Uniform Residential Loan Application Jon Sheehan Southern

What is the Uniform Residential Loan Application Jon Sheehan Southern

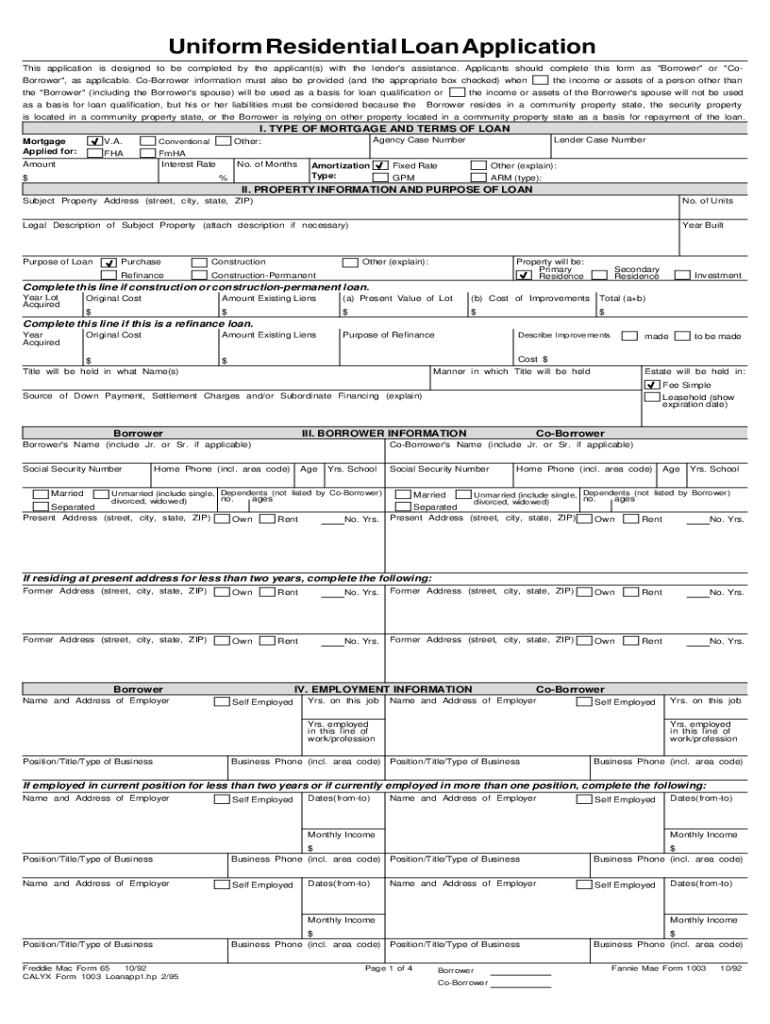

The Uniform Residential Loan Application (URLA) is a standardized form used by lenders in the United States to collect essential information from borrowers applying for a mortgage. This application is crucial for evaluating the borrower's creditworthiness and financial situation. The URLA includes sections for personal information, employment history, income details, assets, and liabilities. Jon Sheehan, a representative from Southern, can assist borrowers in understanding and completing this form accurately to ensure a smooth loan application process.

Key elements of the Uniform Residential Loan Application Jon Sheehan Southern

The URLA comprises several key components that are vital for the loan application process. These elements include:

- Borrower Information: Personal details such as name, address, and social security number.

- Employment History: Information about current and past employment, including job titles and durations.

- Income Details: Documentation of monthly income, including salaries, bonuses, and additional sources of income.

- Assets and Liabilities: A comprehensive list of assets such as bank accounts and properties, along with outstanding debts like loans and credit card balances.

Understanding these elements helps borrowers provide accurate information, which is essential for loan approval.

Steps to complete the Uniform Residential Loan Application Jon Sheehan Southern

Completing the URLA involves several steps to ensure all necessary information is accurately provided. The process typically includes:

- Gather Required Documents: Collect financial documents, including pay stubs, bank statements, and tax returns.

- Fill Out Personal Information: Enter your name, address, and contact details in the designated sections.

- Detail Employment and Income: Provide information regarding your employment history and income sources.

- List Assets and Liabilities: Accurately detail your assets and any outstanding debts.

- Review and Submit: Double-check the completed application for accuracy before submitting it to the lender.

Following these steps can help streamline the application process and reduce the likelihood of delays.

How to obtain the Uniform Residential Loan Application Jon Sheehan Southern

The URLA can be obtained through various channels. Borrowers can access the form directly from lenders, including Jon Sheehan at Southern, or download it from official mortgage industry websites. It is also available in both digital and paper formats, allowing borrowers to choose the method that best suits their needs. Ensuring you have the latest version of the URLA is important, as updates may occur to reflect changes in lending practices.

Legal use of the Uniform Residential Loan Application Jon Sheehan Southern

The URLA is a legally recognized document in the mortgage lending process. It must be completed accurately to comply with federal and state regulations. Lenders, including Jon Sheehan at Southern, rely on the information provided in the URLA to assess risk and make informed lending decisions. Misrepresentation or inaccuracies can lead to legal repercussions for both the borrower and the lender, emphasizing the importance of honesty and accuracy in the application process.

Eligibility Criteria

Eligibility for a mortgage loan through the URLA is determined by several factors. These include:

- Credit Score: A minimum credit score is often required to qualify for a mortgage.

- Income Stability: Lenders assess the consistency and reliability of the borrower's income.

- Debt-to-Income Ratio: This ratio compares monthly debt payments to gross monthly income, influencing loan approval.

- Employment History: A stable employment history can enhance eligibility.

Understanding these criteria can help borrowers prepare for the application process and improve their chances of approval.

Quick guide on how to complete uniform residential loan application jon sheehan southern

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to swiftly create, modify, and eSign your documents without any delays. Manage [SKS] on any device using the airSlate SignNow applications available for Android or iOS, and simplify your document-related tasks today.

Easily Modify and eSign [SKS]

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal authority as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device. Alter and eSign [SKS] ensuring effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan application jon sheehan southern

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Uniform Residential Loan Application Jon Sheehan Southern?

The Uniform Residential Loan Application Jon Sheehan Southern is a standardized form used by lenders to assess a borrower's financial situation when applying for a mortgage. This application simplifies the loan process and ensures that all necessary information is collected efficiently.

-

How can airSlate SignNow help with the Uniform Residential Loan Application Jon Sheehan Southern?

airSlate SignNow provides a seamless platform for completing and eSigning the Uniform Residential Loan Application Jon Sheehan Southern. With its user-friendly interface, you can easily fill out the application, ensuring that all required fields are completed accurately.

-

What are the pricing options for using airSlate SignNow for the Uniform Residential Loan Application Jon Sheehan Southern?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution that allows you to manage the Uniform Residential Loan Application Jon Sheehan Southern efficiently.

-

What features does airSlate SignNow offer for the Uniform Residential Loan Application Jon Sheehan Southern?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the efficiency of processing the Uniform Residential Loan Application Jon Sheehan Southern, making it easier for both lenders and borrowers.

-

What are the benefits of using airSlate SignNow for the Uniform Residential Loan Application Jon Sheehan Southern?

Using airSlate SignNow for the Uniform Residential Loan Application Jon Sheehan Southern streamlines the application process, reduces paperwork, and speeds up approval times. Additionally, it enhances security and compliance, ensuring that sensitive information is protected.

-

Can airSlate SignNow integrate with other tools for the Uniform Residential Loan Application Jon Sheehan Southern?

Yes, airSlate SignNow offers integrations with various CRM and document management systems. This allows you to seamlessly incorporate the Uniform Residential Loan Application Jon Sheehan Southern into your existing workflows, improving overall efficiency.

-

Is airSlate SignNow secure for handling the Uniform Residential Loan Application Jon Sheehan Southern?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect the Uniform Residential Loan Application Jon Sheehan Southern. Your data is safe, ensuring compliance with industry standards.

Get more for Uniform Residential Loan Application Jon Sheehan Southern

- Dgms form 2

- Cctv installation completion certificate form

- Psptb registration categories form

- Bucs generic team sheet form

- Ionia county building department form

- How i want to receive recognition cuna mutual group form

- New hampshire recreational dredging application form

- High liability authorzation request form

Find out other Uniform Residential Loan Application Jon Sheehan Southern

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online