Az Form 5000 2019-2026

What is the Arizona Form 5011?

The Arizona Form 5011 is a crucial document used for specific tax and legal purposes within the state of Arizona. This form is primarily associated with certain tax exemptions and is often required by individuals and businesses to claim specific benefits or fulfill legal obligations. Understanding the purpose of the 5011 form is essential for compliance with state regulations and ensuring that all necessary documentation is submitted accurately.

Steps to Complete the Arizona Form 5011

Completing the Arizona Form 5011 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details and any relevant financial data. Follow these steps:

- Obtain the latest version of the Arizona Form 5011 from a reliable source.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified submission methods.

Legal Use of the Arizona Form 5011

The legal use of the Arizona Form 5011 is governed by state laws and regulations. It is important to ensure that the form is filled out correctly and submitted on time to avoid any legal complications. The form serves as a formal request for certain tax exemptions or benefits, and improper use may lead to penalties or denial of the requested benefits. Therefore, understanding the legal implications of the form is vital for all users.

Form Submission Methods

Submitting the Arizona Form 5011 can be done through various methods, depending on the requirements set by the state. Users can typically choose from the following submission options:

- Online submission through the state’s official tax portal.

- Mailing the completed form to the designated state office.

- In-person submission at local tax offices or designated agencies.

Each method has its own guidelines and deadlines, so it is essential to choose the one that best fits your situation.

Key Elements of the Arizona Form 5011

The Arizona Form 5011 includes several key elements that must be properly filled out to ensure validity. These elements typically consist of:

- Personal identification information, such as name and address.

- Details regarding the specific tax exemption being claimed.

- Signature and date to validate the submission.

Ensuring that all key elements are accurately completed is essential for the acceptance of the form by state authorities.

Eligibility Criteria for the Arizona Form 5011

Eligibility to use the Arizona Form 5011 varies based on the specific tax exemption or benefit being claimed. Generally, individuals and businesses must meet certain criteria, which may include:

- Residency in Arizona or operation within the state.

- Meeting specific income or financial thresholds.

- Compliance with any additional state requirements.

Reviewing the eligibility criteria before completing the form can prevent unnecessary delays or complications in the submission process.

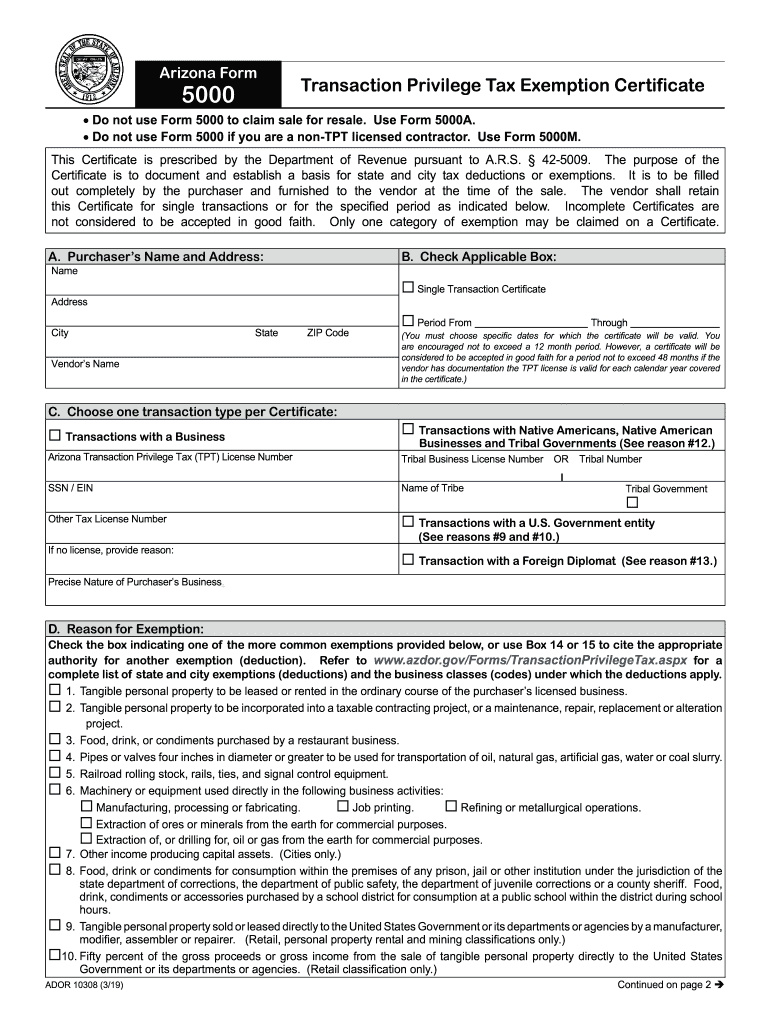

Quick guide on how to complete purchasers name and address

Accomplish Az Form 5000 effortlessly on any device

Digital document administration has become favored among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and digitally sign your documents quickly and without delays. Manage Az Form 5000 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and digitally sign Az Form 5000 with ease

- Locate Az Form 5000 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your digital signature with the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you'd like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and digitally sign Az Form 5000 and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the purchasers name and address

How to make an eSignature for your Purchasers Name And Address in the online mode

How to generate an electronic signature for your Purchasers Name And Address in Chrome

How to create an electronic signature for signing the Purchasers Name And Address in Gmail

How to make an electronic signature for the Purchasers Name And Address right from your mobile device

How to create an eSignature for the Purchasers Name And Address on iOS

How to make an electronic signature for the Purchasers Name And Address on Android OS

People also ask

-

What is the 5011 form and how is it used?

The 5011 form is a standardized document commonly used for specific regulatory purposes. It serves to streamline processes by ensuring that important information is captured and organized efficiently. By utilizing the 5011 form, businesses can improve compliance and reduce administrative burden.

-

How can airSlate SignNow help with the 5011 form?

airSlate SignNow offers an intuitive platform for electronically signing and managing the 5011 form. With airSlate SignNow, users can create, edit, and send the 5011 form seamlessly. This ensures a faster turnaround time and enhances productivity while maintaining document security.

-

What features does airSlate SignNow provide for handling the 5011 form?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for the 5011 form. These tools simplify the signing process and grant users complete visibility into document status. Additionally, the platform allows for secure storage and easy retrieval of completed forms.

-

Is there a cost associated with using airSlate SignNow for the 5011 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for managing the 5011 form. The plans provide access to advanced features that enhance document workflows and compliance. A free trial is available, allowing users to explore the platform before committing.

-

What are the benefits of using airSlate SignNow for the 5011 form?

Utilizing airSlate SignNow for the 5011 form provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Businesses can save time by eliminating manual processes and obtaining signatures electronically. Moreover, the platform ensures compliance and accuracy, critical for official documentation.

-

Can the 5011 form be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications, allowing for easy handling of the 5011 form within existing workflows. Whether it’s CRM tools or project management software, integrations enhance productivity and ensure your team can access and manage documents effortlessly.

-

What industries benefit from using the 5011 form with airSlate SignNow?

Various industries, including finance, healthcare, and real estate, can benefit from using the 5011 form with airSlate SignNow. These sectors often require formal documentation and compliance, and airSlate SignNow’s electronic signature capabilities streamline these processes effectively. This enhances operational efficiency across diverse sectors.

Get more for Az Form 5000

- Miarad 375029815 form

- Naturopathic intake form disclaimer the views opinions suggestions and information contained in the consultation session or

- Help delamar com02gym reimbursement formexercise facility reimbursement program reimbursement form

- Million dollar band medical information form university of bands ua

- Aflac initial disability claim form

- Www peninsula orgsitesdefaultpreceptorship clerkship agreement peninsula org form

- Humana cancellation form hamiltoncountyohio

- 24 hour urine collection form oregon health amp science university ohsu

Find out other Az Form 5000

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer