475 0409 2015-2026

What is the

The form is a crucial document used in various tax-related processes within the United States. It is typically associated with specific reporting requirements that businesses and individuals must adhere to when dealing with certain financial transactions. Understanding the purpose of this form is essential for compliance with IRS regulations and ensuring accurate reporting.

How to use the

Using the form involves several steps that ensure proper completion and submission. First, gather all necessary information related to the financial transactions that require reporting. This may include details about the parties involved, the nature of the transactions, and relevant financial data. Next, accurately fill out the form, ensuring that all sections are completed as required. Finally, submit the form through the appropriate channels, which may include online submission or mailing it to the designated IRS address.

Steps to complete the

Completing the form requires careful attention to detail. Here are the key steps:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documentation and information needed for completion.

- Fill out the form accurately, ensuring that all fields are completed as per the guidelines.

- Double-check the information for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the

The form serves a legal purpose by ensuring compliance with IRS regulations. It is essential for businesses and individuals to use this form correctly to avoid potential penalties or legal issues. Proper use of the form helps maintain accurate records and supports transparency in financial reporting, which is vital for tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the form are critical to ensure compliance with IRS regulations. Typically, forms must be submitted by specific dates, which can vary based on the type of transaction or reporting requirement. It is important to stay informed about these deadlines to avoid late fees or penalties. Regularly checking the IRS website or consulting with a tax professional can help keep track of important dates.

Required Documents

When completing the form, several documents may be required to support the information provided. These documents can include financial statements, transaction records, and identification information for all parties involved. Having these documents ready can facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Who Issues the Form

The form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations and the importance of accurate reporting.

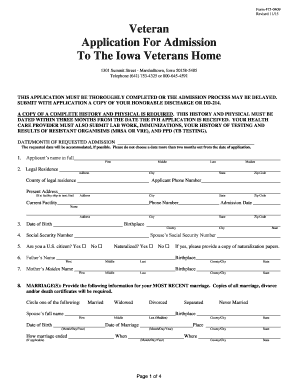

Quick guide on how to complete veteran application for admission

Effortlessly Prepare 475 0409 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without any hold-ups. Manage 475 0409 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The Easiest Way to Edit and eSign 475 0409 Without Any Stress

- Find 475 0409 and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your delivery method for your form: by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Edit and eSign 475 0409 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the veteran application for admission

How to generate an eSignature for your Veteran Application For Admission in the online mode

How to create an eSignature for your Veteran Application For Admission in Google Chrome

How to create an eSignature for putting it on the Veteran Application For Admission in Gmail

How to generate an eSignature for the Veteran Application For Admission right from your mobile device

How to make an eSignature for the Veteran Application For Admission on iOS

How to make an electronic signature for the Veteran Application For Admission on Android OS

People also ask

-

What is the significance of the number 475 0409 in airSlate SignNow?

The number 475 0409 is a reference code that potential customers can use to inquire about specific features or support related to airSlate SignNow. This code helps streamline customer service interactions, ensuring you receive tailored assistance for your eSigning needs.

-

How much does airSlate SignNow cost for businesses?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be a cost-effective solution for businesses of all sizes. When you call 475 0409, our sales team can provide you with the most current pricing information and help you select the plan that best fits your needs.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as eSignature capabilities, document templates, and workflow automation tools. By calling 475 0409, you can learn more about specific features that can help enhance your document management processes.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Dropbox, and CRM systems. If you have specific integration questions, feel free to call 475 0409 to speak with our support team who can guide you through the integration process.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly improve your workflow efficiency by reducing the time needed to send and sign documents. The easy-to-use interface and cost-effective pricing make it an ideal choice for businesses looking to streamline their operations. For more personalized benefits, call 475 0409.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and compliance with industry standards, to protect your sensitive documents. For specific security features and protocols, you can signNow out to us at 475 0409.

-

How can I get support if I have questions about airSlate SignNow?

If you have any inquiries or need assistance with airSlate SignNow, you can signNow our dedicated support team by calling 475 0409. Our knowledgeable representatives are available to help you with everything from technical issues to feature explanations.

Get more for 475 0409

- Physlet physics answer key form

- Learner licence mizoram form

- Massage intake form revised docx

- General relief hotel voucher form

- Lead based disclosure warning form

- Business between friends contract template form

- Business associate contract template form

- Sf400adm notice of peace officer appointment eff 7 1 15doc form

Find out other 475 0409

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe