File 172 25 149 2 Scratch Pad TCS CA Forms as Per New Inter

What is the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter

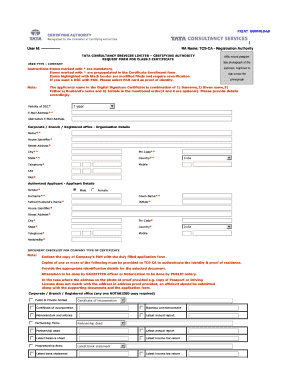

The File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter is a specific form used for tax-related purposes in the United States. It is designed to facilitate the reporting of certain financial information to the appropriate tax authorities. This form is particularly relevant for individuals and businesses who need to comply with state and federal tax regulations. Understanding its purpose is crucial for accurate tax reporting and compliance.

How to use the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter

Using the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter involves several steps. First, gather all necessary financial documents that pertain to the information required on the form. Next, carefully fill out the form, ensuring all entries are accurate and complete. It is important to double-check the information before submission, as errors can lead to delays or penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the tax authority.

Steps to complete the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter

Completing the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter involves the following steps:

- Review the form instructions carefully to understand the requirements.

- Gather all relevant financial documents, including income statements and expense records.

- Fill out the form, ensuring accuracy in all entries.

- Verify all information against your documents to prevent discrepancies.

- Choose your submission method: online or by mail.

- Keep a copy of the completed form for your records.

Legal use of the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter

The legal use of the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter is essential for compliance with U.S. tax laws. This form must be filled out accurately to avoid legal repercussions, such as fines or audits. It serves as an official record of your financial reporting and must be submitted by the designated deadlines. Understanding the legal implications of this form helps ensure that individuals and businesses remain compliant with tax regulations.

Required Documents

To complete the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Expense records relevant to the reporting period.

- Previous year’s tax returns for reference.

- Any additional documentation requested in the form instructions.

Filing Deadlines / Important Dates

Filing deadlines for the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter are crucial to adhere to in order to avoid penalties. Generally, the deadline for submission aligns with the federal tax filing dates. It is advisable to check the specific dates each tax year, as they may vary. Marking these dates on your calendar can help ensure timely filing and compliance.

Quick guide on how to complete file 172 25 149 2 scratch pad tcs ca forms as per new inter

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant areas of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the file 172 25 149 2 scratch pad tcs ca forms as per new inter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter?

The File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter is a specialized document designed for tax compliance in Canada. It allows users to efficiently manage and submit their tax-related information while ensuring adherence to the latest regulations. This form is essential for businesses looking to streamline their tax processes.

-

How can airSlate SignNow help with the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter?

airSlate SignNow provides a user-friendly platform to eSign and send the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter. With its intuitive interface, users can easily fill out, sign, and share the form, ensuring a smooth and efficient workflow. This saves time and reduces the risk of errors in document handling.

-

What are the pricing options for using airSlate SignNow for the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Users can choose from monthly or annual subscriptions, with options that include features specifically designed for handling the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter. This ensures that you only pay for what you need.

-

Are there any integrations available for the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing the usability of the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter. This allows users to connect their existing tools and streamline their document workflows, making it easier to manage tax forms and other documents.

-

What are the benefits of using airSlate SignNow for the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter?

Using airSlate SignNow for the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are stored safely and can be accessed anytime, making tax compliance simpler and more reliable.

-

Is airSlate SignNow secure for handling the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter. With encryption and secure access protocols, you can trust that your sensitive information is safe while using the platform.

-

Can I track the status of my File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter submissions?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter submissions. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter

Find out other File 172 25 149 2 Scratch pad TCS CA Forms As Per New Inter

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document