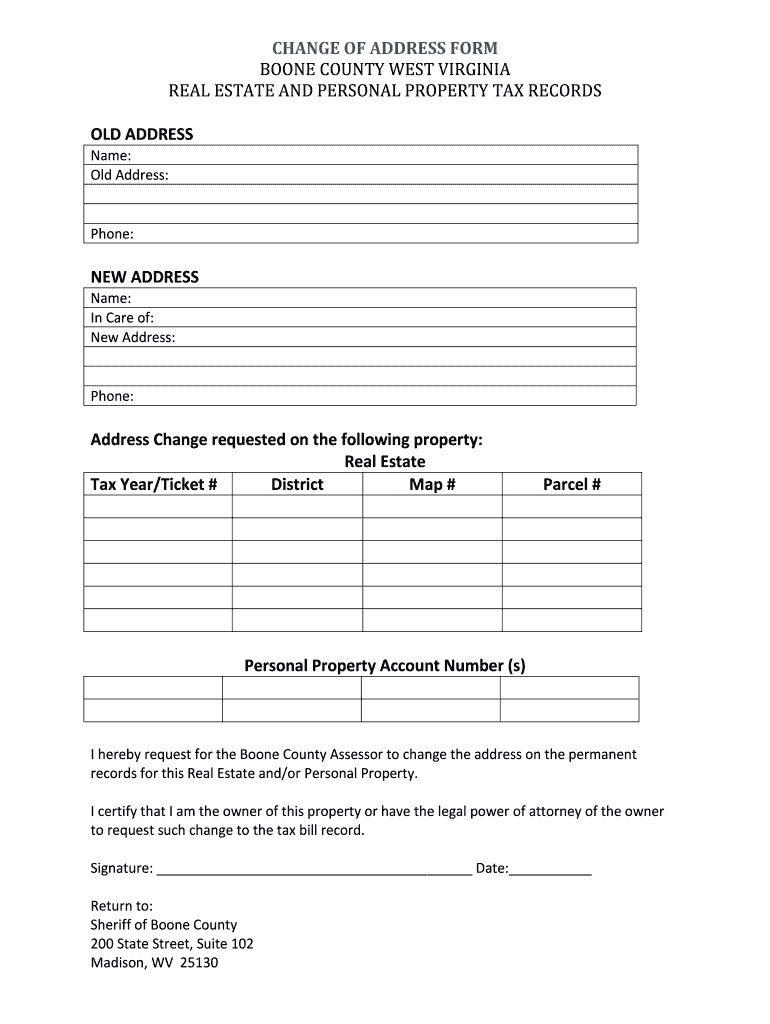

REAL ESTATE and PERSONAL PROPERTY TAX RECORDS Form

Understanding REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS are essential documents that provide information about property ownership, assessed values, and tax liabilities. These records are maintained by local government authorities and are crucial for determining property taxes owed by homeowners and businesses. They include details such as the property's legal description, ownership history, and the amount of taxes assessed for each tax year. Understanding these records is vital for property owners to ensure they are aware of their tax obligations and to verify the accuracy of the information recorded.

How to Obtain REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

To obtain REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS, individuals can typically visit their local county assessor's office or the official website of the local government. Many jurisdictions offer online databases where property records can be searched by address or parcel number. In some cases, a formal request may need to be submitted, especially for older records or specific information. It is advisable to have relevant details, such as the property address and owner’s name, ready when making a request to expedite the process.

Key Elements of REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

Key elements found in REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS include:

- Property Identification: A unique identifier for the property, often a parcel number.

- Owner Information: The name(s) of the current property owner(s).

- Property Description: Details about the property, including its location, size, and type.

- Assessed Value: The value assigned to the property for tax purposes, which may differ from market value.

- Tax History: Records of taxes paid, outstanding balances, and any exemptions applied.

Steps to Complete the REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

Completing REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS involves several steps:

- Gather Information: Collect all necessary details about the property, including ownership and assessed value.

- Access the Form: Obtain the appropriate form from the local tax authority’s website or office.

- Fill Out the Form: Accurately complete all sections of the form, ensuring all information is correct.

- Submit the Form: Submit the completed form through the designated method, whether online, by mail, or in person.

- Keep Records: Retain copies of the submitted form and any related documentation for future reference.

Legal Use of REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS have various legal uses. They serve as official documentation for property ownership and tax obligations, which can be critical during property transactions, disputes, or legal proceedings. These records may also be used by lenders to assess property value when providing mortgages. Additionally, they can play a role in estate planning and inheritance matters, ensuring that property taxes are accounted for in the transfer of assets.

Filing Deadlines and Important Dates

Filing deadlines for REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS can vary by state and locality. Typically, property tax assessments are conducted annually, with deadlines for filing appeals or exemptions often set in the spring. It is essential for property owners to be aware of these dates to avoid penalties or missed opportunities for tax relief. Checking with the local tax authority for specific deadlines is advisable to ensure compliance.

Quick guide on how to complete real estate and personal property tax records

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Edit and electronically sign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

Create this form in 5 minutes!

How to create an eSignature for the real estate and personal property tax records

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS?

REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS are official documents that detail the assessed value of properties and the taxes owed on them. These records are crucial for property owners and buyers to understand their financial obligations and property valuations.

-

How can airSlate SignNow help with REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS?

airSlate SignNow streamlines the process of managing REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS by allowing users to easily send, sign, and store documents electronically. This reduces paperwork and enhances efficiency, making it easier to keep track of important tax records.

-

What features does airSlate SignNow offer for managing tax records?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed for REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS. These features ensure that your documents are handled securely and efficiently.

-

Is airSlate SignNow cost-effective for managing tax records?

Yes, airSlate SignNow provides a cost-effective solution for managing REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS. With flexible pricing plans, businesses can choose the option that best fits their needs without overspending on unnecessary features.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS. This integration allows for a more streamlined workflow and better data management.

-

What are the benefits of using airSlate SignNow for tax records?

Using airSlate SignNow for REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS offers numerous benefits, including improved efficiency, reduced errors, and enhanced security. The platform simplifies document management, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow for handling tax records?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS. You can trust that your sensitive information is safe and secure while using our platform.

Get more for REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

Find out other REAL ESTATE AND PERSONAL PROPERTY TAX RECORDS

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure