for the ASSET ALLOCATION WHOLE LIFE PRODUCT the WORD POLICYS REFERS to CERTIFICATES 2016-2026

Understanding the New York Life Loan

The New York Life Loan is a financial product that allows policyholders to borrow against the cash value of their whole life insurance policies. This type of loan is secured by the policy itself, meaning that the loan amount is limited to the available cash value. Borrowers can use these funds for various purposes, such as paying off debt, funding a major purchase, or covering unexpected expenses. It is important to understand the terms and conditions associated with this loan, including interest rates and repayment options, to make informed financial decisions.

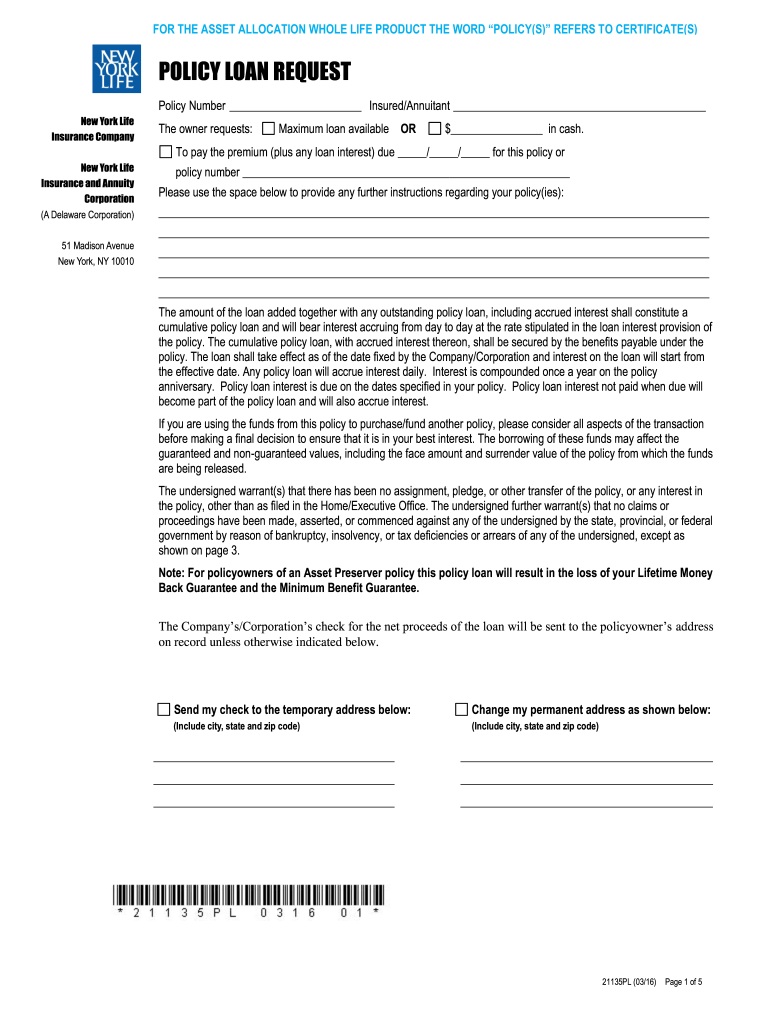

How to Complete the New York Life Loan Request Form

Filling out the New York Life loan request form is a straightforward process. Begin by gathering necessary information, including your policy number, personal identification details, and the amount you wish to borrow. The form typically requires you to provide your contact information and specify the purpose of the loan. Ensure that all information is accurate and complete to avoid delays in processing. Once filled out, the form can be submitted electronically or printed and mailed, depending on your preference.

Legal Considerations for the New York Life Loan

When engaging in a New York Life loan, it is essential to be aware of the legal implications. The loan agreement is a legally binding document, which means that both parties are obligated to adhere to its terms. Understanding the rights and responsibilities outlined in the agreement can help prevent disputes. Additionally, the loan must comply with state regulations and federal laws governing insurance and lending practices. Familiarizing yourself with these legal frameworks ensures that your loan process is compliant and protects your interests.

Key Elements of the New York Life Loan

Several key elements define the New York Life loan. These include the loan amount, interest rate, repayment terms, and the impact on your policy's cash value and death benefit. The interest on the loan is typically charged annually, and unpaid interest may be added to the principal amount. It is also crucial to understand how taking a loan against your policy may affect your overall financial situation, including potential tax implications and the risk of policy lapse if the loan balance exceeds the cash value.

Eligibility Criteria for the New York Life Loan

To qualify for a New York Life loan, you must be a policyholder with a whole life insurance policy that has accumulated cash value. Eligibility also depends on the amount of cash value available, as this determines the maximum loan amount. It is advisable to review your policy details and consult with a representative if you have questions about your eligibility. Meeting these criteria ensures a smoother loan application process.

Submitting the New York Life Loan Request

Submitting your New York Life loan request can be done through various methods. If you choose to submit electronically, ensure that you have a reliable internet connection and access to the necessary digital tools. Alternatively, you can print the completed form and send it via mail to the designated address. Regardless of the submission method, keeping a copy of your request for your records is advisable. This ensures that you have documentation of your application in case of any future inquiries.

Quick guide on how to complete for the asset allocation whole life product the word policys refers to certificates

Access FOR THE ASSET ALLOCATION WHOLE LIFE PRODUCT THE WORD POLICYS REFERS TO CERTIFICATES effortlessly on any gadget

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without hindrance. Manage FOR THE ASSET ALLOCATION WHOLE LIFE PRODUCT THE WORD POLICYS REFERS TO CERTIFICATES on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign FOR THE ASSET ALLOCATION WHOLE LIFE PRODUCT THE WORD POLICYS REFERS TO CERTIFICATES with ease

- Obtain FOR THE ASSET ALLOCATION WHOLE LIFE PRODUCT THE WORD POLICYS REFERS TO CERTIFICATES and then select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to secure your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing fresh copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Alter and electronically sign FOR THE ASSET ALLOCATION WHOLE LIFE PRODUCT THE WORD POLICYS REFERS TO CERTIFICATES and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for the asset allocation whole life product the word policys refers to certificates

How to make an electronic signature for your For The Asset Allocation Whole Life Product The Word Policys Refers To Certificates online

How to generate an eSignature for your For The Asset Allocation Whole Life Product The Word Policys Refers To Certificates in Google Chrome

How to create an electronic signature for signing the For The Asset Allocation Whole Life Product The Word Policys Refers To Certificates in Gmail

How to make an eSignature for the For The Asset Allocation Whole Life Product The Word Policys Refers To Certificates from your mobile device

How to make an eSignature for the For The Asset Allocation Whole Life Product The Word Policys Refers To Certificates on iOS

How to make an electronic signature for the For The Asset Allocation Whole Life Product The Word Policys Refers To Certificates on Android devices

People also ask

-

What are lifeloans and how can they benefit my business?

Lifeloans are flexible financing options designed to meet the unique needs of businesses. They can provide immediate access to capital, allowing you to invest in growth opportunities without the burden of traditional loan structures. With lifeloans, your business can manage cash flow more effectively.

-

How does airSlate SignNow integrate with lifeloans?

airSlate SignNow seamlessly integrates with lifeloans to provide businesses with streamlined document management solutions. You can easily eSign loan agreements and related documents, enhancing efficiency and reducing turnaround time. This integration ensures that your financial processes are both secure and expedient.

-

What are the pricing options for airSlate SignNow when using lifeloans?

Pricing for airSlate SignNow is competitive and varies based on the features you choose to utilize alongside lifeloans. We offer tiered pricing plans that cater to businesses of all sizes, ensuring you can find a plan that fits your budget. By leveraging lifeloans with our service, you can optimize your investment in document management.

-

Can I manage multiple lifeloans using airSlate SignNow?

Yes, airSlate SignNow allows you to manage multiple lifeloans efficiently. You can upload, eSign, and store documents related to various lifeloans in one secure platform. This centralized approach helps you keep track of your financial agreements easily.

-

What features does airSlate SignNow offer that are beneficial for lifeloans?

airSlate SignNow offers several key features beneficial for lifeloans, including customizable templates, automated workflows, and real-time collaboration. These features help streamline the process of managing loan documents, ensuring that your team can work efficiently and effectively. Additionally, eSigning capabilities enhance the speed of loan finalization.

-

Is airSlate SignNow secure for handling lifeloans?

Absolutely! Security is a top priority for airSlate SignNow when handling sensitive documents like lifeloans. We employ advanced encryption standards and comply with industry regulations to ensure that your documents are secure and your data privacy is maintained.

-

What are the benefits of using airSlate SignNow for lifeloans compared to traditional methods?

Using airSlate SignNow for lifeloans signNowly enhances efficiency by eliminating the need for physical paperwork and in-person signings. With our digital solution, you save time and reduce costs associated with traditional loan processing. Furthermore, the ability to access documents from anywhere supports greater flexibility for your team.

Get more for FOR THE ASSET ALLOCATION WHOLE LIFE PRODUCT THE WORD POLICYS REFERS TO CERTIFICATES

- Www philippinelegalforms com201401sample affidavit of non operation philippine legal forms

- Lungsod ng maynila city of manilawelcome to department of health website department oflungsod ng maynila city of manila form

- Credit application form credit application form

- Mpbl lum17 appeal form 29012020 cdr

- Application for program transfer submit a program form

- Application document form

- For office use only undergraduate course request form

- Carpfm form

Find out other FOR THE ASSET ALLOCATION WHOLE LIFE PRODUCT THE WORD POLICYS REFERS TO CERTIFICATES

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure