill out the form with accurate personal and financial information.

- Gather necessary documentation, such as proof of enrollment and any financial statements.

- Submit the completed application and documentation to the financial aid office.

- Await notification regarding the loan decision.

Legal Use of the Loan Program

The UCM Short Term Loan Program is governed by specific legal guidelines to ensure compliance with federal and state regulations. Students must use the funds solely for educational purposes, such as tuition, books, or necessary living expenses. Misuse of the loan can result in penalties, including the requirement to repay the loan immediately. Understanding the legal implications of the loan is crucial for responsible borrowing.

Quick guide on how to complete the ucm short term loan program is available to assist students who need financial help 500 or less

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to The UCM Short Term Loan Program Is Available To Assist Students Who Need Financial Help $500 Or Less

Create this form in 5 minutes!

How to create an eSignature for the the ucm short term loan program is available to assist students who need financial help 500 or less

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UCM Short Term Loan Program?

The UCM Short Term Loan Program is designed to assist students who need financial help of $500 or less. This program provides quick access to funds, ensuring that students can cover urgent expenses without delay. It is a reliable option for those facing temporary financial challenges.

-

Who is eligible for the UCM Short Term Loan Program?

Eligibility for the UCM Short Term Loan Program is primarily for students enrolled at UCM who require financial assistance of $500 or less. Applicants must demonstrate a need for short-term financial support and meet specific criteria set by the university. This program aims to help students navigate unexpected financial hurdles.

-

How can I apply for the UCM Short Term Loan Program?

To apply for the UCM Short Term Loan Program, students can visit the university's financial aid office or website. The application process is straightforward and typically requires basic personal and financial information. Once submitted, applications are reviewed promptly to expedite funding.

-

What are the repayment terms for the UCM Short Term Loan Program?

Repayment terms for the UCM Short Term Loan Program are designed to be manageable for students. Generally, loans must be repaid within a specified timeframe, often aligned with the academic calendar. This flexibility helps ensure that students can repay their loans without added stress.

-

What are the benefits of the UCM Short Term Loan Program?

The UCM Short Term Loan Program offers several benefits, including quick access to funds and minimal application requirements. It helps students address immediate financial needs without high-interest rates typically associated with other loans. This program is a valuable resource for maintaining academic focus.

-

Is there a fee associated with the UCM Short Term Loan Program?

There are typically no hidden fees associated with the UCM Short Term Loan Program. The program is designed to provide financial assistance without burdening students with additional costs. Students should review the terms during the application process for complete transparency.

-

Can I use the UCM Short Term Loan for any expenses?

Yes, the UCM Short Term Loan Program can be used for various expenses, including tuition, textbooks, and other essential costs. This flexibility allows students to allocate funds where they are most needed. It's an effective way to manage financial challenges during the academic year.

Get more for The UCM Short Term Loan Program Is Available To Assist Students Who Need Financial Help $500 Or Less

- Bantuan masjid dari qatar 2022 form

- The world of psychology 9th edition form

- Cambridge grammar and writing skills learners book 4 pdf download form

- Oet writing samples for nurses pdf 2022 form

- Motor trade theory n1 notes pdf download form

- Ethiopian grade 12 physics teacher guide pdf form

- Sales test questions and answers pdf form

- Family dollar letterhead form

Find out other The UCM Short Term Loan Program Is Available To Assist Students Who Need Financial Help $500 Or Less

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now