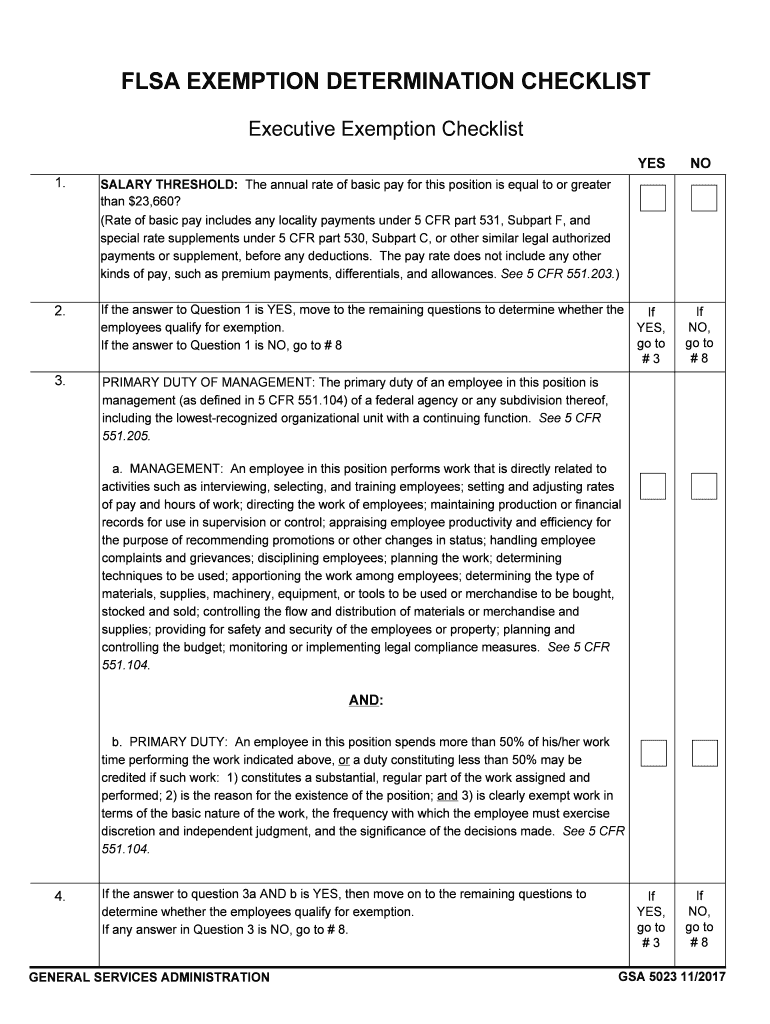

Executive Exemption Checklist Form

Understanding the FLSA Audit Checklist

The Fair Labor Standards Act (FLSA) audit checklist serves as a vital tool for employers to ensure compliance with federal labor laws. This checklist outlines the essential criteria that must be met to determine whether employees are classified correctly under the FLSA. It includes guidelines on minimum wage, overtime pay, and exemptions applicable to various job roles. Employers can use this checklist to evaluate their payroll practices and ensure they are adhering to legal standards, thereby minimizing the risk of penalties and lawsuits.

Steps to Complete the FLSA Audit Checklist

Completing the FLSA audit checklist involves a systematic approach to reviewing employment practices. Here are the key steps:

- Identify employee classifications: Determine which employees are non-exempt, exempt, or classified under special categories.

- Review pay structures: Assess whether employees receive at least the federal minimum wage and are compensated for overtime work.

- Evaluate job descriptions: Ensure that job duties align with the classifications and exemptions claimed.

- Document findings: Keep detailed records of the audit process and any discrepancies found.

- Implement corrective actions: If issues are identified, take steps to rectify them promptly to maintain compliance.

Key Elements of the FLSA Audit Checklist

Several critical elements must be included in the FLSA audit checklist to ensure comprehensive compliance. These elements typically cover:

- Employee information: Names, job titles, and classification status.

- Wage information: Hourly rates, salaries, and overtime calculations.

- Work hours: Records of hours worked, including regular and overtime hours.

- Exemption criteria: Specific criteria that justify an employee's exempt status under the FLSA.

- Training and communication: Documentation of training provided to employees regarding their rights and responsibilities under the FLSA.

Legal Use of the FLSA Audit Checklist

The legal use of the FLSA audit checklist is crucial for employers to demonstrate compliance with labor laws. By utilizing this checklist, businesses can proactively identify potential violations and take corrective measures before any legal issues arise. Furthermore, maintaining accurate records from the audit can serve as evidence of compliance in case of an investigation or audit by the Department of Labor. This proactive approach not only protects the business but also fosters a fair working environment for employees.

Eligibility Criteria for Exemptions

Understanding the eligibility criteria for exemptions under the FLSA is essential for proper classification. The main categories of exemptions include:

- Executive exemption: Employees who manage a business or a department and supervise at least two full-time employees.

- Administrative exemption: Employees performing non-manual work related to management or general business operations.

- Professional exemption: Employees engaged in work requiring advanced knowledge in a specific field, typically through higher education.

- Outside sales exemption: Employees primarily engaged in making sales or obtaining orders away from the employer's place of business.

Common Penalties for Non-Compliance

Failing to comply with FLSA regulations can lead to significant penalties for employers. Common consequences include:

- Back pay: Employers may be required to pay back wages to employees for unpaid overtime or minimum wage violations.

- Fines: The Department of Labor may impose fines for violations, which can escalate based on the severity and frequency of non-compliance.

- Legal fees: Employers may incur legal costs if employees file lawsuits for wage and hour violations.

- Reputational damage: Non-compliance can harm a company's reputation, affecting employee morale and public perception.

Quick guide on how to complete executive exemption checklist

Complete Executive Exemption Checklist effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Administer Executive Exemption Checklist on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to adjust and electronically sign Executive Exemption Checklist effortlessly

- Find Executive Exemption Checklist and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Executive Exemption Checklist and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the executive exemption checklist

How to create an electronic signature for your Executive Exemption Checklist online

How to generate an eSignature for your Executive Exemption Checklist in Chrome

How to generate an electronic signature for signing the Executive Exemption Checklist in Gmail

How to generate an eSignature for the Executive Exemption Checklist from your mobile device

How to make an eSignature for the Executive Exemption Checklist on iOS

How to make an electronic signature for the Executive Exemption Checklist on Android

People also ask

-

What is the FLSA exemption test checklist?

The FLSA exemption test checklist is a vital tool that helps employers determine whether an employee is exempt from the Fair Labor Standards Act's (FLSA) minimum wage and overtime pay requirements. This checklist outlines key criteria that must be met, providing a clear framework for proper classification of employees.

-

How can airSlate SignNow assist with the FLSA exemption test checklist?

airSlate SignNow streamlines the process of documenting employee classifications related to the FLSA exemption test checklist. By utilizing our e-signature solutions, businesses can easily send, sign, and store necessary documents securely, ensuring compliance with labor laws.

-

Is there a cost associated with using airSlate SignNow for the FLSA exemption test checklist?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses of all sizes. You can choose a plan that fits your specific needs, which includes features that aid in managing the FLSA exemption test checklist efficiently.

-

What features does airSlate SignNow offer to support the FLSA exemption test checklist?

airSlate SignNow provides essential features such as customizable templates and automated workflows that enhance the functionality of the FLSA exemption test checklist. These features enable quick adjustments and accurate documentation essential for employee classification.

-

Can I integrate airSlate SignNow with other tools for FLSA compliance?

Absolutely! airSlate SignNow easily integrates with a variety of third-party applications and platforms. This allows businesses to create a comprehensive solution that aligns with the FLSA exemption test checklist alongside other compliance tools.

-

What benefits does using airSlate SignNow bring for managing the FLSA exemption test checklist?

Using airSlate SignNow enhances efficiency, reduces the risk of errors, and ensures that all necessary documents related to the FLSA exemption test checklist can be managed in one secure location. This leads to improved compliance and streamlined workflows.

-

How does airSlate SignNow ensure the security of documents involved with the FLSA exemption test checklist?

airSlate SignNow prioritizes data protection with advanced security features, including encryption and secure data storage. This ensures that all documents related to the FLSA exemption test checklist are safeguarded against unauthorized access.

Get more for Executive Exemption Checklist

Find out other Executive Exemption Checklist

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure