Individual Self Certification Form for FATCA and CRS

What is the Individual Self Certification Form For FATCA And CRS

The Individual Self Certification Form for FATCA and CRS is a crucial document used by financial institutions to collect information regarding the tax residency of individuals. This form is essential for compliance with the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). It helps ensure that financial institutions report the necessary information to tax authorities, thereby preventing tax evasion. By completing this form, individuals confirm their tax status and provide relevant details such as their name, address, and taxpayer identification number.

How to use the Individual Self Certification Form For FATCA And CRS

Using the Individual Self Certification Form for FATCA and CRS involves several straightforward steps. First, individuals must obtain the form from their financial institution or download it from a reliable source. Once in possession of the form, users should carefully fill in their personal information, ensuring accuracy to avoid any compliance issues. After completing the form, it must be signed and submitted according to the instructions provided by the financial institution, which may include online submission, mailing, or in-person delivery.

Steps to complete the Individual Self Certification Form For FATCA And CRS

Completing the Individual Self Certification Form for FATCA and CRS requires attention to detail. Here are the key steps:

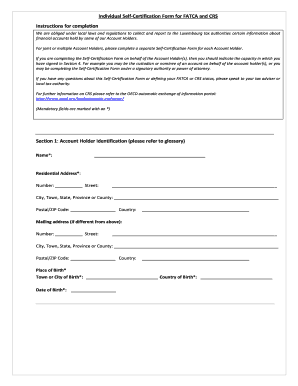

- Begin by entering your full name as it appears on official documents.

- Provide your current residential address, ensuring it is up to date.

- Indicate your country of tax residence and provide your taxpayer identification number.

- Complete any additional sections that may apply to your specific situation, such as information about other countries of tax residency.

- Review the completed form for accuracy and completeness.

- Sign and date the form to validate your information.

Legal use of the Individual Self Certification Form For FATCA And CRS

The Individual Self Certification Form for FATCA and CRS serves a legal purpose in the context of international tax compliance. Financial institutions are required by law to collect this information to comply with FATCA and CRS regulations. By submitting this form, individuals affirm that the information provided is true and accurate, which can have legal implications in case of discrepancies. It is essential for individuals to understand that providing false information can lead to penalties and legal actions.

Required Documents

When completing the Individual Self Certification Form for FATCA and CRS, certain documents may be required to verify the information provided. Typically, individuals should have the following documents ready:

- Government-issued identification, such as a passport or driver's license.

- Proof of residency, which may include utility bills or bank statements.

- Tax identification number documentation, if applicable.

Penalties for Non-Compliance

Failing to complete or submit the Individual Self Certification Form for FATCA and CRS can result in significant penalties. Financial institutions may impose withholding taxes on accounts if the required documentation is not provided. Additionally, individuals may face legal repercussions, including fines or other sanctions, for failing to comply with tax regulations. It is essential for individuals to ensure timely and accurate submission of this form to avoid such consequences.

Quick guide on how to complete individual self certification form for fatca and crs

Complete Individual Self Certification Form For FATCA And CRS effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Individual Self Certification Form For FATCA And CRS on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Individual Self Certification Form For FATCA And CRS seamlessly

- Obtain Individual Self Certification Form For FATCA And CRS and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that reason.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Adjust and eSign Individual Self Certification Form For FATCA And CRS and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual self certification form for fatca and crs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Self Certification Form For FATCA And CRS?

The Individual Self Certification Form For FATCA And CRS is a document used to signNow an individual's tax residency status for compliance with international tax regulations. This form helps financial institutions determine the tax obligations of their clients under the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). Completing this form accurately is crucial for avoiding potential penalties.

-

How can I access the Individual Self Certification Form For FATCA And CRS?

You can easily access the Individual Self Certification Form For FATCA And CRS through the airSlate SignNow platform. Our user-friendly interface allows you to download, fill out, and eSign the form seamlessly. Additionally, you can store and manage your completed forms securely within our system.

-

Is there a cost associated with using the Individual Self Certification Form For FATCA And CRS?

Using the Individual Self Certification Form For FATCA And CRS through airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. We offer various pricing tiers to accommodate different needs, ensuring you get the best value for your document management solutions. Check our pricing page for more details.

-

What features does airSlate SignNow offer for the Individual Self Certification Form For FATCA And CRS?

airSlate SignNow provides a range of features for the Individual Self Certification Form For FATCA And CRS, including eSigning, document templates, and secure storage. Our platform also allows for real-time collaboration, making it easy for multiple parties to complete the form efficiently. Additionally, you can track the status of your documents to ensure timely completion.

-

How does airSlate SignNow ensure the security of the Individual Self Certification Form For FATCA And CRS?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your Individual Self Certification Form For FATCA And CRS and other sensitive documents. Our platform is compliant with industry standards, ensuring that your data remains confidential and secure throughout the signing process.

-

Can I integrate the Individual Self Certification Form For FATCA And CRS with other applications?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflow. You can easily connect the Individual Self Certification Form For FATCA And CRS with CRM systems, cloud storage services, and other business tools. This integration capability enhances productivity and ensures that your document management processes are efficient.

-

What are the benefits of using airSlate SignNow for the Individual Self Certification Form For FATCA And CRS?

Using airSlate SignNow for the Individual Self Certification Form For FATCA And CRS offers numerous benefits, including time savings, reduced paperwork, and enhanced compliance. Our platform simplifies the signing process, allowing you to complete forms quickly and efficiently. Additionally, you can access your documents anytime, anywhere, making it a flexible solution for your business needs.

Get more for Individual Self Certification Form For FATCA And CRS

- Dr 321 form

- Pub 5 child in need of aid alaska court records state of alaska form

- Alaska p 370 form

- Download the pdf file alaska court records state of alaska 6967375 form

- Dr 1151 amend of agreement on claiming tax exemption for children 10 15 domestic relations form

- Alaska anchorage veterans court form

- P 339 form

- Dr 485 alaska court records state of alaska form

Find out other Individual Self Certification Form For FATCA And CRS

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast